Fitch Solutions has projected import growth will be significantly impacted due to weak and deteriorating economic conditions which have affected businesses and households.

According to the central bank, total merchandise imports amounted to US$7.6billion, up by 11.9 percent on year-on-year basis and driven mainly by the oil import bill. Oil and gas imports increased by 87.8 percent to US$2.3billion, while non-oil imports dipped by 4.7 percent to US$5.3billion at end-June 2022.

The elevated inflation – which reached 31.7 percent year on year (y-o-y) in July 2022 – fiscal consolidation, and tighter monetary conditions are impacting businesses and households. Accordingly, this is expected to curtail demand for imported consumer and capital goods.

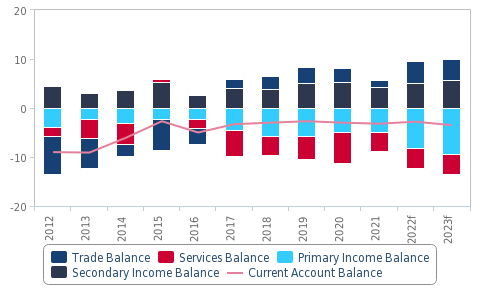

“As such, we expect merchandise import growth to remain well below export growth, at 15 percent over 2022. Overall, we see the trade surplus widening to 4.4 percent of GDP in 2022 from 1.4 percent in 2021,” Fitch said.

However, on the export front, Fitch anticipates merchandise exports to increase by a robust 26.9 percent over 2022; up from 1.8 percent in 2021. The dynamics of this rise involve the expansion of gold production by a healthy 4 percent, supported by the start of new gold mining projects and integration of artisanal miners into Ghana’s formal gold mining sector.

In contrast, there is a projected decline of 1.3 percent for oil output in 2022 – an indication that Ghana will not be able to reap the full benefits of elevated energy prices.

The Bank of Ghana’s data show that total merchandise exports for the first half of 2022 reached US$9billion, compared with US$7.6billion for the same period in 2021. Crude oil exports went up by 61.3 percent year-on-year to US$42.8billion while non-traditional exports increased to US$1.4billion, up by 21.7 percent; and gold exports were US$3billion, higher by 13.1 percent.

“Elevated global commodity prices will cause Ghana’s trade surplus to widen in 2022. Supply disruptions and risk-of sentiment following Russia’s invasion of Ukraine have increased prices of crude oil and gold – Ghana’s two leading export commodities (together accounting for roughly a third of total exports); and, in turn, Ghana’s export earnings,” Fitch said.

For half-year 2022, on the external payments front, the generally favourable commodity prices impacted positively on the terms of trade. At the end of June 2022, the BoG reported a surplus trade account of US$1.4billion representing a year-on-year growth of 62.1 percent – stemming from higher export receipts from crude oil, gold and non-traditional exports.

Fitch Solution expects that the positive impact of a larger trade surplus will be partly offset by a widening primary income deficit, due to the increased borrowing on international capital markets in recent years.

Ghana’s total external debt stock has risen from 37.1 percent of GDP in 2017 to an estimated 50.5 percent of GDP in 2021. With most of Ghana’s debt denominated in foreign currency, selling-off the cedi – which lost roughly 30 percent of its value against the US dollar year-to-date (August 2022) – will inflate the external debt-to-GDP ratio to a projected 78.5 percent in 2022.

“We expect external borrowing to continue, further increasing already high interest payments over 2022 and causing the primary income deficit to widen to a forecasted 8.2 percent of GDP from 4.8 percent in 2021.

“We forecast that the Ghanaian current account deficit will narrow to 2.8 percent of GDP in 2022, from 3.2 percent in 2021. This marks a revision from our previous 2022 projection of a 3.1 percent of GDP deficit – reflecting weaker-than-anticipated merchandise import growth of 7.7 percent y-o-y over the first four months of 2022 while exports grew by 17.1 percent.”