The research team at BestBrokers set about to answer the question of “Where does Big Venture Capital invest their money?” To do that, we looked into the most recent data on Unicorns – privately-owned start-ups, valued at US$1bln or more.

The mythical herd doubled in numbers over the course of 2021 when 519 new companies grew enough to make the list. This was a result of large amounts of venture capital getting poured into start-ups while the world economic background kept shifting dramatically.

Methodology

Based on the June 2022 unicorn data, published by CB Insights, we identified the top 10 entities (mainly VC firms) that have ownership in most Unicorns. It turns out that these 10 firms have ownership in 38 percent of all 1143 unicorns. The ranking with the respective number of unicorns each entity has ownership in is represented in this chart:

We then grouped the totality of these Unicorns by industry to get a visual representation of the chief industries that Top Venture Capital is invested in:

The first 3 industries account for 53 percent of the total number of Unicorns

- Internet Software & Services – 22.8 percent

- Fintech – 18.8 percent

- E-commerce & direct-to-consumer – 11.7 percent

The next 4 industries amount to just a bit over a quarter of the Unicorns:

- Artificial Intelligence – 7.5 percent

- Cybersecurity – 7.1 percent

- Health – 6.1 percent

- Data management and analytics – 5.3 percent

The next 8 industries share the remaining 21 percent of the unicorns.

“When we look at the current data, we must do that in the context of the last two and a half years. There have been major political, economic and social changes throughout the world, and this is influencing where Venture Capital goes.

Since the beginning of 2021, Fintech Unicorns grew by a staggering 330 percent, followed by Internet Software & Services with 274 percent, and Cybersecurity with 267 percent. Next in the list are Health, Data Analytics, Logistics and AI. We can clearly see how the trending industries are influenced strongly by the pandemic and the changes it brought about.”

– commented Alan Goldberg, analyst at BestBrokers.

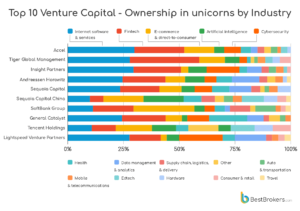

We then looked at the individual entities and grouped the Unicorns they have invested in by industry:

From this visual distribution, we can do some interesting observations:

* Clearly, Software and Fintech are in the lead. These two industries account for over 50 percent of the unicorns that the 3 dominant firms in the list (Accel, Tiger Global Management, and Insight Partners) have ownership in.

* E-commerce – the third most backed industry – however, is strongly represented in the portfolios of all Asian entities in the list – Sequoia Capital China, SoftBank Group, and Tencent Holdings. The industry takes the first place in all three Asian firms.

“China is, without any doubt, the world’s leading manufacturer. According to Statista, e-commerce revenues in Asia are expected to touch the US$2trillion mark by 2024, and it comes as no surprise that Asian entities heavily invest in this industry,” added Alan Goldberg.

* AI and Cybersecurity – the 4th and 5th industries in the list have also seen significant growth in the last year with 150 percent and 267 percent, respectively. We can see them represented very strongly in the portfolios of certain firms in the top 10 list.