- At 2030, I would say that you probably have two billion people that’ll be using day-to-day banking services, independent of banks.

Research by Statista (2020) indicates that almost 2 billion people globally actively used online banking, and this trend is projected to rise. In fact, by 2024, there will probably be 2.4 billion people who actively use online banking. Moreover, between 2020 and 2024, the Asian market is forecasted to reach almost a billion.

Most players in the banking sector recognise the scale of the digital transformation they are now part of. Digital disruption is happening at every level in the banking industry, and everyone agrees that digital transformation is essential to stay ahead of the pack, reduce costs and ensure viability. However, in place of the hype and the froth, a sense of realism about the future of banking and how to achieve it is very welcome. Indigenous banks are fascinated about the prospects but at the same time wary of the quantum of risks and challenges associated with the transformation.

Digital banking simply means the full digitization of banks and all its activities, programmes and functions. It’s not just about digitizing your services and products (the front-end that customers see) but also about automating your processes (the back-end) and connecting these worlds with middleware. Digital banking is about the automation of every step of the banking relationship, and it goes way beyond an online or mobile banking platform.

Banks are affected by digital disruption and penetration, and they know they need to act fast to manage it. New entrants or startups are changing customer expectations and impacting revenue streams. Banks need to improve customer experience, increase operational efficiency and respond faster to industry changes if they want to succeed in a digital economy. They need to make a fundamental switch in their day-to-day operations, yet stay true to their own identity; they need to handle digitalization in a way that suits their organization, customers, and workforce.

Digital banking doesn’t only create opportunities for improving efficiency and reducing long-term costs and creating high-value digital services; it also leads to major challenges and risks. The risks and challenges become stumbling blocks for indigenous banks to scale up to the “real digital world situation”.

Ghana banking ecosystem

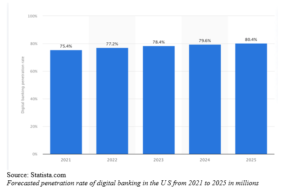

Digital transformation has been by far one of the most discussed topics within the ecosystem and virtually all financial institutions have digitized their operations in one way or the other However, full digitalization is still far off and at a slow pace due to many factors. Although Deloitte (2022) indicates that 73% of people worldwide use online banking at least once per month, majority are concentrated in the West where for example in the US alone, 76% of the surveyed respondents use a mobile banking app according to Forbes (2022).

Statista also show in the Far East and China in 2020, there were over 800million online banking users and the number keeps soaring There were 360million active users in Europe and 240million users in North America.

Crust of the matter

There are lots required for Ghana`s ecosystem to attain an appreciable level of digitalization and strongly take centre stage within the global banking ecosystem. The reasons for slow pace include:

- Culture of maintaining strong ties with legacy platforms:

For most banks, legacy infrastructure is the biggest challenge and highest hurdle to digitalization. Having been built up piecemeal over time, they allow banks to replicate certain parts of a given process online, but that is the limit to what they can achieve. They are the source of siloed information and siloed operations: the direct opposite of the agile, nimble digital processes banks now require.

Their complexity and old-fashioned architecture are the reason for such immense maintenance spends. Legacy platforms reach into almost every aspect of the businesses, and replacing them is not always the right thing to do. Re-engineering core systems and processes to be built upon a digital core foundation can be a smart solution.

- Finding the right talent to transform:

Digital transformation is a complex process, and you need specialists to metamorphose into a digital bank. Finding the right people, who can guide you through this transformation, is a real challenge for many banks. Digital transformations are more about people than machines. Having the right individuals in place to lead the transition is a matter of honestly assessing your own capabilities and shortcomings. As technology continues to shape the way business gets done, placing your trust in people first will be your best strategy for success. Sustainability leadership is required to help source the right talent to undertake the transformation drive for the institution.

- Winning & retaining customer`s trust:

Trust is the essential prerequisite for widespread adoption of digital banking by customers; they must be sure that their identity will not be stolen, that fraudulent payments will not be made from their accounts, and that electronically-signed bank contracts retain the same legal value and validity as hard-copy contracts.

Just like legacy platforms, customers of a bank become fixated with traditional services provided by brick and mortar. This therefore makes it challenging to entirely change that with technology. In the event of retaining their clientele, banks will therefore tread cautiously on the digital transformation journey. They want to build a 100% trust for customers.

- Staying on point with regulatory requirements:

The ever-changing regulatory requirements for banks, sometimes pose great challenges to various institutions within the ecosystem. Banks are virtually always watching their shoulders for the next possible change or requirement from the regulator especially with issues on digital transformation. Banks are required to comply with increasingly stringent legislation associated with digital transformation. These requirements are instituted internationally and therefore pose challenges to indigenous banks who are already reeling under the tough internal regulations. They must also protect themselves from cyber-attacks, etc., to fulfill risk management obligations.

- Cautious optimism in dealing with risk of cyber threats:

The challenge for banks to protect themselves against cyber-attacks and digital fraud is also a risk. Threats have become extremely advanced, and the attackers are smart enough to identify the kind of precautions that the banks can take, and they design their attacks accordingly. It’s something banks need to be well aware of. Banks need customers’ data to improve their customer experience, but it can also lead to reputational damage as customers may feel that banks have too much data. Privacy becomes increasingly important, so trust is key.

What next

The Ghana banking ecosystem is ‘in transit’ and yet to arrive at the final destination. There are roadblocks to achieving digitalization but there are also strategies to surmount these roadblocks by all means and at all costs. Banks should focus on the low hanging fruits to help them in the transformation with a step-by-step approach.

These challenges are surmountable and banks can take the bull by the horn to ensure this is done. Digitalization eventually will have the needed effect on the bottom line when fully embraced and implemented y financial institutions.

Conclusion

There is no doubt that the eruption of the digital is no longer just a change in the ways of life but a progress of it. Traditional banking can no longer be maintained if it does not update its services and adapt to the demands of increasingly digitized consumer profiles. Technologies such as Big Data or the Cloud are already part of new business models that have made the banking sector more updated than ever. We can see it with the appearance of Blockchain or Fintech and in such simple actions as making payments with only a slight movement in the mobile phone. As a result, we have a modernization in the sector that facilitates faster transactions and many other advantages.

Consumers desire for digital banking services will most likely increase, per research findings and supporting stats, forcing many traditional financial institutions to fast-track digital innovation efforts. As a result, many legacy banks may look to fintech firms for assistance in bringing better digital banking solutions to the marketplace. Before the recent coronavirus outbreak and resulting market instability, several large acquisitions occurred in late 2019 and early 2020.

As the marketplace adjusts to some new realities, many more acquisitions, partnerships, and collaborations may occur that could completely change the banking ecosystem as we know it. The recent activity has been focused on data, advanced analytics, payments, lending and investment opportunities. These combinations provide an excellent perspective on trends in the much broader banking ecosystem that every bank executive should be aware of.

References

Boateng. K and Nagaraju. Y (2020), The impact of digital banking on the profitability of deposit money banks: Evidence from Ghana

https://safeatlast.co/blog/online-banking-statistics/#gref

https://practiceguides.chambers.com/practice-guides/fintech-2022/ghana/trends-and-developments

https://thedocs.worldbank.org/en/doc/412821598381054828-0090022020/original/GhanaDE4ALOWRes.pdf

About the Writer

Ebenezer ASUMANG worked in banking & NBFIs for close to a decade. He researches, consults, writes, coaches, and speaks on access to innovative & sustainable finance and investment for MSMEs, and also women & youth groups in entrepreneurship.

He is a Development Communication professional, Innovative finance & investment analyst, Certified digital marketer, Sustainability enthusiast and Writerpreneur.

You can reach him at:

[email protected]/www.ebenezerasumang.com

LinkedIn: Ebenezer Asumang

Instagram: eben_asumang

Facebook: Ebenezer Asare Asumang