Government’s decision to suspend the Price Stabilisation and Recovery Levy (PSRL) – a fund set aside to cushion consumers in times of high global crude prices – has proven unrealistic for tackling rising prices at domestic pumps, the Institute for Energy Security (IES) has said.

Ghanaians pay GHp16 on a litre of petrol and GHp14 on diesel to the fund, and it is believed that about GH¢1.26billion had accrued from the PSRL between 2015 and October 2021. Ideally, the GH¢1.26billion should have been used to cushion consumers; but government opted to suspend it all together between November 2021 and January 2022.

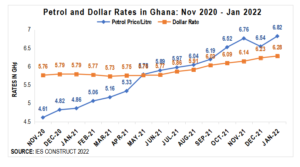

However, three months after suspension of the levy, IES said domestic fuel prices have risen by more than 9 percent to reflect rising international oil and fuel prices and fall in value of the local currency. “Analyses of happenings on the local market show that suspension of the PSRL over the past three months has proven to be an unrealistic strategy for bringing down domestic fuel prices – thus questioning credibility of the levy,” the energy think-tank said in a report.

It said the strategy – deployed in November 2021 and when average prices of petrol and diesel hit GH¢6.52 per litre – failed in halting the frequent upward fuel price adjustments. “Whereas the PSRL has proven unsustainable in its present form and substance as validated by IES’ study, the National Petroleum Authority’s incompetent application of same to realities of the Ghanaian fuel market is a worse cause for worry,” IES said.

It further warns that consumers might have to part with more money for a litre of fuel in the coming months, should prices on the international market continue to rise and the local currency continue to depreciate against the United States dollar. “Should these two variables maintain their traction on the foreign and local markets, petrol and diesel prices are likely to stay above GH¢8 per litre before mid-2022.”

The Institute also noted that an elevated geopolitical risk, shrinking spare capacity and a relatively mild effect of COVID-19 infections on petroleum demand will be counted as key factors in oil and fuel prices increases on the global market more likely to impact negatively on domestic fuel prices.

The rising global crude oil prices, meanwhile, remain a constant challenge to the cedi’s value sustenance against the greenback; due to the attendant growth of the country’s oil and fuel import bill.

As of Thursday morning, the local currency traded at GH¢6.9 to a dollar, compared to GH¢5.8 to a dollar this time last year. It added that even a downward correction in international oil prices, as the world heads toward the lower demand period of spring and summer, will have very little impact on local pump prices given the persistent fall in value of the cedi against the US dollar.

“As it has become increasingly apparent that petrol and diesel prices will likely finish the first-half of the year at record highs, there must be a more sustainable and pragmatic response to the exposures from international oil prices and the foreign exchange (Forex) market; one that goes beyond the PSRL,” the report advocated.