A recent banking sector survey has revealed that customers of Bank of AfricaSpecial focus on AfCFTA: Bank of Africa’s contribution towards the implementation of AfCFTA (BoA) are the most satisfied customers in the country’s banking space.

According to the research firm, Global InfoAnalytics, in its Semi-Annual Banking Sector Brand Health Report, 2022, based on metrics such as customer care and product-use convenience, the BOA recorded the highest rating among its peers in the Ghanaian banking industry.

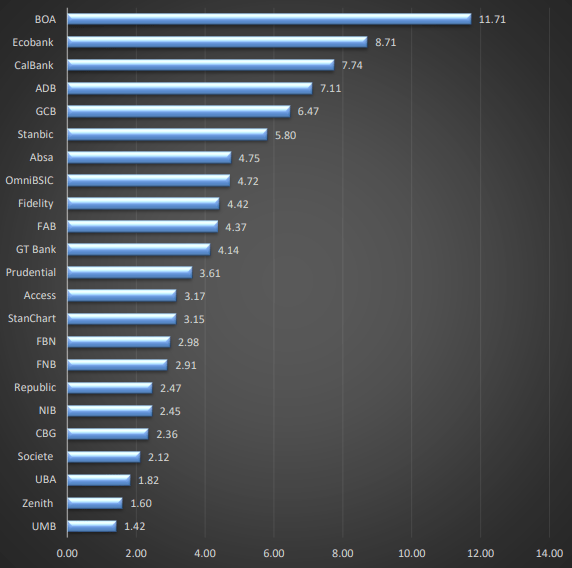

The report showed that the BoA led the customer satisfaction rankings with a gap of three percent compared to the second-placed bank in the survey, recording a rate of 11.7 percent.

The BoA was followed by Ecobank with a score of 8.7 percent customer satisfaction rate in second place, and Cal Bank with 7.7 percent in third place.

The other banks that completed the first 10 customer satisfaction included Agriculture Development Band (ADB) with 7.1 percent, Ghana Commercial Bank (GCB) with 6.5 percent, Stanbic with 5.8 percent, ABSA with 4.8 percent, OmniBSIC with 4.7 percent, Fidelity with 4.4 percent, and First Atlantic Bank (FAB) with 4.3 percent.

Regarding brand satisfaction, the survey revealed that most banking customers are satisfied with their brands as 80.64 percent of respondents indicated that they are extremely satisfied or satisfied with their brands.

However, 15.71 percent of the respondents said they were neutral, while some 3.66 percent were either extremely dissatisfied/dissatisfied with their brands.

Global InfoAnalytics defines customer satisfaction as the rating of a customer’s satisfaction with banks based on customer service delivery and product use. The customer assesses the level of satisfaction based on firsthand experience in patronising banking services and/or other banking products with their respective banks as account holders.

It also defined brand satisfaction as the number of times a brand is mentioned on the web against competitors. Share of voice covers both brand awareness and customer engagement as it reflects how often a brand is seen online.

Head of Service Excellence, Sheilla Gyamfi-Yeboah, touches on what this rating means for the brand, emphasising that one of the bank’s values is customer–focused.

“My department is solely dedicated to ensuring that our customers are always satisfied. It is good to know that the efforts we have dedicated toward the well-being of our customers have been recognised, appreciated, and acknowledged by our customers,” she said.

Brand equity

In the aspect of brand equity, BoA scored quite low ratings and placed 15th, which seems unfortunate. However, the Head of Marketing and Corporate Communications Department, Eric Kojo vanESS Kuranchie, explained the reason for the low performance, stating that four main factors contribute to good brand equity – brand loyalty, brand awareness, brand association and perceived quality.

He indicated that the Bank of Africa has done exceptionally well in these areas except for brand awareness in the retail sector. This, he indicated, is because the strategic intent of the bank is to be recognised as the ‘Trade Bank in Ghana’, and therefore, has directed most of its public engagements to corporate institutions and SMEs. And because of the excellent work the bank has done in this area, it was recognised as the ‘Trade Finance Bank’ of the year 2021.

“Nonetheless, we believe this report is a good wake-up call to develop innovative public awareness strategies for the retail market. Next year, we are poised to be ranked among the top three banks with solid brand equity in Ghana,” he said.