….“Lessons to be learned from “DeBeers Diamond Dilemma”

I am sure that most stakeholders in the Cocoa sector have heard about the “Lab-Grown Chocolate” project under trial in Switzerland.

This innovation which is been trialled as a possible solution to the “sustainability issues” raised in the cocoa sector has led to my concerns of whether what is sustainable is also ethical and which of these two should be paramount?

In this article, I will be looking at how the impact of this same “Lab Grown” phenomenon disrupted the minerals sector and the long-term implications of this new development on the cocoa sector.

I will also demonstrate the power of narrative creation and storytelling and how that has led cocoa-producing countries to become complicit in cocoa farmers’ poverty and the economic unsustainability of the sector. I will also make some suggestions to Ghana’s cocoa sector regulator – Ghana Cocoa Board on how to strategise.

The Swiss Lab-Grown Chocolate trial

It’s been reported that the Zurich University of Applied Sciences is currently growing chocolate in the laboratory.

Their objective is to play a role as scientists in driving the environmental sustainability agenda in its current framing where deforestation and child labour seem to be the highest concern of lead firms in the value chain, other than the net loss cocoa farmers earn from the cocoa trade which perpetuates the sustainability issues they so claim to be passionate about solving.

But why am I being petty on an idea in just a lab which has not been mainstreamed?

What do we know about the DeBeers Diamond Dilemma?

Reading the “DeBeers Diamond Dilemma” in 2018, brought me the inter-sectoral learnings that the cocoa sector could pick valuable lessons from DeBeers Corporations who felt that the resurgence of lab-grown diamonds was going to be about “Product Authenticity” rather than a “Well-crafted narrative that hit the soul of the buyer”.

When the idea of Synthetic Diamonds (lab-grown Diamonds) emerged, it was seen as rhetoric and wondered why anyone would even think of buying a synthetic diamond for what diamond truly means.

The then CEO of Gemesis Corporations was quoted in 2007 in the Washington Times saying, “the mystique of natural diamonds has been built by the industry. One hundred fifty million carats of mined diamonds are produced every year, so they are not that special if you look at those”.

The Finance Director of DeBeers, the then supplier of 80% of the world’s rough diamonds, was quoted in Bloomberg on May 17, 2007, saying “We don’t see synthetic diamonds as a threat, but you cannot ignore it completely”.

Both CEO of Gemesis and Finance Director of DeBeers felt that the preciousness of natural diamond is felt by users from it being a natural gem mined from the earth, hence lab-grown diamonds posed no threat at all to their business.

They underestimated that a well-told story about the financial, political, social, and environmental effects of diamond mining was much more powerful than marketing campaigns for the status quo.

Politically, a movie like “Blood Diamond” was enough to get some diamond lovers switching course from natural diamond to synthetic diamonds.

For example, when DeBeers was allegedly accused as being involved in the blood diamond trade in the 1990s, that is, buying a diamond from a situation where it was defined as indirectly funding rebels in war in Angola, Sierra Leone, Liberia, and the Democratic Republic of Congo, it formed a perfect narrative to switch diamond purchase from taste (natural Diamonds) to morality (Lab-grown Diamond).

Secondly, because synthetic diamonds were produced in the lab, without any direct cost of mining the earth, their prices were 15% to 40% less than natural diamonds.

The cost consideration combined perfectly with the moral correctness further drove many consumers to cross the carpet to synthetic diamonds.

Environmentally, the synthetic diamonds agenda setters posited that a karat of diamond required the extraction of tons and tons of earth, most times at the expense of humans and other animal life, hence making synthetic diamonds eco-friendly.

Regardless of the progress DeBeers and other natural diamond traders have made to improve such horrendous situations diamond mining created, they couldn’t compete with a narrative that leaves a long-lasting moral and sympathetic imprint in the minds of people.

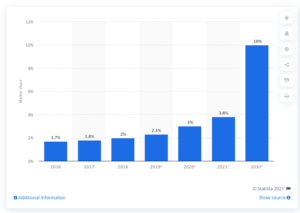

Today, according to Statista, lab-grown synthetic diamonds will form 10% of the overall diamond market by 2030.

Graph 1 – Lab-grown Diamond Market Share in the overall Diamond Market (2016-2030)

Any lessons for the Cocoa sector?

Ghana and Ivory Coast cocoa sector’s current situation with the emergence of lab-grown chocolate can be likened to DeBeers and the lab-grown diamond.

The quantity of Cocoa production keeps increasing with Ivory Coast recording an average annual increase of production by 200,000MT and Ghana topping it up with the million tons production in 2020/21 crop season.

As financialized commodities, cocoa and diamond react to supply and demand, hence the effects of this production-focused cocoa strategy in Ghana and Ivory Coast leading to an 8-month continuous price dip in this cocoa crop season (2020/21). See graph 2.

Graph 2 – Cocoa Prices from September 2020 to August 2021

China’s entry as I have predicted, but downplayed by Ghana Cocoa Board, will also in the future contribute to oversupply, hence further dipping the price of cocoa.

Olam and Mondelez are already pumping millions of dollars in their experiment for new sustainable cocoa production technologies geared towards increased cocoa beans quantity per tree, on a 1000-acre nucleus cocoa plantation in Indonesia.

When successful, they intend to scale throughout the Indonesia region. The aim is to create the world’s sustainable commercial cocoa plantations.

This will increase cocoa production, hence further driving down the price of the crop millions of people depend on in West Africa.

After all this, chocolate, the very product for which cocoa beans are mostly used for is going to have its lab-grown substitute.

Like DeBeers, reality denials in the cocoa sector, plus strategic chocolate manufacturers who are happy in disguise, would initially argue how lab-grown chocolate can never compete with chocolate made from naturally-grown cocoa.

But remember, the current global business terrain is currently being by environmentally and ethically conscious consumers; Investment firms being scrutinized using what we call “Environmental, Social and Governance (ESG) Investing” framework. So, any sort of solution that satisfies consumers emotional uprightness and business organisation’s ethical reputation, will be adopted without an argument.

A lot of campaign groups and advocacy firms are relentlessly campaigning against the patronage of products and services of businesses and brands whose activities can be framed as being complicit around issues like child labour, deforestation, etc. Hence a reason for us not to downplay it.

This is not different from the narratives Lab-grown diamond producers used in grabbing a part of the diamond market.

We have learned about scientists at the Zurich University of Applied Sciences trialling lab-grown chocolate with the narrative of it being the sustainable alternative to conventional natural cocoa-based chocolate which contribute to child labour, deforestation, etc.

Also, a Munich-based start-up “QOA” is already making entirely cocoa-free chocolate using other plant ingredients.

KOA is not only supported by the German Federal Ministry of Food and Agriculture and Zurich University of Applied Sciences but they are also being supported by the well-preached narrative of the existence of child labour and deforestation in the cocoa sector.

With their mission, KOA intends to substitute a bigger chunk of the 5.5 million pounds of chocolate consumed every day with a bar of cocoa-free chocolate, by 2035.

They aim to have a price that is 20% cheaper than conventional chocolate with a 10x more sustainable product.

So, you see, the value proposition of the lab-grown chocolate isn’t different from the story of the lab-grown diamond.

Should Cocoa Producing Countries like Ghana be concerned?

It’s very easy for cocoa-producing countries to discard this development because after all, it’s still in a trial stage.

First, they should be concerned because, any substitute to chocolate, called chocolate but cocoa-free, would mean a reduction in cocoa purchases.

This will reduce demand, which will negatively impact cocoa prices. Don’t forget that a price fall means cocoa farmers not receiving any increase in their producer price and could even see a reduction in current farmgate prices.

Also, this is a clear legal way of skipping the payment of any Living Income differential (LID), a $400 per tonne premium on cocoa beans from Ghana and Cote d’Ivoire aimed at improving the living conditions of cocoa farmers.

Already China’s entry, Olam-Mondelez cocoa plantations in Indonesia, etc. are all legal ways of avoiding the payment of the LID.

Secondly, Ghana and Ivory Coast would one day be so strong with their intent to produce chocolate on a commercial scale for export to increase their value capture from the value chain.

This will raise geopolitical concerns among the consuming world who would also want to produce their chocolate locally to maintain jobs and other economic benefits.

Does it not stand to reason why Big Chocolate would consider investing in developing the lab-grown chocolate if cocoa growers intend to divert or exercise control over cocoa beans supply?

After all, chocolate manufacturers are predominantly in the West, where cocoa is not produced yet chocolate is heavily consumed.

So, what stops them from joining the lab-grown phenomenon as Marlboro did by buying a 35% stake in an E-Cigarette firm called Juul, with The Wall Street Journal highlighting that, their decision was influence by smokers switching from cigarette to vaping.

Again, what stops consuming countries from slapping origin chocolates with higher tariffs and unrealistic trade standards to render them uncompetitive in their markets?

And what stops these countries from conveniently heeding to the strong consumer advocacy demands to end the importation of West Africa’s “unsustainable cocoa”? Don’t forget the European Union is actively working on legislation in that direction.

My Concluding Thoughts

My thoughts may make me sound like a scare-mongering Ghanaian who sees only problems.

But I am, honestly, concerned about the millions of cocoa farmers, especially in West Africa, who are being paid a pittance for the commodity.

So, this can give you an indication of how a sector that keeps failing cocoa farmers around the world never ceases to fail them now and even in the future.

Ghana Cocoa Board needs to sit down with researchers and industry experts in Globalisation, Trade, and Industry (not just agronomists) to strategise on how to build a sustainable cocoa sector, amidst the failed path the sector keeps threading.

I will leave you with the dilemma of diamond buyers from the statements of two salesmen, which I believe may be the Dilemma for today and future chocolate buyers:

Natural Diamond salesman:

“You simply cannot give your girlfriend a synthetic. I won’t let you. The appeal of a diamond is its age and where and how it was created. Where is the romance in something created in a lab by a cold, metallic machine? Besides, the synthetics don’t come in sizes larger than 1 carat and I can tell that you want something grander for your loved one.”

Lab-Grown Diamond Salesman:

“If you go into a florist and buy a beautiful orchid, it’s not grown in some steamy hot jungle in Central America. It’s grown in a hothouse somewhere in California. But that doesn’t change the fact that it’s a beautiful orchid.”

==========

Bio:

Kwame is a Cocoa Farmer’s Son with expertise in international trade & policy, industrial policy, and project management, with a professional focus on the Cocoa-Chocolate Industry and the digital economy.

Twitter: @asamoahpeters

Email: [email protected]