- as he turns three score and a decade on earth or simply put, 70.

Monday, August 14, 2017, would go down as the most memorable day in the history of the country’s financial landscape. It was the day the most sweeping regulatory crackdown on the nation’s banking sector came into effect.

For the retired army Captain, chartered accountant, serial businessman, Founder, former Chief Executive Officer of the Unique Trust Financial Services Limited (UTFSL, later UT Bank), the day started off like any other post-retirement from active service in leading the country’s fastest-growing financial institution in 2015. Up at 0730 hours, he was preparing for a day on the golf course.

It was not until a call from his daughter explained why his phone had been inundated with calls, messages and emails, which he had not seen, that the reality of the situation was made clear. The next couple of months then served as a true test of grit and resilience.

A setback of this magnitude was guaranteed to keep him down. But like the mythical phoenix, he has emerged from adversity for the umpteenth time, with a wealth of knowledge, which he is willing to impart.

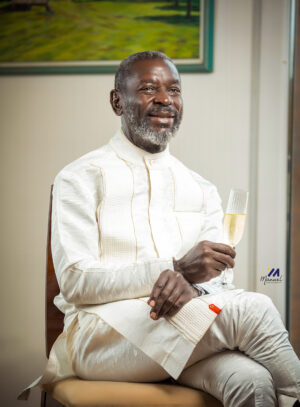

The B&FT’s Bernard Yaw Ashiadey, Ebenezer Chike Adjei Njoku, and Mabel Korkor Ocansey picked the brain of the larger-than-life character that is Captain Prince Kofi Amoabeng (PKA) as he turns 70 years on mother earth on a wide range of subjects, from banking to real estate, the stock market, and cryptocurrency.

BFT: Traditional banks have and continue to receive flak for their lending approach. What set UT apart in this regard?

PKA: UT was set up by me because of the difficulty I had experienced in raising capital. I had been a businessman and sold a wide array of things but despite my experience and other seemingly favourable factors, I got refused again and again when I needed money. Finally, it hit me that I just could not get it from the banks.

Remember, I was a chartered accountant, and I had a degree in Accounting, and I was a retired army officer. I believe I had integrity and had done business for over 15 years, and I never had a loan approved. The only time I had one approved, I was given ¢3 million (old cedis), when I needed ¢20 million. And this was for a specific business deal. Anything short of the full amount was practically useless.

The thing is, bankers are not business people. They might have fancy degrees, but they learn based on their relationship with business people. It is not the same as having first-hand knowledge. I was a businessman, and I was coming to solve a problem that I knew existed in the field and that made us, that is UT, completely different.

Take, for example, a typical SME businessman/owner, comes to you as an institution for a sum, he probably needed it yesterday and the business would not wait forever; it might not even wait for a week. And I’ve been in that situation so many times. UT came to solve a problem I had endured for so many years and I knew others were facing the same, I could relate to them.

We must understand also that one aspect of lending is like a cat and mouse game. The businessman is thinking, “What story do I spin to get this money?” And the banker is probably thinking, “This man wants to outsmart us.”

That is the reason it takes such a long time for them to get to the point of approval and even that would come with many demands for collateral as security and other things. Eventually, by the time the loan is approved and hits the account of the businessman, it is usually so late that the business is no more there. But oftentimes, they would take the money because of the effort that went into getting it but it would be put to use elsewhere. So even the project that was used to evaluate the loan request is gone; this model is structured for default.

For UT, when we first got on the scene, a key factor for us was the speed of delivery, and once we got that right, it set us apart, and we invariably gained momentum and grew as a lending institution.

BFT: How well did UT achieve what you set out to achieve?

PKA: We did, even exceeding our own expectations. We were surprised by the pace of growth. It is clear for everyone to see; from our beginning, out of a small office somewhere in Kantamanto, the success of I and three other people who were barely qualified to run a full-fledged finance house. It is a great Ghanaian story; to grow this business, and within a decade, to become the most vibrant financial institution and a trustworthy brand and become the employer of choice. It is nothing short of remarkable.

Because I taught at the Stock Exchange and applied what I had learned there to UT, it was evident to everyone, especially, after we listed the company on the Stock Exchange, that it was money that was earned genuinely and there was transparency for all. We had the financials to prove our track record and we were providing services that excited people.

One thing the banks have not done well and continue to fail to do is to get into the shoes of the businesspeople. SMEs are already intimidated by the prospects of writing and speaking to bankers and meeting them in their plush glass houses to go take money from them; it is scary. The banking that is being done, there is no heart to it.

I knew their predicaments, sometimes, even better than they did themselves and we did things that went beyond the typical banking; it was banking with a heart. Our goal was to help businesses, not assume their assets. This built fierce loyalty in our customers. Whilst we were a business, we found fulfillment in seeing our people succeed. And it is not always that people need loans, sometimes, they need to be pointed in a particular direction and it would serve them better. We devised products and services that saved people time.

One thing about life is that, your life is simply defined by your time. There’s nothing else to it. After all, when we say someone lived for 70 years, what are we saying? It’s that his time was 70 years. So if you want to respect someone’s being or his life, it is about respecting his time.

In business, as in every sphere of life, keep your eye on the time. There are two aspects to it, the nominal, which is, the length of time and the real, or quality of time. So in shaping your products, two questions must ring: How do I save this person time, because you want to give him some of his life? And: The time I am going to take from him, how do I ensure that it is quality time? Make the customer feel respected and trust blossoms.

At UT, we were doing things that were realistic and meaningful and with respect but unfortunately, there were times that these went against the cultural expectations of some customers. They enjoy it when they experience it, but they would not give same back. As an example, when I was at the bank, I used to drive myself and carry my bag people did not like that. They felt I needed to create an aura around myself; to be distant meant to be respected.

But there had to be a unique company culture, especially in our settings. We would all go to the gym, and I was the instructor, because frankly, most of the staff were not as fit as they should be. I would queue at the cafeteria, so managers who would otherwise have wanted some special treatment could not get it because even I was not getting any.

My telephone number was in the reception area of every branch; if you need me, call on that number. We created a culture of respect for everybody, and it worked perfectly when we were a smaller group because my influence could reach everywhere.

Transitioning into a bank, teething pains and culture shocks

But by the time we were transitioning into becoming a bank, we needed to reinvent ourselves. One anthropologist argues that in any human sphere, when you grow to the figure of 150 persons, you have to reinvent yourself. By the time we had grown that big, I was still trying to preach the same message but it was struggling to sink in.

One key thing is that, when we became a bank, we had people joining from other banks, mostly as departmental heads, because our people did not have all the experience needed at that level. And these new people came with the culture and mindset of their previous places of employment.

There was a sharp culture shock! Some learned to change, others could not. The old members of staff had line managers who did not hold unto the company’s values of Respect, Professionalism, Integrity, Why-Not, Standing-Up-To-The-Plate, and Ubuntu. We had icons for each value, and I was the icon for Respect.

BFT: Have measures to assess creditworthiness improved since you first arrived on the scene? How much of a role has technology played in this?

PKA: It has changed. For us, we had a lot of clients who were creditworthy and that is largely dependent on the lender. As a lender, you must ensure that you develop trust with the borrower and develop an interest in his well-being and success. Mainstream financial institutions begin from a point of mistrust and suspicion and are thus quick to label any default as the act of a crook.

But sometimes, even with the most extensive checks and seemingly foolproof nature of the business, things can go bad and when that happens, the first reaction should be to see if the situation can be remedied. Would an additional facility help? There were times I would give a defaulting customer enough to cover the initial loan and conduct new business if the latter was lucrative enough. The Bank of Ghana never agreed with me on that, and I understand them, but we were coming from different ends of the rope. I was coming from a place of trust first until the trust was broken. It is in the name; special, unique trust.

We started off with tomato sellers, used-clothes dealers, egg sellers, and the likes and required that they made weekly payments. The interest was a little high, at about 15 percent a month, but it was nothing compared to prevailing rates of around 50 percent monthly. Lenders must also learn to accept some responsibility in the event of a loan defaulting. When I am asked about UT, I say I failed, not because I had a faulty model, but it needed to be tweaked to account for the cultural setting.

The spotlight that comes with growth requires that you play with certain powerful individuals – chiefs, politicians and religious men. I did none of that. In that sense, I was not Ghanaian enough. And it should give us all cause for concern, that this is a defining feature of our ecosystem. Little drops of water, it seems, do not make a mighty ocean, they evaporate.

BFT: Has record-keeping improved since you got onto the scene and has technology played a role in this?

PKA: Absolutely. A lot of financial institutions are now able to, on a daily basis, know their financial health. The system has improved a great deal. It’s a far cry from the simple diary I kept when we began in 1997. Now we see Artificial Intelligence and Machine Learning are used to give credit.

BFT: More specifically, what’s your take on the Ghana card-only directive by the BoG?

PKA: It is long overdue. In other more advanced jurisdictions, the social security number is everything. So why we haven’t done that up until now, I do not really understand it? Admittedly, there are issues with how smoothly the registration has run but all in all, let’s start from somewhere and I am fully in support of the directive. Let us use one card and one unique number to identify people.

BFT: Are you optimistic it would lead to more lending?

PKA: It should. Perhaps, not so dramatically early on but in the long run, it should.

BFT: What are your thoughts on the current average lending rate, which is hovering around 20 percent? Is it a fair reflection of existing risk and cost-related variables or is it artificially high?

PKA: Honestly, I think even the current rates are low. If the government is borrowing at about 13 percent, which is the opportunity cost of lending to others, and banks are lending on average, at 20 percent, that is just 6 to 7 percent to cover running costs. The margins are not great. The cost of running a bank is quite huge, I was surprised by how much we had to invest to ensure power was uninterrupted. Electricity can still be erratic and so there are many redundancies that have to be built into the system. The current margins are not excessive.

Unless government stops borrowing so much domestically and allows the interest rates to drop, we would not see any change.

BFT: The majority of bank funds come from cheap deposits…

PKA: Irrespective of the cost of funds, we must remember that the opportunity cost is the guaranteed 13 or 14 percent from lending to the state. Forget about where it’s coming from or the cost, if banks don’t lend to the private sector, they can easily just give it to the government and get their decent rates. And mind you, many banks, especially the newer ones do not have access to cheaper sources of funds.

For us, we were known as a lending institution. People were not coming to us to make deposits. They only came when they needed loans and that was part of the problems we had. So, we eventually had to make adjustments to our model to attract deposits. And that was quite confusing. Previously, we took every step to retrieve outstanding loans but since we now required deposits, we had to soften the stance a little and contain some excesses.

BFT: Did you make a mistake moving from Non-Bank Financial institution to becoming a full-fledged bank?

PKA: With the benefit of hindsight, it is easy to say yes. But we had grown and established ourselves and the brand was big and the issue that informed the decision, if we were to look at them again today, we would still say that we want to become a bank. But then, we would have done things a little differently.

During the strategic session where the decision was made, someone said, clients would come to UT, take out a loan, and go deposit it in the bank because they want a letter of credit (LC). Clients would take expensive money, and deposit half, if not all of it as collateral for an LC of maybe 180 days. Now, if we were to become a bank, we could provide better services by giving them the LC directly, because the other arrangement was rather exploitative.

In addition to that, if we became a bank and received deposits, we could dilute our cost of credit and bring down the cost of credit for our clients.

Love for staff

But the most personal to me was that I saw the professional transformation it could give our staff, many of whom had been there from the get-go. They could find themselves as professionals in treasury, compliance, risk et cetera. So, it is out of love for our people, our clients, and processes that we moved into banking. We would have still gone into banking but would have done it differently.

For instance, we formed a project team to evaluate the transition, but I believe the team was not strong enough. We should have brought in seasoned bankers to guide us through the nuances, looking at where we were coming from. That team lacked experience in some regard. Then again, because we were succeeding at everything, we perhaps took the next step for granted.

BFT: Some say leading banks make super-normal profits and are often very opulent…

PKA: Banks still have to satisfy their shareholders. And banking is not the most profitable, with regards to dividend payments. Banks owe a responsibility to the economy, to their clients but the first responsibility is to shareholders. Even the government expects heavy taxes from banks, and they have to be profitable to do this.

B&FT: From your experience at both ends of the business spectrum, what are the biggest mistakes small business owners make? Do you see any line between our (cultural) attitude to authority and the (historic) performance of our economy?

PKA: First and foremost, everything hinges on leadership. The best form of leadership is by example. But the culture is at loggerheads with that. Typical of us, the chief sets the rules but he is above them and consequently, his wife, family and trusted inner circle are above them. So, the rules, really, are just for a group of people, not everyone.

Now, we tend to take this attitude to business, as the big man, you can come to work at anytime and you are just to be treated as special. There is a chasm between you and them. Every policy that you put in place as the leader, you must live by it, otherwise, do not put it there. Everything rises and falls on leadership. You need to show good values and create the culture. Leadership is not the group, it’s the topmost person. If the leader, for instance, believes we must live frugally, there would be a ripple effect if he, himself does so or otherwise.

Let me tell you a story. When we moved to our new offices at Adabraka, it was quite a big office. Head of HR said to me that a book had been put at the reception, but staff were not signing. I told her it was not something we were doing previously, and I could not be bothered about signing in if everyone was performing as expected. But she said in the event there was something like a fire outbreak, we would need to know the number of persons in the building.

I agreed. It was expected that I would write an email to that effect. All I had to do was be the first person to sign. Once word got out that PK had signed. It was a race to sign after that. That is the power of leadership. At UT, no meeting started late because I was always there, early. And there are many implications of this, even for our socio-political life.

B&FT: The cost of the financial sector clean-up still weighs heavily on the state. Not specific to UT alone, could anything have been done differently?

PKA: Each company should have been treated on a case-by-case basis. What went wrong in each case? The first line of action should not have been that the banks be assumed. Some could actually have been bailed out.

UT owed the state about GH¢800 million and it cost the state about GH¢2.2 billion to assume it. But the brand was strong. I had appeared in Oxford and at other imminent places to speak about UT. We had a footprint in South Africa, Nigeria, and Germany and for a Ghanaian company to attain that, you don’t just close it. I cannot overstate it, just because it is me, but I struggle to see reason behind the action.

Then again, what information was fed to BoG and the Ministry? Did they really verify or just ran with it? It was a bit rushed. I know some institutions were not being run well but that was not the case with UT. We should be asking if BoG appointed anyone on the board, for instance.

B&FT: If Ghana were a company, how well-run would you say it has been, historically? If you were CEO of said company, what measures would you put in place to make it more efficient?

PKA: First and foremost, as CEO it would be to live in a way to show that we need to avoid waste and be disciplined. And this is theoretical, but you would want to appoint the best people for the job and hold them accountable. You should be able to appoint your brother if he is qualified, but you should also never hesitate to sack him if he crosses certain lines.

In all honesty, there are some political appointments that border on being comical, if not sad and perhaps, insulting. Also, I would have to nip corruption, especially, the very blatant one, which only breeds impunity.

B&FT: Similarly, if Ghana as a company were seeking a loan from you, based its books, would you extend the facility? What would you advocate be done to address the country’s level of debt, which is slowly approaching distress level?

PKA: The way it has been run, no. But if there is a new strategic path, yes, probably.

B&FT: Do you reckon enough has been done to forestall another financial sector crisis? What regulatory interventions would you propose to block loopholes?

PKA: I have always had a problem with the way regulation is done here. In many ways, it breeds corruption. When we were kids, a pupil-teacher was respected, and his pay was sufficient. When you have a regulator, you must ask if remuneration across the board is sufficient.

I have, on a number of occasions, suggested that banks remit a portion to the BoG to enable it better pay staff. This was shot down, saying we pay taxes and that should suffice. When the regulators are not paid well, I believe they will be compromised and the quality of work will suffer. Raising minimum capital only served to put banking in the hands of foreigners, as it is with oil, mining, telecom, trade.

B&FT: What can be done to improve the mortgage market?

PKA: The housing problem is really a currency and value problem. Houses are denominated in a stable currency, in this case, the USD to safeguard value. One thing we refuse to talk about as much as we should is the effect of the redenomination of the cedi. When redenominating, you do not cut off four zeros, you cut three. So that million becomes a thousand but there was an obsession with getting parity with the USD, which was useless as we could not hold it there.

B&FT: Cryptocurrencies – evolution or disaster waiting to happen?

PKA: That is where the world is going whether you like it or not. Just like when the internet started, people were joking about it. But I have taken a personal interest in it, at least, to understand it. Admittedly, it is disruptive and anything that is disruptive, we have to watch it. And it appears to be more dependable due to reduced human intervention. And take it or leave it, it is growing.

B&FT: Payday loans are considered predatory because of the high-interest rates for mostly low-income earners. The most famous outlets here charge on the average 7 percent per month (plus 12.5 percent for defaults). Would you say that is fair? What can be done to better improve the payday lending space?

PKA: The truth is that, whilst many people have low incomes, most customers of payday loans are people who do not order their affairs well, as such, are in need of quick fixes and oftentimes, they would have burnt bridges and would not be able to borrow from family and friends. For those with genuine concerns, I sympathize with them, but it would amaze you that they are in the very small minority.

B&FT: There are calls to compel regulated financial institutions to list on the Exchange, what’s your take on it? Should the Exchange alter its rules to accommodate for some less profitable companies?

PKA: Compelling business is going to be a tricky thing. Even with the state institutions, we see a lot of them posting consistent losses, it is mind-boggling. If those under the state’s remit are not profitable, then it requires a lot of questions to be asked. It would not be prudent for the Exchange to amend the requirement of a minimum number of years of profitability. Our market is not the most information efficient. We cannot have the market woman invest in companies that are not profitable, when we can barely suggest the fortunes would turn.

B&FT: What’s the one professional advice you’d give a 20-year-old would-be businessperson?

PKA: Learn, learn, and learn some more. Acquire knowledge. If you get in too early and without anyone to guide, you stand the risk of failing. I started UT at age 45, with a colored experience. And by the time I started, I had seen it all and nothing could faze me. For many young people, they want a Mercedes at 25, so I ask them, what would you drive at 60?

But they should also learn the system. There is a system in Ghana that cannot be ignored. When you come above the radar and people are aware of you, you must relate well with powerful people – chiefs, politicians, and clergymen. But also, their family. They should be able to deal with it, not fight it.