The alternative

Investing in precious metals usually takes the form of purchasing physical gold or silver, or investing in shares of individual mining companies – each approach with its own unique merits and risks.

Direct equity/debt investments in mineral resources companies are ubiquitous among investors; however, investing in royalty and streaming (R&S) companies are unconventional.

R&S companies should not be conflated with the royalties (essential taxes) paid to sovereign governments in exchange for mining rights.

As an alternative to procuring physical minerals or thoroughly researching specific mining companies, royalty and streaming companies expose investors to a diversified mineral revenue portfolio.

R&S companies make an attractive investment for institutional investors looking for solid returns during a time of low-interest rates.

The role of R&S companies

R&S companies offer financing for the capital-intensive expansion and development of mining projects through R&S agreements. In return, they receive a percentage of the mining company’s revenue or metal production at a discounted price.

These companies are not directly involved in mine operations. They primarily search for new value by funding and directly engaging miners that require capital to forge agreements that deliver value for their shareholders through stable exposure to minerals production.

Royalty deals are settled by cash while streaming deals are settled with the physical transfer of metal.

The bulk of streaming deals has been targeted at gold and silver, representing more than 90 percent of streamed volumes as of 2020. However, there is an opportunity to replicate this business model in other mineral types like lithium.

Comparing R&S companies with mining companies

R&S companies present lower, steady and predictable costs and higher profit margins relative to mining companies due to the absence of huge overhead costs and risks from expensive equipment and large teams.

Certain R&S agreements present bonus benefits from upturns in commodity prices, the growth of the company and expansion activities, usually at no extra cost other than the initial up-front payment.

However, there is a limit to which the R&S company will remain truly insulated from a prolonged increase in costs that have a damaging impact on the underlying business. Also, a fall in spot price impacts the revenue stream to R&S companies.

Notwithstanding, R&S companies are better positioned to manage risk and diversify their portfolio on account of exposure to a large and varied asset base compared to mine operators – who are typically bound to a few mines at any given period.

Of the two, dividends of R&S companies are much less reactive to precious metal movements. On average, R&S dividends were up to ten times higher during gold’s downturn from 2014 to 2016.

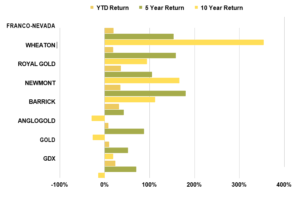

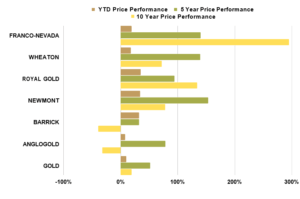

A comparison of total returns of three major royalty and streaming companies with the performance of gold and the GDX (VanEck Vectors ETF Trust)) reveals that royalty companies significantly outperformed gold and the GDX over the last decade (Fig. 1). Stock prices of royalty and streaming companies generally outperform the prices of gold (Fig.2).

The path forward for Africa

Many mining companies find it tasking to secure funding for capital expansion projects through traditional financing. Industry commentators predicted the onset of private debt and equity as the panacea for the capital raising challenges in the mining sector. However, the emergence of private debt and equity has not been as impactful in mining as initially envisaged.

In contrast, R&S finance, as a source of alternative financing, has surged from US$2.1billion in 2010 to more than US$15billion in 2019. McKinsey believes alternative financing could represent approximately US$800billion in financing, equivalent to approximately 40 percent of the industry’s estimated capital-investment needs over the next 10 years. The bourgeoning growth of this alternative financing, combined with a rising commitment to growth by management teams, sets R&S financing on a high growth trajectory over the next decade.

R&S finance has been prevalent in the North American markets, and is now recording investor interest globally. Although R&S companies such as Sandstorm Gold, and Vox Royalty have significant assets and growing interest in Africa, the continent itself cannot boast a well-established indigenous R&S company.

The mitigating risk feature of this form of finance in which investors are not required to invest directly, but can leverage potential upside and income generation from a portfolio of mining projects, is leading to increased interest by investors with no prior experience in metals and mining in Africa. As more nations take to renewable energy sources, the expectation is for the trend to expand to include African base and battery metals as demand increases.

What this means is that junior and mid-tier mining operators across Africa can now access the required capital to adjust to the rapidly evolving terrain without adversely altering the capital structure. R&S finance will also play a significant role in financing base and battery metal mines across the continent in the coming years.

The Ghana opportunity and Agyapa Royalty Company

Government, through the Minerals Income Investment Fund (MIIF), seeks to diversify its sources of funding for long-term investment in gold mining companies in Ghana and internationally, infrastructure in mining communities and other aspects of the gold mining value chain by leveraging on a portion of its royalty receipts from mining operations.

Specifically, the MIIF Act stipulates that the fund can “monetise the minerals income accruing to the Republic in a beneficial, responsible, transparent, accountable and sustainable manner”.

Pursuant to this strategy, MIIF, in 2020, initiated the process of leveraging a portion of the royalties it collects by setting up a pure gold royalty company called Agyapa Royalties Limited. The strategic objective of Agyapa Royalties Limited is to provide MIIF and the Government of Ghana with another avenue to derive more value from the gold mining sector.

The long-term strategic objective is to leverage on the market advantages of a royalty company, namely: lower risk and, wider margins and diversification. Agyapa will invest in existing gold mines and other royalty companies globally and raise funding to support infrastructural development in mining communities.

MIIF, in this vein, seeks to list Agyapa on the London Stock Exchange and the Ghana Stock Exchange. This will be Africa’s first publicly listed gold royalty company.

Beyond the gains of long-term capital for investment, this transaction will offer both retail and institutional investors the opportunity to share in the wealth of the mineral resources of Ghana, and other assets that the fund will acquire. It will deepen the capital market in Ghana, and open a new frontier of responsible investing and shared wealth for stakeholders.

To derive substantial benefits from mining, Ghana and the rest of Africa need to develop balanced policies which would incentivise global investments in the sector and also allow substantial Ghanaian and African interests across the value chain. The traditional medium of relying mainly on royalties and dividends through free-carried interest is outdated and cannot meet expectations in terms of economic growth and development.

The creation of royalty companies, such as Agyapa in Ghana, presents a proven alternative investment model or approach which will help the continent and Ghana derive the much needed long-term value from mining.