A few weeks ago, the Ghana Bar Association (GBA) had its annual conference. The event, held in Bolgatanga, was under the theme ‘Ensuring an increase in revenue mobilisation through taxation for the purpose of accelerated national development: The role of the Lawyer’.

Addressing the bar conference, Attorney General, Godfred Dame, advised lawyers to desist from the practice of helping their clients avoid or evade taxes; and also take up the personal responsibility of leading by example. It has been reported that many lawyers are caught in the phenomenon of tax evasion as they unjustifiably avoid being caught in the tax net, either by understating their profits or concealing their true income.

And according to the finance minister, over 6,000 lawyers and doctors are not paying tax per an exercise conducted by the Ghana Revenue Authority (GRA). That is, lawyers, doctors and civil servants must be entreated to honour their fullest tax obligations, as not doing so is not only criminal, but borders on a gross violation of their professional rules.

It has been said that the corruption of our best professionals is the worst, because such levels of corruption among the highly knowledgeable with reputable professions makes the fight against corruption somewhat unsurmountable. Additionally, how can they lash out at government when things are hard, as it is their responsibility to at all times comply and pay taxes to help in the execution of projects and policies to develop the country? It is not good enough to be educated and enjoying elitism while evading your civic and moral duties.

Considering the dynamics of our growing economy and the workforce in both the formal and informal sectors, the major step government ought to take to ensure maximum realisation of revenue mobilisation is the digitalisation of our tax administration. Despite the low challenges in collecting tax in the formal sector, the informal sector is the most declining in tax collection for our fast-growing economy – according to data from GRA.

Decline of tax revenue

About 1.5 million out of the six million eligible Ghanaian taxpayers pay tax. This makes Ghana one of the lowest tax to Gross Domestic Product (GDP) ratios in Africa. Ghana’s tax revenue to GDP was 13 percent in 2020 and is estimated to reach 20 percent in 2023.

According to the Institute of Economic Affairs (IEA), Ghana has a lot to do to meet the sub-Saharan average of 17 percent, which is above the nation’s 13 percent mark that governments have over the years tried to upscale – with the country’s challenge of collecting less tax and relying mostly on external help: International Monetary Fund, World Bank, bonds and others. Besides, Ghana’s total revenue (both tax and non-tax) to GDP was 14.3 percent in 2020 and is expected to rise to 16.9% in 2024.

Governments’ efforts in rolling out new taxes is to increase revenue mobilisation

Although Ghana’s tax rate is high, the nation is not accruing enough revenue because of the low efforts in revenue mobilisation – especially from the informal sector.

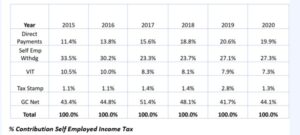

According to GRA, the major contributor to the country’s public purse from the informal sector, the Vehicle Income Tax (VIT), saw a drop from 8.3 percent in 2017 to 7.3 percent in 2020 – while the Tax Stamp, which is the other contributor, also witnessed a drop; from 1.4 percent to 1.3 percent in the same period under review.

The decline, according to some tax experts, is in sharp contrast to recent figures released by the Ghana Statistical Service in its Ghana Living Standard Survey (6), which pegs the population of operators in the informal sector at 90 percent of the country’s workforce. According to the data, Ghana realised only GH¢35,811,805 from the Vehicle Income Tax and Tax Stamp out of a total revenue realised from self-employed people that was GH¢413,594,327 in 2020.

In view of the need to expand the tax net in the informal sector to generate more revenue, the National Identification Authority (NIA) and Ghana Revenue Authority (GRA) announced the commencement of plans to replace the GRA Tax Identification Number (TIN) with the National Identification Authority (NIA) Personal Identification Number (PIN), known as the Ghana Card PIN.

The goal of tax digitalisation is to collect the maximum amount of revenue with minimum cost to the state. The transitioning from TIN to Ghana Card will provide data statistics and information about the economy – for example, determining which assessable persons are and are not taxable.

Thus, the transitioning could aid in reducing tax avoidance and evasion by providing unique identification of individual tax data. When combined with other mechanisms like withholding tax and withholding VAT in a proper way, it can rope-in the informal sector (the biggest evaders of tax in Ghana). This may not necessarily make people pay the right amount of tax, but it will increase the taxpayer base.

Also, with increased digitisation, using the bio-data provided on the National Identification System, data analytics can be employed to automate some tax audits and point GRA officers toward risky or potential evaders. This will hopefully reduce unfair targetting of the compliant few.

Digitalisation of the tax administration

The international tax rules are being reformed to cope with the increasing digitalisation of businesses. Thus, current international tax rules allow countries to tax profits of non-resident companies which are attributable to a permanent establishment in the country. Meanwhile, countries including the US, UK and other advanced nations have taken unilateral action to tax non-resident companies outside their countries, although work is ongoing to reach an international consensus.

For example, technology companies with digital platforms such as search-engines and social media platforms can make substantial profits through the sale of advertising. Adverts may be targetted at users of the platform in a particular country, yet the technology company might have no substantial physical presence there – and it pays tax to its local revenue authority on the profits garnered outside the country.

In recent years, considerable media attention has focused on the fact that US-owned technology companies such as Facebook, Instagram and Google have made large profits from interactions with individuals resident outside the country – but they have paid low levels of tax in those countries, or indeed anywhere. This issue is broader than just technology companies. Ideally, the international tax system needs to be radically reformed to deal with the increasing digitilisation of all types of business.

The insertion of digital tools into public administration and the informal sector may help expand the set of taxpayers, reduce costs and improve tax performance. Governments can better identify taxpayers by issuing Intrusion Detective System (IDS).

An IDS is a system that monitors network operating systems to detect suspicious activity, and alerts when such activity is discovered or breached. Rather than relying on the manual anomaly of detecting and reporting tax evaders, an IDS in the network payment systems in the public – and especially the informal private – sector will monitor, detect and report infringements in the network payment system.

For example, government has established an online platform for e-filing and e-payments of taxes and import duties which started effectively 1 July this year. Digital technologies help strengthen tax administration by lowering transaction costs and allowing innovation in tax policy. Digital tax administration may reduce tax evasion and fraud. Although it may not necessarily make all taxpayers pay the right amount of tax, it will increase the taxpayer base.

Conclusion

Domestic revenue mobilisation (DRM) refers to the generation of government revenue from domestic resources from tax or non-tax sources. Improving DRM of developing countries is a crucial factor in accelerated development. As noted earlier, only about 1.5 million out of the six million eligible Ghanaian taxpayers pay tax – making Ghana to have one of the lowest tax to Gross Domestic Product (GDP) ratios in Africa.

Our revenue target for this year is GH¢57billion. Tax revenue from last year was more than GH¢42billion. Also, as at the middle of this year, government had already collected more than GH¢26billion. Going by this development of tax evasion by both the formal and informal sectors, it means that if we have less than half of it from taxes, more than GH¢30billion is left to be mobilised. This is a major outcome of development lapses in tax collection.

Although government has established a transformation agenda to block the leakages of tax collection in key sectors of the economy with the establishment of the Revenue Assurance and Compliance Enforcement (RACE), the catalyst for this development agenda should be digitalisation.

>>>the writer is a tax analyst. He can be reached on [email protected]