Very soon it will be Christmas and Christians all over the world will joyfully celebrate the remembrance of the birth of a savior. It will also be a significant secular family holiday and increasing number of consumers, both Christians and non-Christians from all walks of life will be consuming more of goods and services ranging from carols, cards, fire crackers, and light fixtures to other consumer goods such as apparels, computers, television sets, toys and agricultural products.

How does this concern the engineers, researchers and data scientists at Data Insight Group? Our studies and analysis shows that there is a serious big data argument here ranging from production process to the supply chain through to consumption.

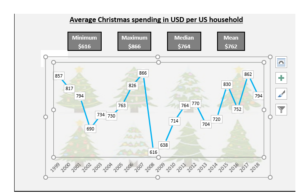

Christmas spirit incredibly increases spending and other activities during the holiday. Globally, Christmas is typically the largest economic stimulus for many nations as sales increase dramatically in both formal and informal economy. From chart below, empirical evidence over a two decade period shows that average household spending in the USA ranges from 616 to 866 US dollars respectively from 1999 to 2018. Undoubtedly, 2007 was when consumers spent most followed by an obvious and significant decline of about 28.9% in 2008 with the least consumer spending.

Average Christmas spending in USD per US household

Minimum Maximum Median Mean

$616 $866 $764 $762

Christmas is classic and at the end of the day, many traders, importers and other strategic trading partners will continue to seek for opportunities by identifying product niche and exotic fashions for subsequent years. For others, it is common to re-evaluate business strategies as organizations plan to begin a new calendar year and start a new fiscal year. Christmas is unique and offers opportunity to largely increase revenue target and profit margin for the end of calendar year. Behind all these activities are huge amount of data generated domestically and internationally through international trade.

More growth opportunities of Christmas on International trade

The joy of Christmas is remarkable and spreads across global boundaries through international trade. Technically, international trade is influenced by factors including consumer price index, inflation, bond rates, interest rates, import and export among others. And trading globally offers consumers from various countries the opportunity to have access to goods and services not available in their territories, or have the option of purchasing relatively less expensive products domestically. In Ghana, government support for import substitution helps identify priority sectors to benefit from wide range of credit to stimulate growth.

Ghana is also a marketplace with many opportunities for export of traditional products and services and according to the International Trade Administration (ITA) of the U.S. Department of Commerce, Ghana is an excellent platform for market entry into 55 countries of Sub Saharan Africa, a market of 1.3 billion people.

The festive occasion has the potential to change the look of many markets with loud music throughout the day and displays of several traditional assorted gifts. Traditionally, cocoa and gold are key capital goods that Ghana trades across international borders. However, research shows that there are multiple other products and commercial services that Ghana trades in with rest of world. From fiscal policy perspective, these are worth several millions of dollars.

Leveraging machine learning (ML) algorithms to data from the World Trade Organization (WTO) which deals with the global rules of trade between nations, it is clear that the flow of finance, technology transfer, capacity building and trade among others are relatively high during the Q4 periods in Ghana. Evidently, aggregate trading in commercial services in Africa also reveals how trade increases in the fourth quarter with significant regional and country variation in growth that offers many opportunities

Christmas in Ghana and the impact on local market

At micro level, Christmas is the season for many individual families to travel far and near, spend time with friends, cook favorite and sumptuous holiday foods, enjoy more junkies and drink excessively. Amazingly, the staggering number of cows, goats, and sheep among others moving in various territories will potentially end up in the market and millions of middle income families will notably purchase one or two such livestock from one of the several regional livestock markets. The impact of this informal economy and its amplification on the explosion of big data is phenomenal.

Obviously, the informal economy thrives in the context of high unemployment, underemployment, poverty reduction, gender inequality and precarious work. However, lack of infrastructure to track the activities of such business-to-consumer (B2C) is affecting development, stalling any possibility of advancement, as well as hindering opportunities in a world of digital economy to identify important outcomes. And looking at this point, it is clear that Ghana will continue to miss a window of opportunity and the things we should be thinking about.

As a data consulting and research company, the Data Insight Group (DIG) has been observing the situation from far beyond for several years. And one of the reasons why progress is not seen is because most of the time, the bad from the past has been ignored and not analyzed. Finding the roots of today’s problems clearly requires empirical evidence and looking at why setting up statistical parameters in addition to data collection and statistical analysis is strategic and critical. Getting access to big data domestically and being able to analysis to identify patterns and relationships that may otherwise remain hidden means progress is possible.

Growing up, it was interesting that even the affluent poor income families will treat their families by cooking rice during Christmas. So now, how much better can rice production excluding import be produced locally? Building dataset from historical food production data from the Ministry of Food and Agriculture from 2004 to 2016, presents some interesting facts about rice production locally. Looking at the following great data visualization, there is clearly a strong positive correlation of rice production and land size.

With estimated correlation of about 0.93, intuitively such a strong relationship can easily be transformed into future insights. And using predictive analytics such as linear regression to predict the estimated amount of rice production per hectare of land can help to uncover new facts about rice production locally. Understandably, several inputs are required for agrarian farming, however, by introducing an entirely new assumptions with just a univariate as an explanatory variable, increasing the size of land by one hectare will increase rice production by 0.000466 metric tons per hectare.

Before then, spending more time in further exploratory data analysis (EDA) to understand the quality of data and investigate how the data can meet expectations or not, provided additional insight. Per chart below, the boxplots look roughly the same besides the obvious several outliers per period that DIG believes could have been resulted from error data entry increased interest in local food production important new science in expanding production great education program to improve product quality improved labor skills and productivity rates good season yielding high production per metric ton.

Overall, the data presents some interesting facts about rice production. By default, it was a good practice to repeat analysis with and without the outliers. And after realizing that the impact showed minimal effect on the results and, it is not clear why there are outliers, it was reasonable to keep the outliers in a best case scenario. In 2016, significant outliers occurred in Builsa, West Akim, East Akim, and Dangme West respectively.

For the time being, it is clear that local production is not enough to feed a total population of 30.8 million and that is why Christmas offers new and huge opportunities to noble traders to rush to import all kinds of goods including rice to grace the occasion.

At this level in this 4th industrial revolution (4IR) the Data Insight Group believes that, the sense of knowing that keeping up to date with data, coding, machine learning and artificial intelligence are key strategies that will certainly demonstrate competitive advantage with comprehensive win. Leadership from different levels including departmental heads and local governments’ preparedness to facilitate the processes of technology development and knowledge transfer such as skilled data science will successfully and quickly improve the informal sector as the growth engine for economic transformation.

For further data team development questions, data initiative or long run transition concerns, feel free to reach out to

Ebenezer Obeng-Nyarkoh on WhatsApp

027 213 7778 / +1 774 253 2207