The Fiaseman Rural Bank PLC at Bogoso in the Prestea Huni-Valley District of the Western Region has posted impressive growth in all financial indicators in the 2021 year under review.

Operational performance

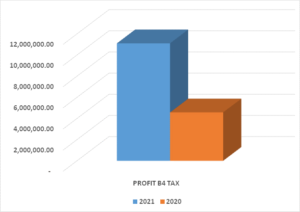

The bank has posted a pre-tax profit of a little over GH¢11million, a remarkable growth of approximately GH¢6.5million compared to about GH¢4.5million recorded in 2020, representing a remarkable growth of 142.8%.

The bank recorded total deposit of GH¢208.2million, representing a percentage increase of 8% from approximately GH¢193.6miilion in 2020, with total assets of the bank hitting GH¢240.7million compared to that of the previous year of about GH¢220.8million, which represents a percentage growth of 39.80%.

Total Loans and Advances for the period under review also moved up by 20% from approximately GH¢72.3million in 2020 to about GH¢86.4million in 2021, with stated capital also going up marginally from a little over GH¢4.3million in 2020 to GH¢4.4million in 2021.

The board and management of the bank were confident about the year under review because other opportunities for sustainable growth were explored, and the team’s commitment to be innovative and distinguished in service delivery and the pandemic recovery was also expected to propel public confidence.

The board and management of the bank were confident about the year under review because other opportunities for sustainable growth were explored, and the team’s commitment to be innovative and distinguished in service delivery and the pandemic recovery was also expected to propel public confidence.

The Chairman of the Board of Directors, Lawyer Kojo Appiah-Annin, announced these and more at the bank’s 33rd Annual General Meeting held last Saturday at Bogoso.

Operational environment

According to him, the bank operated in a very challenging macro-economic environment in the reviewed year. He mentioned that Ghana’s economy rebounded from the COVID-19 induced slowdown by recording a GDP growth rate of 4.1% in 2021 as against 1.7% in 2020. Inflation surged from 10.6% in 2020 to 12.7% in 2021. In a bid to curtail the rising inflationary pressures in 2021, the Bank of Ghana increased the policy rate to 14.5% from 14.08% in 2020.

The 91-Day Treasury bill rate, however, moved down from 14.1% in 2020 to 12.14% in 2021.

The Ghana cedi, on the other hand, lost 4.1% of its value against the United States dollar, 3.1% against the British pound, but appreciated by 3.5% against the Euro.

The poor performance of the cedi was largely driven by Ghana’s wide fiscal deficits and rising public debts. The rising trend in import, and weak investor confidence were no exception.

Corporate social responsibility

The bank continues to support communities, individuals and institutions within its catchment areas. A total amount of GH¢39,000 was spent on donation and corporate social responsibility in areas of agriculture, education, health, security and recreations to deepen the bank’s commitment to societal responsibility.

Future outlook

The Board Chairman mentioned that in consideration of the economic challenges regarding the need for government to address the fiscal deficit, revenue generation, rising inflation, interest and exchange rates in the first quarter of 2022, coupled with global economic pressures and the results of rising crude oil as well as the effects of Ukraine war, the bank seeks to be more prudent in its strategic decisions in order to protect stakeholders’ interest.

The board also seeks to deepen the tech solutions to better serve clients of the bank given the digitisation and the E-levy proposals commitments by government. Accordingly, the bank has introduced an exciting product called the Smart Loan to expand the service standard.

The Chief Executive Officer of the bank, Godfred Frank Opoku, in an interview with the Business & Financial Times, said the bank’s business focus in 2022 is on driving growth, innovations, efficiency and service as the main pillars in achieving profitability.

He has stressed that the bank would follow stringent cost reduction policies, strengthen internal control measures, and develop the human capital to meet demands of functioning profitability as well as achieving the objective of overcoming the shocks of the unfriendly macro-economy and rising cost of living as well as its devastating effects.