Senegal’s euphoric wave looks set to continue after winning the Africa Cup of Nations for the first time in the tournament’s 65 year history.

This week, European Commission President Ursula von der Leyen landed in Dakar, picking Senegal and Morocco as her first touch points to explore investment from the European Union’s €300bn “Global Gateway” infrastructure plan – the EU’s response to China’s Belt and Road Initiative.

Head of Trading, AZA

EU funding is earmarked for green and digital economic transition, along with €125m for Covid vaccination programmes. Von der Leyen’s visit included a signing ceremony at the Ndici Madiba Project, a plant to produce vaccines against COVID-19 and other diseases that the EU is supporting. Further infrastructure plans include the new €238m Diamniadio Olympic Stadium, which is set to host the 2026 Youth Olympics.

Senegal—with 17 million people and projected economic growth of 5.5% this year according to the IMF—can be expected to continue punching above its weight. President Macky Sall was this week elected Chairperson of the African Union.

The nation is now centre stage in every aspect of Africa’s development. Investors will be cheering on the Lions of Teranga for some time to come.

Trading Desk Manager, AZA

Naira steady as oil receipts offset dollar demand

The Naira held firm against the dollar this week, trading at the 570 resistance level as supply and demand remained evenly poised.

Nigeria’s FX reserves continued to decline, falling below the $40bn mark this week despite rising crude prices.

Major cities across Nigeria are experiencing long queues at the pumps after the government ordered filling stations to stop selling ‘dirty’ high sulphur fuel that has been circulating in the country.

The problem was exacerbated by a supply shortage at the Nigerian National Petroleum Corporation, the country’s sole petrol importer. We expect balanced supply and demand forces to keep the Naira within close range of the 570 psychological level in the coming weeks.

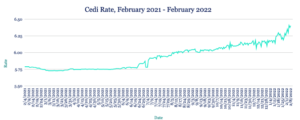

Cedi tumbles after Moody’s ‘junk’ downgrade

The Cedi slumped against the dollar this week, sliding to 6.375 from 6.296 at last week’s close, after Moody’s cut Ghana’s credit rating deeper into junk territory, reducing it one level to Caa1 from B3.

The rating agency said the government faces an increasingly difficult task to address its liquidity and debt challenges at a time when weak revenue generation constrains its budget flexibility.

In a bid to raise extra revenue, Ghana this month introduced its 1.75% ‘e-levy’ on electronic transactions. As liquidity contracts and dollar demand continues to ramp up, we expect the Cedi to remain under pressure.

Rand gains with business confidence at 3-month high

The Rand strengthened against the dollar this week, appreciating to 15.26 from 15.46 at last week’s close.

An index measuring South African business confidence hit a three-month high in January amid optimism that the Omicron Covid-19 variant is not as severe as earlier strains.

Employment Minister Thulas Nxesi announced this week that the minimum hourly wage will increase by 6.9% to ZAR23.19 from next month.

With unemployment stubbornly high at around 35%, focus is on President Cyril Ramaphosa’s State of the Nation Address for further direction in the Rand.

Egyptian Pound stable as UAE bank eyes EFG stake

The Pound continued to trade in a narrow band between 15.71 and 15.73 to the dollar for a second consecutive week. UAE’s First Abu Dhabi Bank this week offered to buy a majority stake in Egypt’s largest investment bank EFG Hermes, a deal that would value it at $1.2bn.

Also this week, Supply Minister Ali Mosselhi said the country will buy up to four million tonnes of wheat from local farmers this season, up from 3.6 million last year. The government raised the procurement price of wheat in November to encourage farmers to ramp up production and reduce dependence on imports.

With the combined positive effects of the country’s re-entry into JPMorgan’s emerging market bond index and its domestic policy hedge against FX fluctuations, we expect the Pound to remain stable in the long term.

Treasury Associate, AZA

Kenyan Shilling vulnerable to rising oil and election

The Shilling was steady against the dollar this week, trading at 113.5/114.1 as dollar demand from importers was matched by supply.

The Kenyan government’s interventions to reign in rising electricity and fuel prices helped bring inflation down in January to 5.4% from 5.7% in December. Central bank efforts to support the Shilling caused FX reserves to decline to $8.22bn from just under $8.29bn the previous week.

We expect the pressure on the Shilling to resume in the near term, in part because of rising oil prices globally but also as political campaigning intensifies ahead of August’s general election.

Pipeline funding to help stabilize Ugandan Shilling

The Shilling depreciated against the dollar this week, sliding to 3513/3523 from 3495/3505 at last week’s close as import activity picked up following the relaxation of Covid-19 restrictions.

Monthly inflation data showed prices rose at a slower pace in January at 2.7%, from 2.9% in December. Meanwhile, the East African Crude Oil Pipeline which will transport oil from Uganda to Tanzania’s port of Tanga—a project that is expected to cost $5bn—is entering its fundraising stage.

EACOP shareholders including TotalEnergies are expected to finance $2bn of those costs, with the remainder coming from loans, likely provided by Export Credit Agencies in Europe and China. Against this backdrop, we expect a stable Shilling in the near term.

Tanzanian Shilling steady as debt jumps by a fifth

The Shilling remained broadly stable against the dollar this week, trading around 2308/2318 levels. Like its east African neighbours, Tanzania’s inflation rate edged lower in January, slowing to 4% from 4.2% in December.

The Tanzania Petroleum Development Corporation has dispersed around $80m as part of its $308m commitment to help finance the Uganda-Tanzania oil pipeline (see previous story). TPDC has a 15% equity stake in the East African Crude Oil Pipeline.

Government borrowing to fund infrastructure projects in the country, most notably in the transport sector, caused Tanzania’s national debt to increased 19.5% in 2021. We believe this infrastructure investment will improve the overall business environment, which in turn should result in a more stable Shilling.

Note to journalists: please feel free to quote from this briefing for news reports and let us know any requests for further comment or interviews via the contact details at the end, or by reply to this email. AZA is Africa’s largest non-bank currency broker by trading volume at over $1 billion annually. See https://www.azafinance.com

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.

For more information, high-resolution charts or interviews, please contact:

Gavin Serkin

[email protected]

+44 20 3478 9710