A Financial Sector & Micro Small and Medium Enterprises (MSME) Financing Expert with the AFC Agriculture & Finance Consultants GmbH, Samuel Kojo Darko, says MSMEs in Africa need innovative and segmented financial solutions to grow sustainably.

He maintained that African MSMEs have unique characteristics which translate into different business dynamics in each sector of their operations; hence, financial service providers and development agencies should extensively engage these MSMEs and integrate their inputs into any product designs and intervention programmes before rolling them out to the MSMEs for whom they are intended.

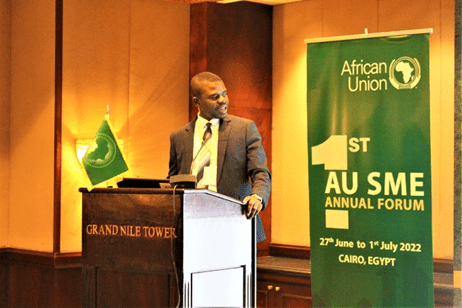

Mr. Darko said this during a presentation at the maiden Africa Union (AU) annual SME conference in Egypt, in a session under the topic: ‘Integrated Financial Services for Sustainable MSMEs in Africa: Insurance & Pension Fund Schemes from MSMEs.”

“For MSMEs, because of the peculiar characteristics of their businesses, we cannot replicate what is happening in the formal sector to them, they need a different approach. We need to be innovative to be able to come up with financial services or products that can better serve them.

“The MSMEs are into different kinds of trades, such as dressmaking, sales of assorted imported products, and others are also into hairdressing, metal fabrications, etc. These are all different sectors of the economy, and we cannot develop a single financial service or product and roll it out to them on wholesale basis and expect better results; we should segment it for each sector,” he maintained.

Insurance for MSMEs

Touching on insurance for MSMEs, Mr. Darko said insurance services are sometimes perceived by MSMEs as something for the big businesses and high net individuals. Therefore, they usually stay away from them.

He, therefore, charged insurance service providers to surgically correct this perception by promoting insurance literacy among the MSMEs.

“African MSMEs are the backbone of our economies; yet, the most vulnerable and most less covered by risk protection mechanisms.

“To better serve this market, the insurance service providers must seek to actively engage the MSMEs to co-create insurance products intended for them through their sector associations. The insurance providers must also solicit the sector associations to elect their own members to champion the sales of developed products as agents,” he stressed.

About the AU SME summit

The AU SME annual conference is the first ever platform which brings together all relevant players in the MSME ecosystem in Africa. It was under the theme: ‘Economic empowerment of SME’s, Women and Youth Entrepreneurs to Realise Africa’s Industrialisation in the Context of the Integrated Market’.

Participants include: Development Financial Institutions, Development Agencies, MSME sector associations, governmental agencies, multilateral financial institutions, and private sector institutions targeting MSME development on the continent.

The event unmistakably coincided with the international SME day which was sanctioned by the United Nations General Assembly resolution 71/279 to be celebrated on 27th June of every year to create awareness, and recognise the immense contributions SMEs play in national development in areas of jobs creation and poverty alleviation among the youth, women and people in the low-income bracket.