Investors participating in the nation’s issued Eurobonds have expressed optimism about the economy despite having concerns over the debt situation, after they engaged with government in a Non-deal Roadshow (NDR).

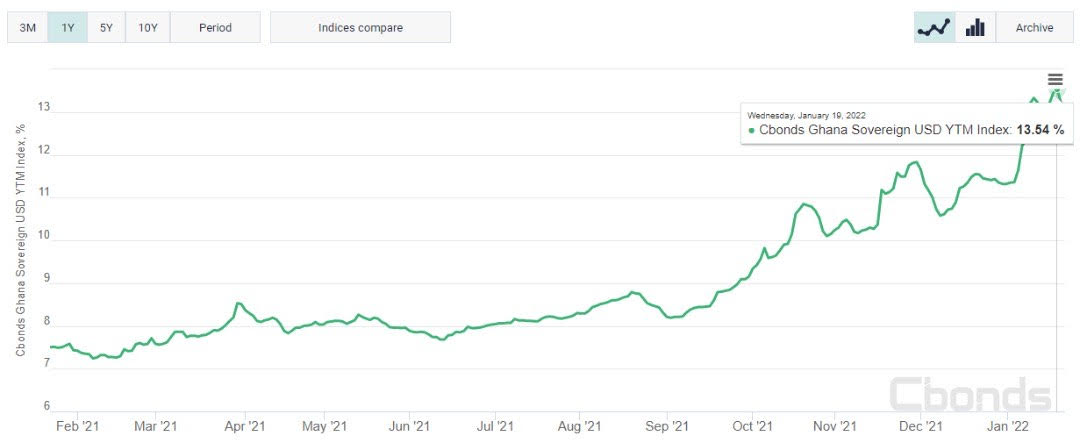

The optimism can be deduced from data compiled by the bond-tracking platform Cbonds, which shows the US$ yield-to-maturity (YTM) index (interest rates) on the country’s Eurobonds dipped marginally from a peak of 13.54 percent on January 19, 2022 to 12.94 percent as of Friday, January 21, 2022; a development Minister of State at the Ministry of Finance (MoF), Charles Adu Boahen, attributes to success of the NDR.

Speaking during a media interaction at the close of engagements which served as a platform for government to engage with offshore investors, banks and fund managers, as well as onshore investors, in a bid to give them first-hand information on performance of the economy and answer pertinent questions, Mr. Boahen said the three-day programme is already bearing fruit.

“The engagements have been largely successful, and the feedback received so far from the market has been encouraging. We have observed that Ghana’s Eurobond spreads have started to tighten across the curve, meaning that the engagement was successful and had an impact.

“It is important I reiterate that these engagements over the past three days have impacted the market positively, and concerns of investors over the economy, in particular, due to the 2022 budget have been addressed,” he said.

With investor sentiments having turned sour in the past couple of months over concerns about the nation’s debt sustainability, the Minister of State noted that participants were appreciative of insights gained during the interactions – while insinuating that some investors were bemused by the performance of the country’s bonds in light of current economic fundamentals.

“What struck me the most as quite interesting is that a lot of them (investors) were almost apologetic about how our bonds had performed. It is almost as though they seem to acknowledge that our bonds are not really reflecting the true strength of the economy’s fundamentals,” he remarked.

In addition, he stated that investors were buoyed by favourable short-term conditions: such as the absence of big maturity payments until 2025; the possibility of converting bridge facilities to term loans as a financing alternative; the availability of funds from the Special Drawing Rights (SDRs); as well as lowered rate of increase in the state’s compensation package, which is locked at 7 percent for the year.

Commenting on the matter, Senior Economist with Databank, Courage Kingsley Martey, agreed that the recent uptick in the country’s bond performance results from the success of timely and effective communication by the Ministry of Finance and Bank of Ghana.

“We know that there is the news effect, and effect of the actual economic performance of government securities. Recently, there has been a lot of negative noise; for instance from the Fitch downgrade, and this has widened our spread by around 1,000 basis points, into distressed territory; but the slight correction we are seeing is a result of the successful communication to calm the nerves of investors,” he explained.

He added that the onus is now on managers of the economy to ensure that numbers recorded during the year are able to sustain the rally.