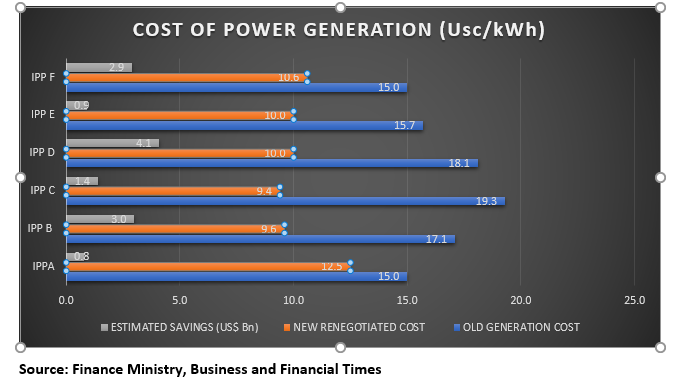

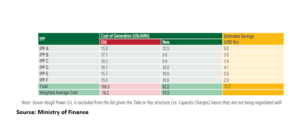

The nation has saved about US$13.2billion in renegotiating power purchase agreements with six different independent power producers (IPPs), the Finance Ministry in its latest investor call update has revealed.

The ministry, as part of efforts to assure investors and boost confidence in fiscal management of the economy, said proactive management of the energy sector is yielding results – given that the average cost of generation has declined, resulting in an estimated savings of US$13.2billion.

“The renegotiated commercial agreement for the IPPs has been secured and documentation of the renegotiated agreement is underway and in-process toward completion. The average cost of generation has declined from 16.2 USc/kWh to 10.5 USc/kWh. This has resulted in estimated savings of US$13.2billion,” the ministry stated in the investor update.

However, government was keen to note that Sunon Asogli Power Co. is excluded from the list of the six IPPs given the Take or Pay structure arrangement (vs. Capacity Charges), “hence, they are not being negotiated with”.

Cash Flow Waterfall

The ministry gave investors assurance of continued implementation of the Cash Waterfall Mechanism (CWM), which is a payment system that allows debtors to pay higher-tiered creditors their full interest and principal first before lower-tiered creditors receive their own principal and interest payment.

The CWM began in April 2020, allowing the Electricity Company of Ghana’s revenues to be distributed in a more transparent manner and managing payments of arrears – despite the challenging fiscal situation that has been exacerbated by the COVID-19 pandemic.

This forms part of the Energy Sector Recovery Programme (ESRP), which identified the policies and actions needed for financial recovery in the energy sector over a five-year horizon from 2019 to 2023.

Usually, debtors structure this mechanism into tranches in order to prioritise and finance the loans with the highest debt obligations, principal and interest inclusive. The idea is that most expensive debts should be serviced first.

This mechanism is part of a wider strategy to ensure an equitable distribution of energy sector revenues to all stakeholders in the value chain, as the ministry plans to put an end to the practice wherein some power producers are given priority over others in terms of financing.

However, the Africa Centre for Energy Policy (ACEP) has said that government needs to fast-track implementation of the cash waterfall mechanism, which has been identified as the one key policy interventions to ensure continuous liquidity of the power and gas sector players.

Replacement of ECG’s obsolete equipment

The ministry said there is an ongoing replacement of the Electricity Company of Ghana’s obsolete equipment. Accordingly, it has committed about US$526million to kickstart the rehabilitation work, beginning 2022.

However, Ghana Grid Company Limited has said that it will take more than US$1billion to upgrade the country’s old-fashioned power transmission infrastructure – some of which account for the majority of power outages.

The company said it will take significant patient investments over a four-year period to bring total improvement and reliability to electricity transmission and supply across the country, because it costs more resources and time to upgrade legacy lines than to construct new ones.

“If government decides to give us a billion dollars today, we cannot take out all the lines at the same time to reconstruct. It needs to be planned and phased; that is what we intend to do to improve on the reliability and quality of supply to Ghanaians,” said its Chief Executive Officer, Ebenezer Essienyi, in an earlier media engagement.