The National Insurance Commission (NIC) has come out with a uniform premium calculation for Motor Insurance Policies that are for a period of less than one year, which took effect from last week September 1, 2021.

This directive is aimed at curbing the undercutting of rates by companies as was the case in the past. Currently, the premium of motor insurance policies that are for a period of less than one year is based on short-term rates instead of pro-rating the annual premium.

According to the regulator, this approach has the inherent disadvantage of resulting in premiums that are punitive. In view of this, a new formula has been introduced.

The premium is to be paid by policyholders when a policyholder requests a motor insurance policy for a period of less than a year; the premium is to be returned to policyholders when the policyholder seeks to terminate an existing policy; and the premium is to be returned to policyholders when an insurer terminates an existing policy.

The newly-introduced formula for a policyholder’s request for a motor insurance policy for a period less than year is calculated as follows:

However, the 130% in the formula above is to allow for the increase in policy administration cost as a result of servicing short-term policies as well as serve as an incentive for policyholders to purchase annual policies as opposed to short-term policies.

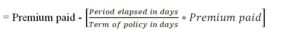

Secondly, where a policyholder requests to cancel a motor insurance policy the formula to be applied is the amount of premium to be returned to the policyholder after their request is calculated as follows:

Premium to be returned

The 140% in the formula above is to allow for the increase in administrative costs of servicing short-term policies as well as a disincentive for policyholders to cancel their policies. In rare scenarios wherein the premium to be returned is negative, no premium will be returned to the policyholder.

Finally, when an insurer cancels a motor insurance policy, the amount of the premium to be returned to the policyholder is calculated as follows:

Premium to be returned

Importantly, the annual premium and premium paid in the various formula refer to the Total Risk Premium; that is, the premium before addition of Motor Insurance Sticker fees and Ecowas Brown Card fees.