Banks that are incapable of delivering essential banking services in a simple-to-use and secure mobile app are in danger of losing their ever-increasingly mobile-loving customers.

The digital evolution has impacted greatly on the financial institutions’ services we have today. The mobile revolution is at the centre of this huge digital transformation that is affecting all industries.

Today a bank’s services are seen as incomplete if it has no mobile app in addition for its customers. You see, more customers are getting mobile now. They want to be able to carry out basic banking transactions on the go. Until recently, having a website alone was enough for Internet banking; but today, no way.

What Customers Want

The modern bank customer does not only want to save money in the bank but, rather, find convenient ways of managing their funds. This they want to be able to do so by using their phones, which are often described as hand-held computers of some sort. Researches carried out to learn exactly some key things customers want from their bank’s mobile apps include:

- A feature to help them check their account balances quicker.

- A brief history of the most recent account transactions.

- Real-time monitoring of their accounts

- To be able to make transfers

- To be able to make bill payments swiftly

- To be able to use their phone’s camera to make cheque deposits

- Etc.

The Bank

The cost of serving customers is no joke, considering the overall operational burden for a bank. It is believed that by serving customers via their mobile devices this cost can be slashed by over 50%.

Creating a mobile app should be seen as an essential addition to the overall customer service experience you want to offer. More importantly, it should be seen as a solution for the ever-growing mobile usage population of which your existing and potential customers are part.

The dilemma for many banks as reported in several researches has to do with which features to enable in the apps – to first satisfy customers’ demands and also meet the regulator’s key requirement of ensuring the security and integrity of data.

Simple but Secure App

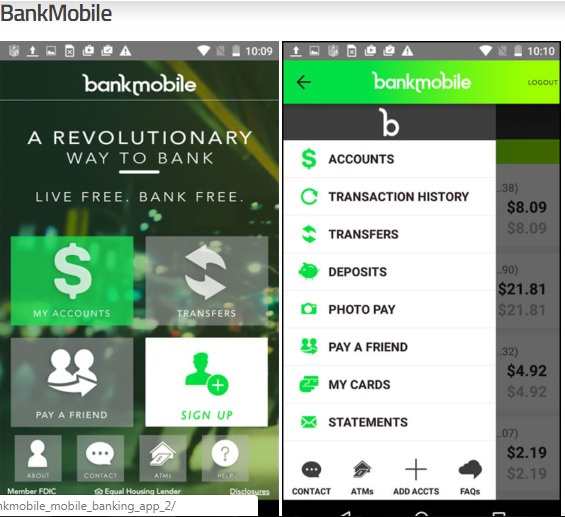

The simplicity as well as the security of the bank’s Mobile App should be a major concern right from the signing-up process.

Simple so as not to discourage customers from completing their sign-ups, but secure enough to protect the same customers against possible threats. Navigation through the app should be easy. Just a few clicks should help customers accomplish tasks on the app.

Unlike browser access to bank accounts, mobile access via the app is known to be a more secure way for data transmissions. Typically, usernames, passwords and sometimes access codes – as is the case is for my own bank – is all one will need to log-in.

However, there are other forms of authentication deployed by some banks to further protect access to customers’ accounts. Various forms of biometric technology are also deployed by some banks. These include fingerprint and facial recognition. In some other cases, voice recognition is also be used to authenticate access.

Additional Checklist

Your bank’ mobile App should have the following basic features to ensure a speedy and convenient banking experience for customers:

- Alternative authentication methods for customers to choose which one is convenient to them alone; these may include PIN, Patterns and Biometrics.

- Interface should be natural to use with easy to locate buttons.

- Pictorial presentation of information is best.

- Contacts shown on the app should have a click-to-dial feature.

- A 24/7 AI chatbots feature that helps with customer’s queries, complaints at all times of the day.

- Having the right GPS technology to help customers locate nearest branches, agencies and ATMs.

- Custom dashboard, where customers can have an overview of their money management activities.

- Customer should be able block their bank cards immediately if it is stolen or can’t be found. No need to call the bank to do so.

- A feature that allows customers to make cheque deposits straight into their account using the phone’s camera. In addition the phones camera can be used to upload shots of bill statements and receipts for appropriate action.

- To be able to schedule bill payments using the app

- Paying for tickets to events, travel etc. is a very good feature to have on your app.

- Right tools to help customers with budget planning and spending. This should come with some good thresholds to check over-spending, especially among millennials.

- Credit reporting is a new essential requirement for bank apps to add in order to help customers monitor their creditworthiness regularly.

The total service experience that a bank can offer today must include a functional mobile app that is simple to use, but secured. With a mobile app, the bank’s overall cost of reaching out and serving customers is also drastically reduced.

Digital Digest

The Nationwide Security Services Online Recruitment.

The Services Website’s Administrators need to ensure that websites handling the recruitment are equipped to avoid error when traffic to them increases.

Errors such as; ‘508 Resource Limit Is Reached ‘or error 509

Reasons for this error could be due to:

- A sudden increase in the amount of requests hitting the site.

- Some backend issues as many upload their documents during application

- Coding issues.

If not constantly monitored and resolved, it could be seen as a deliberate action to cut out many young Ghanaians who have already purchased forms.