- “One day I had the opportunity to discuss my problem of raising money from banks with a well established business elder. He listened for a while and then said to me, “you are a very good engineer, but you need to get a better understanding of how banks work; you talk about money and banking like a man in the street. It might get you into politics, but it will not help you succeed in business. After such a stinging rebuke, I don’t think I slept much that night, but I knew he was right.”………. Strive Masiyiwa, founder & executive chair at Econet Global

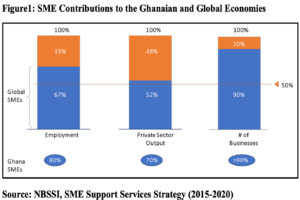

According to the world bank, small and medium enterprises (SMEs) play an indispensable role in most economies, especially in developing countries. SMEs represent the majority of businesses worldwide and are significant contributors to job creation and global economic development. They represent about 90% of businesses and more than 50% of jobs worldwide. SMEs officially contribute up to 40% of national income (GDP) in emerging economies. These figures are significantly higher when informal SMEs are included.

The International Finance Corporation (IFC) estimates that 65 million businesses, or 40% of micro, small and medium enterprises (MSMEs) in developing countries, have an unmet financial need of 5.2 trillion dollars per year which is equivalent to 1.4 times the current level of the global MSME lending. East Asia and the Pacific account for the largest share ( 46%) of total global financial disparities, followed by Latin America and the Caribbean (23%) and Europe and Central Asia (15%).

Estimates show that at least 600 million jobs will be needed by 2030 to absorb the growing global workforce, making SME development a priority for many governments around the world. In emerging markets, most formal jobs are created by small and medium-sized enterprises, which create 7 out of 10 jobs. However, access to finance is a major constraint to SME growth, which is the second biggest obstacle SMEs face in expanding their business in emerging markets. emerging markets and developing countries.

The case of Ghana

The importance of the MSME sector is prominent, employing more than 80% of the workforce and generating at least 70% of national output. MSMEs dominate the country’s industrial scene and have ample potential to fuel the economic development needed to create wealth and alleviate poverty.

They account for about 92% of businesses in Ghana, with specifics of about about 85% of jobs in the manufacturing sector, and contribute about 70% of gross domestic product (GDP). MSMEs are an integral part of the Ghanaian economy and promote the development of various social structures by creating jobs for vulnerable groups including women, youth and skilled workers. low capacity.

In Ghana, MSMEs employ more workers than large enterprises and thus have lower capital costs associated with job creation. They are primarily registered as sole proprietorships, and the largest category of employment is working owners. These groups make up more than half of the MSME workforce. In most cases, the owner’s family is involved in the business. Although they are generally considered unpaid employees, they are active in the company and represent about a quarter of employees.

The rest of the workforce is split between employees and trainees or apprentices. Despite the role of SMEs in the Ghanaian economy, the financial constraints they face in their operations are daunting and this has had a negative impact on their development and also limited their potential to drive the national economy as expected. This is worrying for a developing economy without the requisite infrastructure and technology to attract big businesses in large numbers.

Funding Conundrum

In many of (M)SME access to financing forums, business owners have always pointed to “access to finance” as their biggest challenge in entrepreneurship. For many resource persons however, “capacity building” tops the list. Whichever way this goes, one certainty has been that, financial institutions promise more than they deliver to MSMEs. There are many factors that contribute to this conundrum and both sides have major roles to play to mitigate such challenges. I discuss a few of such below:

- Collateralization

Many financial institutions become reluctant in advancing credit to (M)SMEs because they see many of these businesses as those with inadequate capital base to meet collateral requirement. In a situation where some SMEs are able to provide guarantees, they often don’t have the funds they need to get started on their projects, as the SME property guarantees usually rated at “carnal value” to ensure that the loan is physically insured. in the event of a default due to the uncertainty surrounding the existence and growth of small and medium enterprises.

On the other hand, many (M)SMEs see banks to be exploitative as they require collaterals whose values are almost beyond the roof of a building. Growing businesses do not possess collaterals of such values and therefore are unable to access financing for their businesses as promised by banks when they virtually “chase” these businesses for their accounts.

- Poor bookkeeping skills

Many financial institutions believe (M)SMEs lack capacity in terms of qualified personnel to manage their activities. As a result, they are unable to publish the same quality of financial information as those big firms and as such are not able to provide audited financial statement which is one of the essentials in accessing credit from financial institutions. This is supported by the claim that private companies do not disclose the same amount or quality of financial information as public companies are required to provide. As a result, information about their financial situation, income and earnings prospects may be incomplete or inaccurate. Faced with this type of uncertainty, lenders can refuse credit, sometimes to companies that are able to pay but cannot report their results.

- Lack of specialized products

Many business owners see banks producing and marketing generic products for loans and advances. Many credit products do not specifically address the specific needs of (M)SMEs but only add to the numbers already on the product lists of banks. Specialized products with specialized lending terms in mechanized agriculture, innovative transport, green business, organic food produce, etc. are either woefully inadequate or simply non-existent. Loans and advances are only available for businesses irrespective of their need in a specific sector. This therefore repels appetite of business owners.

- High Interest rates

This is by far one of the most repellents of credit amongst (M)SMEs and banks are fully responsible for such. Where businesses are able to afford credit with skyrocketing rates, their entire capital gets depleted in the long-run. Interest rates within the banking ecosystem pose a big challenge to developing businesses and has a negative rating amongst entrepreneurs within the (M)SME ecosystem. Irrespective of the prime rates from the central bank, banks still maintain high interest rates in lending, to the detriment of (M)SMEs.

- Information asymmetry

There are many businesses still very informal with virtually non-existence information about their operations. Lending institutions greatly rely on available information on institutions when they put in request for credit. Without such, it becomes almost impossible to be considered for financing as a business. Some businesses shun the idea of registering with appropriate authorities in a bid to evade possible taxation and this affects chances of borrowing negatively.

Conclusion

The above are just a few of many factors affecting financing of MSMEs by traditional lending institutions. The banks have major roles to play in ensuring they are not paying lip service in the eyes of business owners. MSMEs also have major roles to play by adequately preparing especially their books to stand a chance of accessing funding. There are also some alternative funding sources to be considered by businesses.

References

https://www.worldbank.org/en/topic/smefinance

https://www.tandfonline.com/doi/abs/10.1080/00036846.2019.1610721?journalCode=raec20

https://smesouthafrica.co.za/10-quotes-famous-entrepreneurs-funding/

About the Writer

Ebenezer worked in banking & NBFIs for close to a decade. He researches, consults, writes, coaches, and speaks on access to innovative & sustainable finance and investment for MSMEs, and also women & youth groups in entrepreneurship.

He is a Development Communication professional, Innovative finance & investment analyst, Certified digital marketer, Sustainability enthusiast and Writerpreneur.

You can reach him at:

[email protected]/www.ebenezerasumang.com

LinkedIn: Ebenezer Asumang

Instagram: eben_asumang

Facebook: Ebenezer Asare Asumang