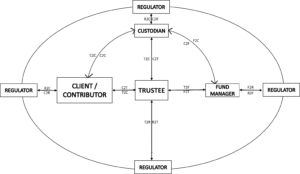

Digitalization with respect to private pensions is the reorganization of pension business and service delivery using Information and Communication Technologies to create digital relationships between the Trustee and the Contributor/Client (T2C); between the Trustee, Fund Manager and the Custodian (T2F2C); between the Regulator, Trustee, Fund Manager, Custodian R2T2F2C); and finally between the Regulator and the Contributor/Client (R2C). It therefore requires some form of remote interaction and processing, anywhere, anytime and on any device. (see figure 2)

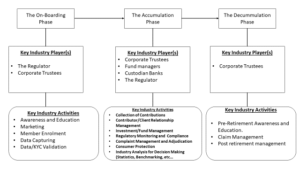

The pension players in any case cannot digitalize without digitizing their internal operations and business processes in the Private Pensions phases (see figure 1). Digitization involves scanning existing paper based documents, analogue, into machine readable electronic form, digital – PDF, Word, Excel – that can be manipulated and analyzed electronically. Also automating internal processes and documentation into machine readable electronic form to allow access through computers, mobile phones and other digital devices. Once this is done, then can the private pensions industry say it is ready for digitalization.

This article is to look at the private pensions’ phases and how each phase can be digitized to allow the digitalization of the private pensions industry in Ghana.

THE PRIVATE PENSIONS PHASES

In Figure 1, I have shown the Private Pensions Phases of On-Boarding, Accumulation and Decumulation with respect to the services and activities that the service providers or players have to undertake. The activities in the three phases are as follows:

- On-Boarding phase which involves the Regulator but squarely falls on the Corporate Trustees with respect to membership enrolment, data collection, data validation and data capturing.

- The Accumulation phase involves all the players, the Corporate Trustees, the Regulator, the Fund Managers and the Custodians with respect to contributions/data management, investment management, client/service management, complaint management, regulatory compliance as wells as retirement education and awareness.

- The Decumulation phase also squarely falls on the Corporate Trustee with respect to pre-retirement engagements, claim management and finally the lump sum benefit payment.

THE PRIVATE PENSION DIGITALIZATION INTER-RELATIONSHIPS

In Figure 2, I have attempted to show the digitalization inter-relationships between the players in the industry in Ghana. The Regulator and the Corporate Trustees have a R2C relationship with respect to compliance and regulatory reporting; the Regulator and Fund Managers have a R2F relationship also with respect to compliance and regulatory reporting but particularly, investment guidelines compliance; the Regulator and Custodians relationship of R2C, is with respect to book keeping of contributions collections from contributors and investments made by the Fund Managers; the Regulator and Contributor/Client with respect to consumer protection, complaints handling and adjudication; the Corporate Trustee and Fund Managers have a C2F relationship with respect to investment advice/options and approvals; the Corporate Trustees and the Custodians relationship of T2C is with respect to book keeping of contributions collections from contributors, transfers to monies to Fund Managers and investments made by the Fund Managers; the Corporate Trustees and the Client/Contributors relationship of T2C is with respect to relationship management by way of investment and contribution statements, complaints handling and service delivery; the Fund Managers and Custodians relationship of F2C is with respect to movements of funds for investment and recording of investments. There is a dual digital relationships and communication between the players.

Having had an appreciation of the phases in private pensions and the digitalization inter-relationships between the various players in the industry in Ghana, we will look at the actual role of each player in the digitization and digitalization process.

Role of players

- The Regulator

The supervisory role of the Regulator requires off-site supervision which requires the submission of regulatory or statutory compliance reports. The Regulator will need to develop an Intranet, a form of closed website or network exclusive to the players, amongst the players, with the reporting formats digitized. The Corporate Trustees, Fund Managers and Custodians can then log-into this intranet to complete whatever forms or returns. This is more efficient than the completion of Microsoft Word and Excel sheets and forwarding of returns by email. Sending reports by e-mail is of course an improvement on manual paper based reporting but is far from throughput digitization. Using digitized on-line forms immediately creates a database of information that can be mined and analyzed for risk management.

The Fund Managers and Custodians need not send email reports to the Corporate Trustees who will then have to have internal systems to process these reports for decision making and analysis to further send their statutory reports by email to the Regulator. With the Intranet, the information becomes immediately accessible to both the Regulator and the Corporate Trustees for their use. The Regulator is then in a better position to have a “helicopter view” of the industry since the digitized data can be manipulated in any form.

A well-developed system by the Regulator will “Push” analyzed reports to the Players instead of the present system of “Pulling” of reports from the Players which cannot be effectively and efficiently analyzed. All the reports would have been automated at the “back end” of the Intranet from the digitized data being collected. Each player would have a specific analyzed report available and an industry wide report also would be available in real-time. It will then be possible, in real time to know the classification of assets as required by the investment guidelines, the weighted average returns on investments, the concentration risks with respect to assets invested in, the ranking of the players by way of Assets Under Management, number of contributors and rate of returns.

The Intranet should also include an in-built complaints management system, where the Contributors can directly lodge complaints that will be directed to the Corporate Trustees involved for resolution. The Corporate Trustees themselves will have to log all complaints received for effective monitoring with complaints being monitored real time and analyzed to manage risk. The system should have a gateway to allow Contributors to initiate porting requests on-line for the Corporate Trustees to respond and make the necessary data and money transfers, all of which will be captured and updated through the system.

The advantage of such an Intranet system is that every industry data will be readily available in a centralized database for analytics. Any analyzed information once made public will bring information symmetry for decision making by Contributors with respect to which Corporate Trustees to do business with. The Corporate Trustees will not have to individually invest in technology for data analytics and regulatory compliance reporting that will require some technology standardization for synchronization.

The Regulator will also have the flexibility to introduce new regulatory and compliance reporting requirements to manage new risks that are identified through the off-site analytics supervision to prompt any risk based on-site supervision. As in figure 2, this will create a digital link between the Regulator and the Players in the industry for effective digitalization.

- The Corporate Trustee

The Corporate Trustees, have to provide services to their clients, the Contributors, with respect to enrolment by opening of individual retirement accounts, collection of contributions, giving them statements (contributions and investment), handling complaints, benefit payments or claim management and general relationship management. It is therefore necessary for all these activities to be digitized internally to allow for digitalization of the services. The critical tool to be used is a fully functional secured transactional website that allows for information pushing and pulling by both the Corporate Trustee and the Contributor.

The Contributors should be able to remotely enroll unto schemes, make changes to certain dynamic data such as beneficiaries, make payments into their accounts, and view their bio-data to make any allowable amendments as well as monitor the performance of their investments. They must be able to remotely make complaints and monitor the resolution process.

- Fund Manager

The Fund Manager is a service provider, agent, to the Corporate Trustee with the relationship being that of Principal-Agent. The Corporate Trustee is to supervise and exercise proper control over the Fund Manager. The Fund Manager is supposed to provide investment advice to the Corporate Trustee for approval and final decision making. They are under section 147 of Act 766 to invest the pension funds and assets in different investments, minimize investment risks whilst achieving the best returns as well as maintain books of accounts on the transactions relating to the investments made. Digital books can be maintained by the Fund Manager and made remotely accessible to both the Corporate Trustee and the Regulator.

The investment advice and approval process can be automated through the digitalization ecosystem with instant notification on any device. The regulator can drill down to know the interactions between the Corporate Trustee and the Fund Manager and monitor compliance benchmarks in real time especially to proactively query certain decisions that seem to be conflict of interest prone. A Fund Manager recommending purchase of stocks that has a linkage with the beneficial owners of the Fund Manager’s company can easily and only be immediately detected with an embedded well modelled risk management analytics tool.

- Custodian

The Custodian is also a service provider, agent, to the Corporate Trustee with the relationship being that of Principal-Agent. The Corporate Trustee is to supervise and exercise proper control over the Custodian. The Custodian under section 155 of Act 766 is to receive contributions from employers or contributors on behalf of the Trustees, hold pension fund and assets in trust for the members of the schemes, settle transactions and undertake statistical analysis on the investments and returns.

There is no better platform for the Corporate Trustee to supervise and exercise proper control on the activities of the Custodian than on a digital platform. To be able to plug into any the digital ecosystem, the Custodian’s must keep all records in digital form and make on-line the investment certificates with real-time update of investments and returns with the associated statistical analysis. This should be accessed remotely by both the Corporate Trustee and the Regulator.

- Client/Contributor

The Contributor’s interest is paramount and he/she is the focal point, the ultimate beneficiary and client to all these private pensions’ arrangements. What he/she requires is flexibility and convenience with respect to making contributions and receiving benefit payments, giving and accessing information, making complaints and receiving feedback.

The Contributor needs analyzed industry information by way of statistics and benchmarks relating to investment returns, complaints management as well as the extent of regulatory compliance by the industry players. This processed information will assist the Contributors in their decision making process to be able to make informed porting choices between Corporate Trustees, as well as determine the adequacy of projected retirement benefits and whether or not there is the need to top up contributions to achieve a desired benefit outcome.

The Contributor who is the Client should be able to log into this digitalization ecosystem to view or access Corporate Trustee specific or Industry wide statistics and personal investment statements for decision making. It will also allow the Contributor to determine their risk appetite as to which Corporate Trustee to do business with.

ADVANTAGES OF DIGITALIZATION

- Supervision and Monitoring by Regulator

Digitalization allows for improved Risk Based Supervision due to early detection of risk events. Data will be gathered on-line and in real time and allow for an in-built risk management modelling. Cost of supervision is therefore reduced as early warning signs can be triggered as and when they occur for effective off-site and follow up on-site supervision.

No need for Regulator to “Pull” information by way of regulatory returns and compliance issues. These could be modelled in the system and automated for real time analysis without waiting on the service providers. Players in the industry can pull whatever information about their operations that have been processed and analyzed. Analyzed data can instead be “pushed” to whoever requires it.

Once the Ghana card is used as the common form of identity, the Regulator will be in a better position to track any money laundering activities in personal pensions such as huge one off placements and layering of multiple amounts with different Corporate Trustees.

- Information Availability, Integrity and Symmetry

Data will be collected on-line and in real-time. Relevant, accurate and reliable information will be readily available through data mining and analytics to all stakeholders for decision making at the same time. This will eliminate the risk of information asymmetry.

- Service Delivery and Consumer Protection

The Contributor is the consumer and has to be protected. Digitalization will allow for prompt customer service by way of flexibility, convenience, target or customized content, complaint management, feedback mechanism and information sharing. It will allow the Contributors to make informed porting decision to more efficient Corporate Trustees and reduce fraudulent benefit claims.

- Informal Sector Private Pensions

The informal sector in pensions is the most challenging sector to engage. The relationship with the Corporate Trustee is many-to-One. Data and contribution collections are expensive activities. A digitized private pensions operations with an inbuilt payment system such the MoMo platform is the most efficient model to reach out to and service the informal sector. A throughput processing system with little human intervention where the Contributor can pull and push information at his/her convenience cannot be over emphasized.

A digitized private pensions operations will encourage voluntary retirement savings by way of personal pensions’ plans at Contributors convenience as and when money becomes available to them to increase coverage. The e-levy however can be a stumbling block in this process if its effect is not addressed immediately.

E-LEVY AND PENSION DIGITALIZATION

Section 89 (1) of the National Pensions Act, 2008 (Act 766) states “Tax is not payable by an employer or employee in respect of contribution towards retirement or pension schemes under this Act”.

Under our pension regime, contributions to pensions are tax exempt. The tax benefit, however, only benefits the formal sector using PAYE system. Unfortunately there is no tax incentive to those in the informal sector since they must make direct payments, contributions, from their earnings towards their pension. The “trotro” driver for example does not use a PAYE system to make contributions that are pre tax deductible. The biggest challenge for the Corporate Trustees has been onboarding of the informal sector unto personal pension plans since the tax incentive is not a selling proposition.

With the introduction of the e-levy, the informal sector contributor who has no tax incentive since payment is made outside the PAYE system will now have to pay 1.5% on for every payment made through the MoMo platform or other banking digital payment platforms. This is not only an illegal deduction according to Act 766 but also negatively affect informal personal pension which is a voluntary contribution

The cost to the Corporate Trustees in operating in that sector is high especially with respect to collection of these retail contributions hence not a profitable business venture. The innovative way for those who are hoping against hope to have “first mover advantage” by operating in that space has been through digitalization and MoMo collection being the mode of collection of contributions to reduce their operational cost. A solution must be found with the application of e-levy when it comes to personal pension plans for the informal sector.

The solution is quite simple though. The Regulator, NPRA, should collaborate with the National Communication Authority, Ghana Revenue Authority (GRA) and the Telcos so the Corporate Trustees are given special MoMo numbers or Merchant Numbers that when used will exempt pension payments form the e-levy. If not, the e-levy is going to derail the small successful steps taken by the Corporate Trustees operating in the informal sector in the digitalization process.

CONCLUSION

Pensions is not about money but about data availability, integrity, and accuracy which can best be done through a centralized, digitized, on-line, real-time system to be accessed anywhere, anytime and on any device. If you have the money but do not know who it belongs to then there is a problem but if you have the data as to who is owed what but no money, the money can be found. Digitization and Digitalization in private pension is the most effective and efficient way forward for data management.

The bulk of the digitalization of the private pension space however falls on the Regulator who must champion and create the enabling digital platform. This will allow the players to plug in for a complete digital private pensions ecosystem for data collection and analytics, information sharing and symmetry as well as inter-party transactions and payments.

The author holds MBA in IT Management and an LLM in IT and Telecommunications Law. He was the former CEO of National Pensions Regulatory Authority (NPRA). (Contact: [email protected])