——Introduction

All economies under the sun have gone through several phases of the economic cycle from boom to depression or from prosperity to depression. It does not matter whether we are discussing the economic history of advanced, emerging, and developing economies, Sub-Saharan Africa and even Ghana.

Economic Cycle

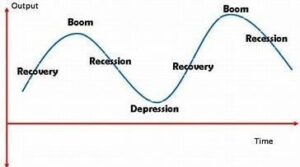

Source: economic cycle diagrams from mrbanks.co.uk

The graph reveals that there is time for boom, recession, depression, and recovery. If the economy is experiencing a boom, steps should be taken to sustain it. If the economy is experiencing a decline, steps should be taken to avoid a recession and depression. Even if recession or depression takes place, efforts should be put in place to ensure recovery.

In presenting this brief analysis, part of the data and graphs have been sourced from the IMF, National Budgets from 2017 to 2022. A five-year analysis is considered to provide easy to observe patterns to be able to question and develop policy measures to address. This is easy to understand, easy to communicate, and creates an active memory for the reader with reference to the tables or the graphs. For example, it is easy to ask why the growth for all the sectors declined from 2017 to 2019?

Economic Growth Projections and Recovery

In 2020, the economic growth for the world economy. advanced economies, and that of emerging markets and developing economies were all negative. Recovery efforts that were deployed produced significant growth in 2021 with positive growth projections for 2022 as in the World economic growth projection graph above.

The lesson is that in times of depressed financial, economic, and fiscal situations, the focus should be on recovery efforts and strategies and not the defense of the depressed situation to look good.

The growth per sector graph below also shows a downturn from 2017 to 2020. The graph shows that from 2017 to 2019, agriculture, industry, and services declined except in 2019 that services recovered marginally. However, in 2020, industry growth was negative(-3.6%) with services just below 1%. In 2021, agriculture and services sectors recovered but industry recorded -o.5% growth with all the three sectors projecting recovery in 2022. The summary is that all the sectors were experiencing decline before COVID- 19 and became worse during the peak of the pandemic. The period of decline coincided with the implementation of Planting for Food and Jobs and One District, One Factory policies. This calls for some investigation into the policies and their implementation.

Government’s position on public debt

Figure 4 in the 2022 budget as indicated below shows that external debt as a ratio of total debt, increased from 47 percent in 2017 to 52 percent in 2021 September. As the cedi depreciated from GH¢4.20 to GH¢6.25 over the period, just using conservative figures and non-open market exchange rates, the depreciation contributed hugely to the debt stock of the country. Between 2017 and 2021 September, external debt in absolute term, increased by 62.5 percent while domestic debt increased by 53.7 percent. The graph also shows that the Debt/GDP ratio increased from 54.2 percent in 2017 to 77.6 percent in September 2021, even though, the GDP was rebased in 2019/2020 if not so the Debt/GDP would have been worse.

It is precarious that between 2017 and 2019 the Debt/GDP ratio increased by 7 percent and between 2019 and 2020 the Debt/GDP increased by 14.9 percent. This shows that the COVID-19 pandemic was used as an excuse to borrow excessively. COVID-19 expenditure audit is required to assure Ghanaians about the use of the COVID-19 funds. This is crucial because the peak of the pandemic was in 2020, an election year where the use of money for election-related inducement was observable throughout the country. Another reason is that the IMF also called for such an audit which has not been adhered to yet.

Finally, COVID-19 related expenditure audits in some countries have reported unfortunate findings and Ghana should conduct this audit to show whether or not procurement rules, the duty of executive accountability, transparency, responsibility, and disclosures have been followed. The threshold for debt sustainability internationally is 60%, implying that the threshold was breached with debt distress indication since 2019. However, using ECOWAS convergence criteria of ≤70 percent, the public debt showed an indication of distress from 2020.

Ghana’s worse income distribution using the Lorenz curve

The Lorenz curve shows whether income distribution among the population is equitable. From the Lorenz curve below, it shows worse income distribution for Ghana. The curve for Ghana is farther away from the line of equity hence worse. Population and national income data from the world bank have been used to construct the Lorenz curve.

Even fragile states performed better than Ghana. Job creation efforts are needed to help citizens share in national income. Transformation of agriculture, skills development with the assurance of product and services market and actualizing regional economic opportunities are key correct the trend.

Source: Graph drawn with Data from World bank 1970 -2020

Table 1: Debt burden indicators

| Year | Debt/Export | Debt/GDP | Debt/TotalRev | IntPay/GDP |

| = 150% | =60% and | =250% | ||

| 70% | ||||

| 2016 | 279.63 | 55.68 | 363.04 | 4.90 |

| 2017 | 227.22 | 52.84 | 366.27 | 5.35 |

| 2018 | 240.53 | 55.36 | 365.00 | 4.83 |

| 2019 | 253.52 | 58.50 | 390.73 | 5.55 |

| 2020 | 359.08 | 76.05 | 529.01 | 6.41 |

| 2021~~ | 405.02 | 76.51 | 485.82 | 7.28 |

Computed by Author with data from IMF and National Budgets

The usual debt burden indicator is the Debt/GDP. Though it does not reveal all the implications of the level of debt of a country, it is an important indicator that communicates possible distress. The structure of the GDP as to whether, it supports new economic opportunities, robust contribution to revenue efforts, and new jobs, will reflect other indicators in table 1 above. Thus, quality and sustained growth are required to manage debt and remain attractive.

The indicators are interpreted based on a benchmark as constructed by the IMF for emerging and developing countries. When the international debt sustainability ratio of 60 percent is used, it means in 2020 and 2021 Ghana’s debt has crossed over to an unsustainable level given that other supporting indicators show a similar trend within the period. This should have started from 2019 had it not been for the rebasing of the GDP. However, with the ECOWAS. convergence criteria of ≤70 percent, Ghana’s debt is not sustainable and induced distress. Since revenue is generated to finance expenditure, we computed Debt/Total revenue and compared it with the benchmark of 250 percent. The Debt/Total revenue ratios from 2017 to September 2021 show the unsustainability of Ghana’s debt with 113.04 percent deterioration in 2017 and 235.82 percent deterioration in 2021.

It means total revenue could only cover the debt in 2017 if the revenue were to increase by 113.04 percent and 235.82 percent in 2021. It also means the borrowing is not guided by revenue levels but other factors not in the fiscal responsibility matrix. The Debt/GDP and Debt/Total revenue show an increasing trend of deterioration of debt sustainability from 2017 to 2021. The debt sustainability of a country also depends on revenue from exports. Thus. we computed the Debt/Export with a benchmark of 150 percent. However, the ratios show incapability to cover the debt each year from 2017 to 2021. In 2017, more than 77 percent of export was needed to cover the country’s debt and 255 percent more export revenue in 2021. It also revealed the need to strengthen export drive through value addition and diversification of export destinations.

Revenue is such an important element in debt management that when its role is undermined debt distress is sure to occur. Revenue comes from exports, taxes, economic activities through economic growth and jobs. So, borrowing is done with future revenue in mind. Debt management cannot be undertaken without considering all these factors including depreciation. Robust exports, lower interest rate, which is lower than the growth rate, good tax administration are all needed to manage a sustainable debt regime. Using the Bank of Ghana policy rate as a proxy for interest rate or even 91-day treasury bill rate or the weighted average lending rate, which are all higher than the growth rate implying this vicious cycle must be dealt with. On average the yield on our bonds is higher than the growth rate of GDP, so these issues must be worked on.

Table 2: Interest Payment Burden Ratios (Debt servicing ratios)

| Year | IntPay/TotalR | IntPay/TaxR | IntPay/TotalExp | IntPay/Export | ExtIntPay/Export |

| =20% | =20% | ||||

| 2016 | 32.00 | 42.00 | 21.10 | 24.63 | 5.27 |

| 2017 | 33.80 | 43.10 | 27.11 | 22.81 | 4.44 |

| 2018 | 31.90 | 40.00 | 26.20 | 21.00 | 3.93 |

| 2019 | 37.00 | 45.00 | 28.13 | 24.03 | 5.42 |

| 2020 | 44.60 | 54.20 | 25.00 | 30.20 | 7.69 |

| 2021~~ | 46.20 | 57.00 | 30.13 | 38.55 | 9.00 |

Computed by Author with data from IMF and National Budgets Interest payment /Tax revenue

On average, from table 2, between 2017 and 2021, 47.86 percent of tax revenue has been spent to pay interest on Ghana’s debt and 57 percent in 2021, meaning the tax revenue is so burdened that it cannot support three major expenditure items. and therefore, continue to deepen the vicious cycle of high borrowing and high-interest payment. This is not sustainable. Another determinant of interest burden is interest payment /Total revenue with a benchmark of 20 percent. Between 2017 and 2021, on average 38.7 percent of total revenue is spent on interest payment which is above the threshold by 18.7 percent.

Both interest payment /Total revenue and Interest payment /Export have been outside the benchmark, meaning all the debt sustainability ratios show serious vulnerability and distress.

The use of the word’’ broke’’ in financial discussions

Technically, experts prefer to describe the acute financial situation of a country using expressions like debt distress, financial distress, default, risk of the economy, and debt sustainability among others. All the debt sustainability analysis in this paper confirms fiscal distress, repayment burden, and general hardship but will not simply be described with the word broke. Ordinarily, when a person is ‘broke’, it means in the immediate time, he/she is not able to finance some basic needs because the level of income is limited. Some people use the term to mean so many things including poverty, bankruptcy, and default. In extreme cases, some experts use the word “broke” synonymously with a ‘failed state’. The use of the word especially for government finances sometimes creates difficulties for government communicators.

When the word is used, it is only to express the sufferings, hardships, inability of the government to meet the expectations of citizens. The word does not mean there is no money. It only means the needs are not being met and are creating disappointments. It does not mean that natural resources have finished, neither does it mean the government is not collecting taxes to generate revenue. It could, however, mean the public and opposition politicians are saying there is mismanagement, unprioritized expenditure, corruption, overborrowing, excessive taxes but the government is not able to deliver.

The public knows that it is because the country is facing financial, economic, and fiscal difficulties that is why in the midst of well-articulated hardships, we face the effects of forex depreciation on prices and public debt, many uncompleted projects, unpaid contractors, and a marginal increase in public sector wages and salaries. The government should understand that the public knows these facts when they say the country is broke. They know all state institutions including the Ghana Revenue Authority (GRA), Bank of Ghana are still functioning. In fact, they know our cherished traders, entrepreneurs, spare part dealers, farmers and indeed washing bays, hairdressing salons, and barbering shops are still in operation. What they are communicating using the word “broke” is upward price development and the inability to finance the basic needs of the home out of their toil and the over-borrowing, high-interest payment are the reasons for their suffering.

When the government wants to introduce e-levy without refining it to reflect the concerns of the public it is because the government does not have enough revenue and is facing interest payment challenges. The business community knows that if banks are lending to the government more than them, it is because the government’s appetite for borrowing is competing with them to meet the acute financial needs. Thus, the use of the word may be full of ‘undecoded’ verdicts on the government.

Conclusion

The use of tables and graphs covering a five-year analysis from 2017 to 2021 provides a quick visual impression of fiscal vulnerability, debt distress, and the interest payment burden of the Ghanaian economy. The trend provides a clear picture of the unsustainability of borrowing. The economy is suffering from a debt repayment burden, lower revenue than expected to remain sustainable. Ghanaians use the word ‘broke’ to convey hardships and the inability of the government to meet basic expectations. The graphs below show increasing levels of both revenue and expenditure but expenditure trends up more than revenue.

Thus, it is not true that revenue has not been performing the problem is with the unwillingness to change the expenditure model. Dealing with export measures can also contain the debt distress of the Ghanaian economy. The trend helps to make understanding simple and appreciate the clear picture provided over time, not at one point in time but over a period (2017-2021). It helps to interrogate the trend for policy intervention as the main drivers and direction are seen over time. Sectoral performance trended downwards from 2017 even though flagship policies such as planting for food and jobs and one district one factory have been implemented.