Amid tighter fiscal policy as well as substantial depreciation of the cedi against the US dollar this year, the construction sector is forecast as one of the economy’s sectors to be hard hit.

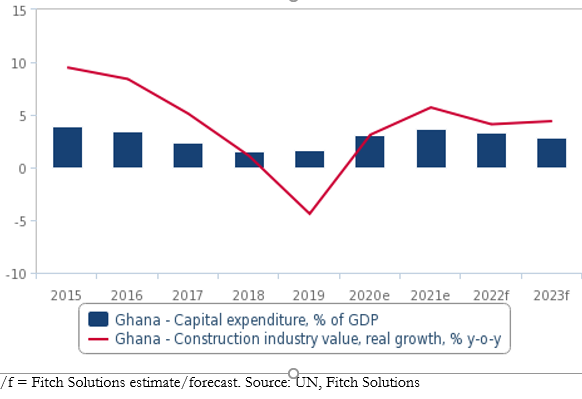

Fitch Solutions in its latest assessment projected that the construction industry will suffer a slowdown in growth to 4.1 percent year on year (y-o-y) in 2022, compared to the estimated growth of 5.7 percent y-o-y in 2021.

“Unlike in other markets, Ghana’s infrastructure construction industry is unlikely to benefit from higher oil and gold prices as we expect that increased public revenues will be channelled toward debt servicing and Ghana’s high public wage bill rather than capital projects, since Ghana’s access to international capital markets will be constrained in the near-term,” Fitch said in its assessment.

In January this year, Minister for Finance Ken Ofori-Atta announced a 20 percent cut of the approved 2022 budget expenditure, as government’s fiscal consolidation agenda is primarily driven by the expenditure side with support from additional revenue. Subsequently, in March 2022 the minister announced a further cut to its expenditure, envisaged to save about GH¢3.5billion – all of which are aimed at achieving the 2022 fiscal deficit target of 7.4 percent of GDP.

According to Fitch, notwithstanding the market’s strong fundamentals – including a track-record of private investment in energy infrastructure, comparatively high political stability and security, and a relatively diverse competitive landscape; a substantial depreciation of the cedi against the US$ in 2022 will, in the near-term, make private investors more reluctant to invest in Ghana’s infrastructure sector.

Following the Ghana cedi’s sharp depreciation in Q4-2021 of 2.33 percent against the American greenback, the local currency suffered a further rout in Q1-2022 against all the major trading currencies. The cedi registered its sharpest quarterly decline in 7-years – plummeting by 15.6 percent against the US$ on the interbank market in Q1-2022, compared with a 14.2 percent loss in Q1-2015 and 0.55 percent gain in Q1-2021.

However, the local unit from start of the second quarter to date has marginally depreciated by 0.2 percent against the US$; mainly driven by the policy interventions of both the monetary and the fiscal authorities in late March 2022. From the start of Q2-2022 to date, the Treasury has cumulatively supplied a gross amount of US$200million and US$379.86million on the general and the BDCs FX forward rate auction market respectively to support the local currency.

“We thus do not expect that private investment will meaningfully cushion the negative impact of subdued public infrastructure spending on the market’s construction industry growth. We forecast that in 2022 the Ghanaian cedi will depreciate by 22.7 percent against the US$, significantly increasing revenue risks for the foreign investors which rely on expatriation of revenues.”

Accordingly, we forecast government capital expenditure to shrink to 3.3 percent y-o-y of GDP in 2022 and 2.9 percent y-o-y of GDP in 2023, down from 3.7 percent y-o-y in 2021.

While this puts capital expenditure levels above those in 2018-2020, when Ghana’s construction industry growth averaged -0.1 percent per year, it remains below the comparatively high annual average levels of 4 percent of GDP between 2010 and 2017 which enabled construction industry growth rates averaging 8.1 percent per year.

In 2023, Ghana’s construction industry growth is projected to accelerate slightly as the cedi depreciation against the US$ slows down to 4.6 percent y-o-y.

Largely, this will reduce revenue risks for foreign investors while lower inflation improves demand for residential and non-residential construction.

However, Ghana’s access to international capital markets is expected to remain constrained and will continue to weigh on public infrastructure spending as well as the market’s construction industry growth.