- …as concerns linger over appetite for debt, effects on equities

Amid the deterioration in investor confidence due to elevated concerns over the nation’s sovereign fiscal and debt sustainability, which have resulted in a sudden tightening of the Eurobond market against Ghana, government in its 2022 budget must outline measures to restore the credibility of its fiscal policy.

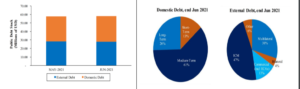

The nation is currently in a difficult position as external debt has risen sharply due to a number of sizable issuances in the international market with more than US$11billion raised between 2018 and 2021 – pushing debt beyond the prudent threshold.

While Eurobond yields for most sub-Saharan African countries remain close to their respective pre-pandemic levels, Ghana’s have sharply risen in recent weeks – by around 250 to 300 basis points (bps), triggering sustainability concerns among investors.

Domestic market analysts, who are of the common view that this development is ‘problematic’, have ahead of the impending 2022 budget presentation enjoined government to speak directly and credibly to investors about its commitment to fiscal and debt sustainability.

Senior Economist with Databank, Courage Kingsley Martey, in an interview with B&FT said: “We think the main mitigation should come from the 2022 budget expected in mid-November 2021. This ought to be a budget that speaks directly and credibly to investors about Ghana’s commitment to fiscal and debt sustainability. Government may have to show alternative but credible financing sources to revive investor confidence”.

Based on the waning investor confidence, Mr. Martey suggested that government must necessarily put forward a strong and credible plan to boost revenue – and reliably demonstrate a stricter control of public expenditure while ensuring the country does not build up arrears.

“At this point, it might not be sufficient to project a higher revenue outlook. There must be supporting measures to achieve these revenue targets, and the market must perceive these measures as credible. Essentially, it appears we’re losing policy credibility; and we need the 2022 budget to be decisive in restoring that credibility, unequivocally. This will be necessary to restore investor confidence and trigger a downward correction in Ghana’s Eurobond yields.”

Sharing his view on the same subject, Senior Investment Analyst at OctaneDC Limited, Kwadwo Acheampong, said although government has done creditably well in some areas, it has taken a lot of flak for not reining-in debt levels.

“The argument may be made about ability to service the debt; but whichever way it is looked at, the debt situation provides no comfort. Therefore, it is not surprising that a number of foreign investors have shed Ghana’s government debt securities in favour of more secure securities like US government Treasuries. Definitely, the US government’s planned tapering, which will squeeze the availability of cheap capital flowing to high yield investments, has played a big part in this,” the senior analyst explained.

He then suggested that government is most likely to borrow less, overall, in 2022; however, the issuance may be oversubscribed given the country’s creditable efforts in weathering the COVID-19 storm well.

“Come early next year, government may try to issue green Eurobonds as well. It is likely that all Eurobond issues will be less than what was raised in 2021. However, the issues will likely be oversubscribed because investors still believe the country has weathered the COVID-19 storm well,” the senior analyst said.

“The 2022 budget reading, due later this month, should show, clearly, a waning appetite for debt. It should show how government intends to raise more revenue outside export earnings. It should show a significantly tighter fiscal regime with spending matching revenue to decrease deficit levels,” he added.

On a similar tangent, Investment Analyst at Nimed Capital Joshua Adagbe said government is in an undesirable position as investors are likely to demand some 800bps, an additional 8 percent, premium for the nation’s Eurobond offerings; while on the local front, recent Treasury bill and bond auctions have failed to attain full subscription.

He expressed concern that this development could negatively impact the stock market, eroding some of the gains it has made this year – including an overall year-to-date gain of 52.92%. He believes this will happen if government cuts expenditure; which he says it needs to do, or crowd out the private sector on the debt market.

“A switch to the domestic market would not really suffice. It will lead to a crowding out of local businesses, which will have a crippling effect as the domestic funds fuel businesses. All these will impact other areas, such as employment. Though government is heading toward the local market more, the market is not responding as well… we might have a case where listed companies and those planning to list suffer due to possible high yields, but we doubt the sustainability,” he explained.

According to the last publicly available monthly public debt newsletter issued by the Ministry of Finance, by June the public debt stock stood at GH¢334.78billion – up 27.26% YoY.