Foreign inward remittances have been observed to be one of the least volatile sources of foreign exchange earnings for developing countries. While foreign capital flows tend to rise during favourable economic cycles and fall in bad times, remittances appear to react less violently and as such tend to exhibit remarkable stability over time.

Essentially, foreign investors base their investment decisions on pure profit motives which are generally dictated by the business environment, while migrants make their remittances on the basis of pure family ties and other economic commitments between family members.

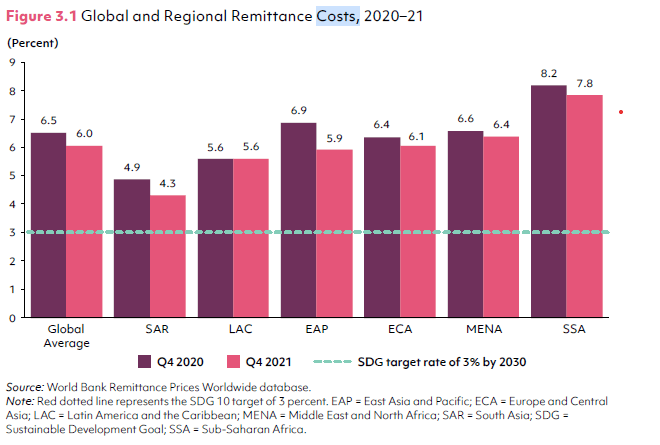

Nonetheless, remittance costs are significantly higher for Africa compared to other regions; sub-Saharan Africa remains the costliest developing region to which remittances are sent. Aggregate regional remittance costs averaged 7.8 percent during Q4 2021. Essentially, reducing these costs will mean substantial extra transfers.

Ghana is the second-largest recipient in the sub-Saharan Africa region. Ghana receives a substantial amount of remittances from the diaspora each year. The World Bank records that the inflow of remittances saw an immense increase from US$32.40million in 2000 to US$135.85million in 2005, and further to US$2.13billion and US$4.982billion in 2011 and 2015. As a result of the global financial crisis of 2015 to 2016, there was a drop in 2016 to US$2.98billion.

Inflows began to increase in 2017, and in 2019 about one million Ghanaian migrant workers in foreign countries and others in the diaspora remitted US$4.05billion – equivalent to about 6.1 percent of GDP. This further increased to US$4.5billion in 2021, equivalent to 5.9 percent of GDP.

Remittances are typically transfers from one person to another person or household. They are targetted to specific needs of the recipients and thus tend to reduce poverty. Cross-country analyses generally find that remittances have reduced the proportion of poor people in the population.

Accordingly, reducing the cost of remittance transactions has a direct impact on development by freeing additional resources that, instead of being paid as transaction costs, will remain with senders and receivers of the flows. An interesting analytical finding reported by World Bank (2006) indicates that the cost elasticity of remittances is high – implying that a 1 percent decline in cost can lead to more than 1 percent increase in the volume of remittances.

Remittance cost as highlighted in Sustainable Development Goal 10 – Target 10 calls for a reduction to less than 3 percent the transaction costs of migrant remittances; and ensuring that in no corridor remittance senders are required to pay more than 5 percent by 2030.

Transmitting Operators involved in the transmission of migrant remittances into Ghana include licenced businesses such as banks and national transfer companies, as well as large international businesses like Western Union. The cost of sending money to recipient countries from the origin country of emigration reflect fees and commission charged to convert the remittance into local currency. According to information obtained from domestic financial institutions representing the foreign Money Transfer Operators (MTOs), these costs have decreased over time as remittance flows into Ghana increased.

It should be noted, however, that for most banks – if not all – inward transfer proceeds credited to customers’ accounts (Foreign) do not attract any charge. Whereas banks use interbank foreign exchange rates for the conversion of remittance proceeds, other financial houses use Forex bureau exchange rates which are higher – thus making them the preferred channel for remittance transfers for some market participants.

Global trends

Globally, the cost of sending money across international borders continued to remain high at 6.0 percent on average during Q4 2021, or double the SDG target of 3 percent (figure 3.1). Sub- Saharan Africa is the costliest (7.8 percent), according to the World Bank’s latest report on Migration and Developments 2021.

Corridor-specific data reveal that remittance costs tend to be higher when remittances are sent through banks rather than through digital channels or through money transmitters offering cash-to-cash services. Money transmitters, however, depend on correspondent banks to deliver cross-border remittance services.

Unfortunately, money transfer operators – in particular those using digital technology – are facing increasing levels of difficulty in finding correspondent banks due to ‘de-risking’ on the part of the latter. According to the Bank for International Settlements (BIS), correspondent banking relationships declined by about 25 percent between 2011 and 2020 (BIS 2021).

Exclusive partnership arrangements established by large money transfer operators and national post offices and banks tend to dilute market competition and increase remittance costs (Teixeira da Silva Filho 2021).

Macroeconomic impact of remittances

Generally, remittances can create a positive impact on the economy through various channels. The general understanding among various economic thinkers is that remittances can impact the economy through savings, investment, growth, consumption, poverty alleviation and income distribution. The importance of remittance flows become critical in economies with credit market imperfections, as is the case in most developing countries.

One major impact of remittances is their effect on the current account of the balance of payment (BoP). Remittances help in raising national income by providing foreign exchange and raising national savings and investment, as well as by providing hard currency to finance essential imports and thereby curtailing any BoP crisis. Bank of Ghana estimates of the balance of payments suggest that remittances placed second after exports in terms of resource inflow as of March 2022.

Essentially, the growth effect of remittances in receiving economies is likely to lead to an increase in savings and subsequently investment. Migrant workers’ remittances come in as a component of foreign savings, and as such complements national savings by increasing the total pool of resources available for investment.

Remittances also carry some positive effects on investment, particularly in developing countries. The difficulty involved in raising enough cheap capital to finance investment activities implies that remittance can serve this purpose.

Remittances are used to finance several social projects including school buildings, clinics and other infrastructure. In addition, return migrants bring fresh capital that can help finance investment projects. In Ghana, migrants also send money down for the purpose of setting up a small-scale business on their behalf. Aside from the income it generates, employment opportunities are created for the youth in their respective localities.

This calls for further reduction in remittance cost, which directly impacts development by freeing additional resources that – instead of being paid as transaction costs – remain with the senders and receivers of the flows.