So, what are my concluding thoughts?

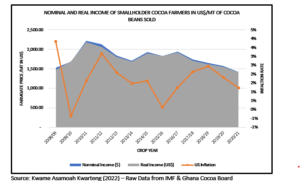

Fighting the global movers and shakers of the cocoa-chocolate industry is highly essential. The unequal distribution of value within the value chain impacts the earnings of producing countries. However, let’s not be deceived that an increase in the world market price results in an increase in the income of cocoa farmers (Refer to Graphs 2 & 3, Fig 1 & 2). We can’t cry to the world that it’s unfair for producing countries like Ghana not to have a hand in the setting of cocoa prices when in our own home we have refused to allow cocoa farmers to also lead in negotiating the farmgate price.

It has also been established that the real income of cocoa farmers is further worsened due to their dwelling in rural areas that lack easy access to amenities that sustain their day-to-day livelihoods, as compared to those in urban areas. We have also seen the unequal distribution of cocoa income between the Ghana Cocoa Board and the Smallholder cocoa farmers.

Ghana Cocoa Board pretend they have farmers representing on the producer price committee, yet I cannot establish how a farmer would agree for producer prices to stay the same in the sight of increased cocoa prices in both US$ and GH¢ terms. Also, how many cocoa farmers are on the committee, and how vital is their representation if a majority vote is used to decide the final decision.

Four Recommendations

- Smallholder Ghanaian cocoa farmers must be paid in US dollars, not in Ghana cedis.

Ghanaian cocoa farmers need to be paid in US$ and not in Ghana cedis. This will help insulate their incomes against inflation as the US$ has proven to outperform the Ghana cedi consistently. As shown in graph 7, the cocoa farmers’ real income is almost equal to the nominal income in US$ terms.

This is because the US$ inflation rate, as shown in graph 7, is 2 percent on average from 2008/09 to 2020/21 crop year compared to graph 6, where Ghana’s inflation rate has since been double-digit until 2018/19. Ghana’s inflation rate, on average, is on the rise; likewise the Ghana cedi’s depreciation against the US$. At the same time, as is practised by most countries when inflation keeps being on the higher side, central banks increase lending rates to discourage consumption.

This will mean that farmers who are mostly encouraged to take loans to finance their farm operations and other livelihood issues will be subjected to more debt due to high-interest rates, aggravating their livelihood challenges. Paying the farmers in US dollars will, hence, allow the farmers to leverage the US$ appreciation rate to reduce the impact of inflation on their livelihoods.

Paying cocoa farmers in Ghana cedis subjects them to demand, and supply-driven inflation of goods and services in addition to forex exchange-driven inflation since a significant amount of our consumption is being imported using US$. Paying cocoa farmers in dollars isn’t a big ask as their cocoa beans are already being traded in US$ by Ghana Cocoa Board. If cocoa processing firms in Ghana can sell their semi-processed products in US$, then why should it be controversial to ask for cocoa farmers to be paid in US$.

Graph 7: Nominal and real income of smallholder cocoa farmers in US$/MT of cocoa beans sold

Note: the 2020/21 nominal income excludes the LID payment. The reason has been explained here.

- Cocoa farmers-led annual negotiations for the % share of the world market price of cocoa, not a GH¢-based producer price.

As highlighted in recommendation one, there are a lot of real income benefits if cocoa farmers are paid in US$ rather than GH¢. We also talked about the cocoa producer price committee’s role in determining the producer price of cocoa each year and claims that they have cocoa farmers on the committee.

So instead of the committee being the arbiter of what a fair producer price is, let’s flip the script to allow cocoa farmers first to be the ones to propose how much they want to be paid as the producer price of their cocoa. Secondly, instead of offering a price, I would recommend the cocoa farmers propose a percentage of the world market price in US$ at which Ghana cocoa board sold their beans. This will lead to cocoa farmers’ ability to request data on the schedule of sales by the cocoa board, and at what price those scheduled exports were sold.

This approach removes the lengthy discussions and confusion around exchange rates that can be wrongly forecasted by the finance team at the Ghana Cocoa Board, leading to hefty pain on cocoa farmers’ livelihoods. Again, this would not be too much to ask as cocoa is sold in US$ in the international market by Ghana Cocoa Board. Hence, agreeing on the percentage of that value as the farmgate price will be a fair income distribution with a positive impact on the livelihoods of cocoa farmers.

—— Subscribe to https://cocoadiaries.substack.com/subscribe to continue reading & view the graphs with detailed labels ——–

Copyright Note:

The content of this publication should not be republished in any shape or form without official consent from the author. You can reach out to me for publication discussions via [email protected].

If you want the complete 5000 worded report sent to you in PDF, kindly reach out to the author for a quote. Alternatively, you can subscribe to my newsletter cocoadiaries.substack.com/subscribe to read the full version of this article.