Noted for its rigour, the nonexistence of exemptions and the 300 plus study hours for each of 3 levels, the CFA Program is popularly referred to as the gold standard of finance and investment certifications. True to this accolade, the CFA program has evolved over its 58-year history, remaining relevant and time-sensitive to market changes in global markets.

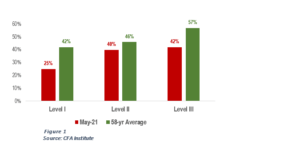

The CFA Program exams have always focused on testing investment tools at Level I, asset valuation at Level II, and portfolio management at Level III. This logical sequence consistently takes into consideration the changes in the investment profession and global markets. With history serving as the precedent, the pass rates for the recent May-2021 exam showed lower than expected pass rates, as shown in Figure 1.

Notable amongst the reasons cited include; candidates having to defer their test twice due to pandemic restrictions and the associated stop-start nature of the deferred candidates’ studies.

Given the Institute’s response to the pandemic, current industry and global capital markets trends, the CFA Institute has announced significant changes to both content and administration of the CFA exams, which most likely point to an even arduous task in becoming a Chartered Financial Analyst.

Curriculum Content

In response to the impact of the pandemic-related disruptions, the CFA institute froze the 2020 curriculum for 2021 exam administrations. Meaning all candidates taking exams in 2021 will be tested on the 2020 curriculum. As we advance, the Institute has announced changes in curriculum for the exam administrations in 2022.

Broadly highlighting the changes across the levels, Level I has seen significant revisions to the Environmental, Social, and Governance (ESG) content to factor in recent developments and their impact on investment management. Additionally, Level I Quantitative Methods has been revised to be more engaging, digitally friendly and now includes code snippets as well as Excel commands to support the data presentation. There is also a new Introduction to Regression reading that focuses on investment applications.

Level II has seen updates to Machine Learning with several data cases to investment problems. In addition, a new Backtesting & Simulation reading provides a sophisticated but accessible introduction to explain how these tools are used to evaluate investment strategies and compare their strengths and weaknesses. Additionally, Corporate Finance as a topic area will now be referred to as Corporate Issuers, focusing on understanding the motivations, interactions and impacts on investors of securities issued by corporations.

The Level III readings have been extensively revised, replacing old content and refocusing on new content that captures current practice. The significant changes and revisions to Private Wealth Management, Institutional Investors, and Performance Evaluation reflect the new 2020 Global Investment Performance Standards (GIPS Standards). Similar to level II, Corporate Finance as a topic area for this level will be referred to as Corporate Issuers.

Administration of Exams

Prior to the pandemic, all papers-based CFA examination levels were taken annually in June, with the option of taking Level I in December. In response to pandemic disruptions, the CFA Institute announced in December 2020 the transitioning of all three levels of the CFA exams to computer-based testing. According to the Institute, these advances bring greater flexibility, faster results, an improved candidate experience, and an exam that reflects the current digital workplace. This transition also allows the Institute to offer the exam multiple times a year to candidates.

Implications for CFA Candidates

CFA candidates who were unsuccessful at any of the levels are now faced with the double-barrel of mastering concepts they were not well abreast with as well as familiarizing themselves with the newly introduced content of the updated CFA curriculum. Additionally, candidates may now face the unique challenge of balancing their knowledge of curriculum content and application with the dexterity and speed of using a computer under strict time allotment.

The Challenge

The rumour of the seeming unsurmountable nature of the CFA program and the countless number who end up being shipwrecked on this quest is the selfsame reason many more throng to exam centres around the world, thirsty for recognition as one of the successful titans approximately two months after the exam.

Bibliography

CFA Institute. (2021, January 12). Exam Overview: cbt-candidate-pathing-infographic. Retrieved from CFA Institute Web Site: https://www.cfainstitute.org/-/media/documents/factsheet/cbt-candidate-pathing-infographic.ashx?la=en&hash=0AAFA552B0D8FEC8191E5AF31471FA87F3B18E17

CFA Institute. (2021). Exam Overview: CFA exam results since 1963. Retrieved from CFA Institute Web Site: https://www.cfainstitute.org/-/media/documents/support/programs/cfa/cfa-exam-results-since-1963.ashx

CFA Institute. (2021). Guide to 2022 CFA® Program Curriculum Changes. Charlottesville, Virginia: CFA Institute.

CFA Institute. (2021). The CFA Program, Where Theory Meets Practice. Charlottesville, Virginia: CFA Institute.

>>>The writer is a CFA Level II Candidate and has deep knowledge in Investment & Infrastructure Finance

Contact us at [email protected] || [email protected] or visit www.cfainstitute.org || https://www.cfasociety.org/ghana for information about the CFA programme.