- Loses GH¢1.9bn in market cap

- Composite Index dips 7.06%

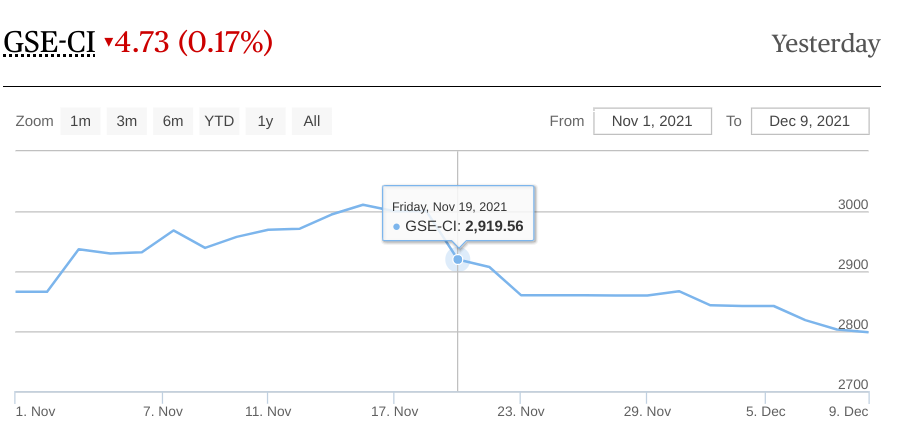

The Ghana Stock Exchange (GSE) has continued its decline over the course of the past four weeks – with its benchmark Composite Index (GSE-CI) falling by 7.06 percent over the period after breaching the 3,000-point mark – from a high 3010.74 points to 2, 798.27 points.

The recent reversal of fortunes has seen the market lose some GH¢1.9billion in market capitalisation – a 3.19 percent drop from GH¢65.8billion in the middle of November to GH¢63.7billion at the close of trading in the second week of December.

Consequently, the GSE-CI’s year-to-date return has shrunk by more than 10 percentage points, from 55.07 percent to 44.12 percent for the period under consideration. This development has been marked by a fall in the share price of market leader MTN, as well as other top performers including oil and gas and financial stocks.

E-levy biting already?

Since its initial public listing in 2018, telecommunications giant MTN has dominated the market; driving total volume traded by as much as 75 percent and 87 percent in the first and third quarters of this year respectively, and reaching a share price high of GH¢1.33 – a 103 percent appreciation over its price at beginning of the year.

The telco’s performance has in no small part been spurred by the growth of its mobile money business, which raked in the equivalent of US$216.4million in 2020.

Its share price, however, has witnessed a decline over the last month to GH¢1.15; and Head of Research at Databank, Alex Boahen – whose outfit forecasted that the market would close the year with returns of 45 percent, believes investors are already reacting to expected impacts of the newly introduced 1.75 percent electronic transactions levy on the profitability of MTN.

“The decline, I would say, has mostly been as a result of some uncertainties concerning MTN. As you notice, shortly after MTN had reached an all-time high in share price, the budget was read and we began seeing some selling pressure immediately; and that is mainly due to the concerns about the E-levy and its implications on the profitability of Mobile Money and MTN as a whole. That has been the major driver.”

He added that while it is yet to be seen how the public reacts to the new levy, evidence elsewhere on the continent suggests that volume of trade will decline with its imposition – and investors are already factoring that into their pricing and selling decisions.

Corroborating this view of effects from the E-levy, Analyst with UMB stockbrokers Ben Ackah said uncertainties surrounding the budget have likely made investors develop ‘a wait and see’ attitude before they invest further in stocks on the market, given the significance of MTN stock.

“MTN’s profitability also includes the component of mobile money commission they make, which is dependent on the volumes they are going to be doing. Now, if there is going to be a significant backlash from users of the mobile money due to the E-levy – which would affect the volume of business MTN does, it is likely to affect their profitability; and so this may have informed investors as to the position they should take in respect to MTN stocks,” Mr. Ackah explained.

Futrher, he said: “MTN has been a huge component in the market’s performance; so if they are falling, then the market as a whole is likely to take a hit too”.

The analyst further highlighted effects of the yuletide season of December as another reason for the decline in performance of the stock market, given that retail investors usually short their holdings during this season to celebrate the holidays. “In this yuletide season of December, we have some retail investors taking some of the funds out just to celebrate during the holiday season. And so it is possible that there is a lot of supply as a result of holiday decision-making by investors,” he said.