Does it really matter to a bank to be social media visibility conscious as a business giant on the Wall Street with assets in over $ 2. 87 trillion?

Certainly, it does. Largest banks in the United States have been investing in social media strategies as part of their overall digital technology business development initiatives. With the banking competition towards the digitally-savvy millennials market growing, social media presence has become a must-do business strategy than a choice.

The dynamic nature of the social media platforms presents banking business with the opportunity to cultivate consumer trust, consumer retention, engaging in consumer conversation, and afford consumers a space to talk-back on banking products and services which subsequently leads to brand authenticity and credibility.

Banking businesses thrive on public and consumer trust, and social media offers a competitive space where consumers measure trust it reposes in competitive banking brands based on shared social media narratives across various platforms. It is against these backdrop that banks need to pay critical attention to their social media presence and the overall visibility strategy. Unfortunately, many banking institutes consider social media as trivial spaces, it is far from that, it requires a scientific business engineering in order for brands to achieve relevance and trustworthiness.

Don’t just be a Bank, be a Social Voice:

Banking today is about meeting consumers on their connective spaces, thus, social media platforms where they are connected. According the Pew Research, over 72% of American adults are connected to a social media platform. Similarly, from a Deloitte data, over 50% of the population in Canada are socially connected. Effective banking in this era of digitalization means offering listening voice and a two-way transparent social media engagement to customers.

Social media engagement provides positive brand image building, offers insight into consumer needs and complaints, subsequently allows for enhance strategic brand communication, positioning, and improved revenue returns. For banks to maximize on social media returns, it needs a continuous monitoring of brands social media visibility, social media mentions, social media reach, social media interactions around the brand, social media sentiments and reviews relating to the brand.

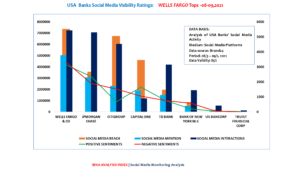

The measurement of these social media visibility values led the Institute of Brands Narrative Analysis (IBNA), brands’ media narrative monitoring agency to measure how the largest banks of the United States are competing for social media visibility ratings.

In an analysis of over 1million social media narratives relating to the largest banks in the United States, from the 3rd of August to the 1st of September, 2021, Wells Fargo & Co bank toped in the following social media visibility categories: social media reach, social media mention, social media interactions, but failed slightly in positive sentiments as its negative sentiment soared above its positive sentiment ratings.

JP Morgan Chase the largest bank in the United States, with a balance sheet of $2.87 trillion gained the second position with less negative sentiment ratings. Citigroup. TD Bank, Bank of America followed JP Morgan Chase in descending order. The study chart is revealed in the following USA Banks social media ratings:

The writer is the Founder of the Institute of Brands Narrative Analysis (IBNA). Email: [email protected]