In ensuring price stability, a further hike in the central bank’s policy rate seems crucial amid the current pace of local consumer inflation, rising global inflation, high energy prices, uncertainties surrounding food prices and investor behaviour, an analysis by the B&FT has shown.

In November 2021, the Monetary Policy Committee of the Bank of Ghana raised the policy rate by 100 basis points to 14.5 percent on the back of the above-listed risks and challenges.

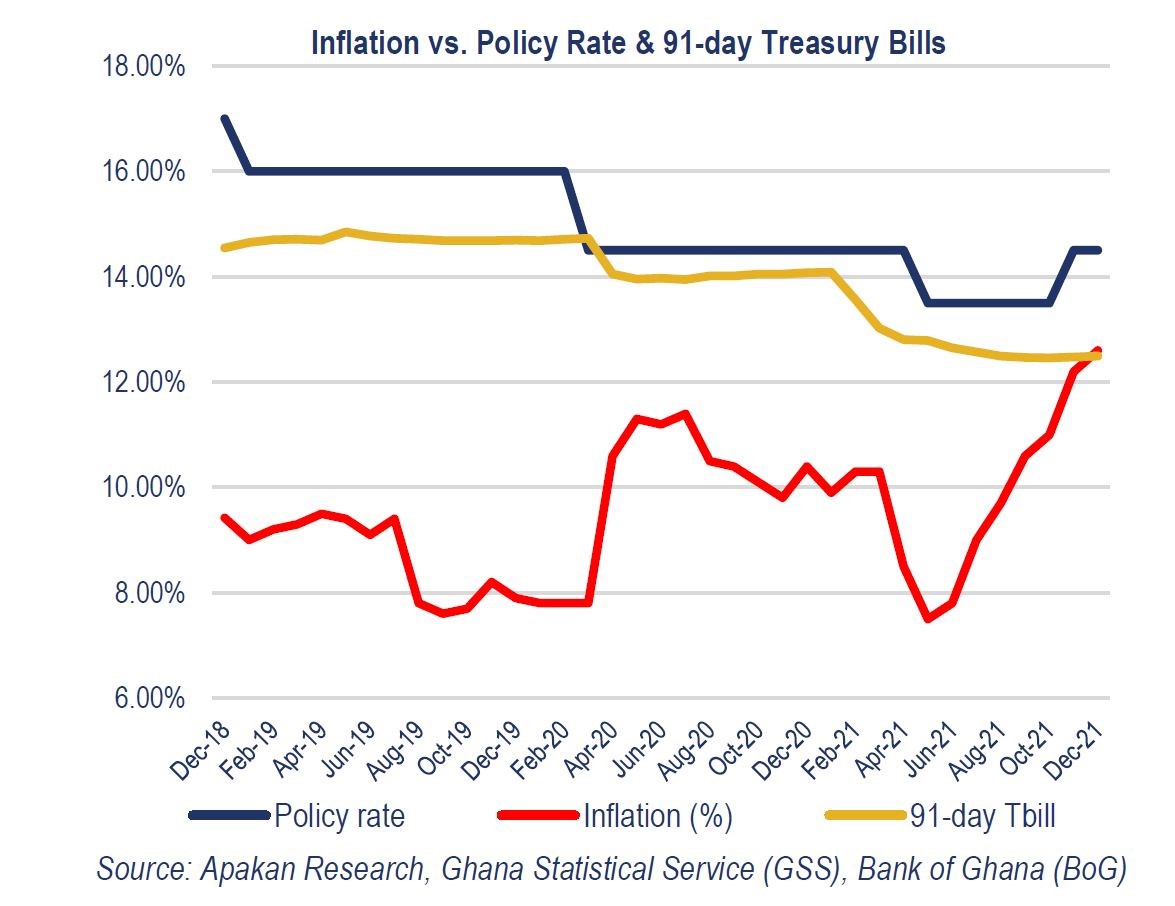

Latest data on inflation published by the Ghana Statistical Service (GSS) show that consumer prices rose for the seventh straight month in December 2021 – from 12.2 percent in November 2021 to 12.6 percent, moving further away from the Bank of Ghana’s (BoG) medium-term target band of 8 percent with a leeway of ±2 percent – largely driven by the food basket, as non-food inflation moderated during the festive period.

This is the highest inflation rate yet in the rebased series, and the sharpest year on year (y/y) price growth since April 2017. The inflation data also showed that, on average, prices rose at a marginally faster pace in 2021 of 10 percent compared to the 2020 level of 9.9 percent; however, on a month-on-month basis, general price levels were up by 1.2 percent.

Describing a gloomy picture that the latest inflation data presents, Senior Investment Analyst at OctaneDC Limited, Kwadwo Acheampong, in an interview with B&FT said that the latest inflation rate figure presents a worrying situation; not for the amount but the trend – the increasing rate since July 2021.

“These may lead the central bank to cautiously increase its policy rate by 25 to 50 basis points. It would be surprising if they do not review upward,” the Senior Analyst said, projecting that come the next monetary policy committee meeting, scheduled to be concluded on Friday, January 28, 2022, a move upward is likely.

Apakan Securities Limited, in its analysis of the inflation data, projected a 50-basis point (bps) policy rate hike at the January 2022 meeting – given the Bank of Ghana mandate to formulate and implement monetary policy to achieve price stability.

“We think the BoG may need to raise the policy rate at its January 2022 meeting to control rising inflation and inflation expectations, as well as to tame the foreign exchange pressures seen in recent months,” Apakan envisaged.

Although the central bank increased its US$ sales at the multiple rate FX forward auctions to US$75million per auction, the Ghanaian cedi remains under pressure. The last forward rates auction on January 11, 2022 suggested a growing backlog of unmet demand for US$, as shown by a bid cover ratio of 3.13x.

Meanwhile, Ghana’s economic recovery has been strong – creating some space for the BoG to raise its benchmark interest rate at the Jan-2022 meeting, the investment firm said. The economy expanded by 6.6 percent in the third quarter of 2021; up from a revised 5.1 percent in the second quarter of 2021, although the industrial sector continues to drag the pace of recovery.

Signalling the policy rate hike’s impact, Apakan highlighted the challenges this will pose to government’s financing requirements. “While we lean toward a 50bps policy rate hike, we think it may also pose further challenges to government’s financing requirements, as yields on the domestic secondary market are likely to remain elevated,” it cautioned.

On the money market, there are expectations that investors will revise their yield positions higher in line with the higher inflation level, as the 91-day Treasury bill currently offers negative real return on investment.