Indebtedness within the Ghanaian market poses a severe challenge to creditors/lenders and businesses trying to grow their investment portfolios.

Debt recovery has always been challenging for individual lenders, financial institutions and other businesses alike. Notwithstanding the challenges in recovery of debt, businesses cannot do away with credit finance and other financial arrangements.

The knock-on effect of customers failing to pay their debts can be significant. Non-payment of debts by customers can cause very serious cashflow issues for businesses, and could ultimately lead to insolvency.

Debt recovery is important because it is directly correlated to performance of the business. If you are being contacted by a debt recovery agency, it means there is a history that you have defaulted on an unpaid invoices/loan.

So, when is the appropriate time for a business to address late or non-payment of invoices?

I certainly do not advocate leaving it until an invoice has become overdue. The principle that prevention is better than cure is very relevant. So, should you consider potential late/non-payment when the invoice is issued? What about when you supply the goods or services for which you will then invoice? Perhaps you should consider the possibility of late/non-payment as soon as you have contracted with someone?

My view is that for contracts of any significant value, you should always consider whether the person or business that you are entering into a contract with has the means, and is likely to pay the contractual price on time before you enter into a contract with them.

The key question that needs to be asked before any others is: “Whom am I contracting with?” Without correctly identifying whom you are contracting with, it is of course impossible to assess the credit-worthiness and other verification performance indicators of the person/business. It also means that if your invoice is not paid on time, there can be considerable difficulty in identifying whom you have a claim against.

Businesses, organisation, creditors, etc. should be particularly mindful of the possibility of confusing individuals using a sole trading name with partnerships or limited companies and/or the possibility of confusing different companies within the same group.

Much of this uncertainty can be avoided by correctly identifying from the start who it is that is asking to contract with you.

Due diligence is one of the ways to reduce bad debts. However, it does not guarantee full repayment of debt because sometimes, a client may pass the credit approval test but still default. And when it comes to this, the business might have to come up with a good plan on how to get back their money or value for services rendered.

It is imperative that firms consider making use of support from debt recovery firms in the process of issuing and recovering debt. This is because these debt recovery professionals have experience in recovering debt. They also have an advantage of dealing with non- compliance. This gives them a third eye of being able to see the problem before designing solutions to the problem. They deal with the debtor, thus, are able to advise on how to avoid falling into the hands of bad debtors.

Dealing with non-compliance helps them take note of the important details which should be considered or looked out for during the approval stage. African Business Trade Checks Ltd. has enhanced skip tracing mechanisms which helps in tracing defaulters by checking whether they changed their business names or rebranded to avoid being detected, moving to a new town or even changing names to facilitate recovery of the debt. This should be done within the confines of the law and by professionals.

African Business Trade Checks Ltd. (ABTC) is a globally known management consultancy firm that provides unique business reporting solutions and standard guidelines for enhancing international trade, focusing on cost effective core business capacities, improving profitability and effectiveness, and admittance to more extensive broadness of company profiling information. In addition, African Business Trade Checks Ltd. is the leading provider of debt recovery services, Company Due Diligence Report and Consented Credit Reports. Contact +233 20 186 0110 [email protected]

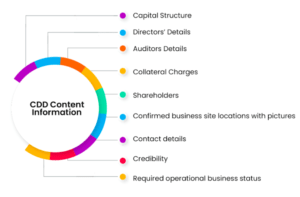

ABTC Company Due Diligence Reports (CDD) serves as a third-party verification tool on all Ghanaian companies/businesses seeking to partner/apply for credit from creditors etc. It has garnered a lot of attention in our financial sector, oil and gas, SME market, banking sector, agro industry, debt recovery space, etc. world-wide and we think it’s a product your organisation might see immediate value in. Contact +233 20 186 0110 [email protected].

Why ABTC’s CDD Report

“One of the most effective ways to acquire business intelligence on current market trends, competitor analysis, and business USPs is to get an expert company profiling on both existing and prospective clients.

ABTC is the leading provider of business information for risk management, sales & marketing, supply management and risk consulting decisions worldwide. Companies across the globe rely on ABTC’s CDD to provide the insight they need to help build profitable, quality business relationships with their customers, suppliers and business partners.

ABTC’s Company Due Diligence Report (CDD) helps you to reduce risk and make informed decisions speedily and efficiently as you acquire new customers, as well as review existing clients. The company due diligence reports reduces the need to gather information from multiple sources, and helps you quickly identify which businesses to work with and which to avoid while providing the most-needed verified information on your customers’ capital structure, company directors details, collateral charges, company on-site visit verification reports, company share holding pattern etc., as well as the credibility of business operational status being it active, insolvent, bankrupt, liquidated, etc.

African Business Trade Checks Ltd.’s top-rated third-party verifications services and debt recovery teams are experts in recovering money that’s due, and resolving disputes over unpaid invoices. We can offer advice on improving your credit control processes, training for your credit control team, and overhauling your contractual documentation and terms and conditions. Contact +233 20 186 0110 [email protected].

We would like to share some key guidelines to help your businesses successfully recover what’s due:

Look the customer up on African Business Trade Checks Ltd. database – if there are any red flag stories about them, consider whether you really want to get involved with them. Also, carry out a credit check and third-party verifications checks on customers (from African Business Trade Checks Ltd.) before doing business with them. If the credit report recommends a maximum credit limit for the customer, make sure any credit you provide to them does not exceed this limit unless you’re happy to take the risk.

Make sure your terms and conditions are up-to-date, clear and unambiguous. They should leave debtors in no doubt about what is to be paid, when it is to be paid and what the consequences are for non-payment (such as additional interest). Most significantly of all, make sure to give these terms and conditions to the customer before the goods/services are supplied, and the order confirmed. You need to make sure that your terms and conditions are part of the contract.

Your terms and conditions might allow 30 days payment terms. Consider offering a small discount if the debt is cleared within 7 days from the invoice date. This often results in speedy settlement of debts, and means a smaller number of debts have to go into a credit control process.

Have a strong credit control system and be proactive. By all means, issue a credit control letter or email if payment isn’t made on time; but also think about picking up the phone and speaking to your customer. Remember to keep a record of the conversation and any promises to pay on a certain date. Follow up with another call or email if payment isn’t made when it was promised.

Some debtors deliberately choose not to pay creditors that don’t have a consistently strong approach on debt recovery. Make sure that any and every failure to pay on time will be addressed.

The writer is an Activist, Columnist, Author

Tel: +233 20 3748 854 Email: [email protected]