“Green bond plays a fundamental role in getting us to a Netzero future. We have to do it and we have to start NOW!” – John Gandolfo (VP & Treasurer, IFC)

The first time I heard of green bonds, I was baffled. I thought the color of the bond certificate is green, and hence the name green bond. Until I learned that a green bond simply is a type of fixed-income instrument designed to raise funds and the proceeds are used to finance climate and environmental projects.

Green bonds are like the usual debt instrument (bond) issued on the capital market by large corporate organizations or governments. Early May 2021, the International Finance Corporation (IFC), an investment banking arm of the World Bank Group, and Ghana’s Securities and Exchange Commission (SEC) announced a partnership aimed at developing the green bond market in Ghana.

This agenda is in line with the World Bank’s Green Bond Program, which was launched in 2010. What are green bonds? What does this partnership mean for Ghana’s sustainable investment drive?

However, green bonds are exclusively used to finance projects aimed at energy efficiency, pollution prevention, sustainable agriculture, fishery and forestry, the protection of aquatic and terrestrial ecosystems, clean transportation, clean water, and sustainable water management. In essence, projects that primarily cultivate environmentally friendly technologies and the mitigation of climate change.

Why Green Bond?

Talking about climate change, its effect is catastrophic. Change in temperatures, precipitation patterns, sea levels, extreme drought poses serious threat to life and economic conditions, especially for developing countries. Climate scientists have for decades warned that the climate crisis would lead to more extreme weather conditions. Evidences around the globe – raging flood in Germany and China, wildfire in Canada, and many others – underscores the impending danger of climate change.

Right down in Ghana, rising sea levels causing destructive tidal waves and coastal erosion along the coastal areas such as Ketu South, in the Volta Region, destroying properties. In an attempt to curtail this phenomenon, the government end-up spending millions on sea defense projects, at the expense of fighting poverty and disease eradication, such as COVID-19. There is an urgent need to fight climate change!

Fighting climate change will demand an extensive amount of financial, human, and technological resources for investments in mitigation and adaptation worldwide. In view of this, the World Bank in 2008, launched the Strategic Framework for Development and Climate Change to help stimulate and coordinate public and private sector activity to combat climate change, resulting to the development of Green Bonds.

In issuing green bonds, corporate organizations and governments commit to use funds raised from green bonds specifically for sustainable investment and climate protection, in their Use of Proceeds agreement document. In that way, they (corporate and governments) are held accountable if funds are not used for the intended purpose.

Green bonds offer better option compared to traditional bonds listed on capital markets as they carry no additional credit risk, thus highly rated “AAA” bonds. In terms of returns, green bonds provide better return compared to ordinary bonds. Finally, green bonds are primarily targeted to climate and environmental mitigation, serving a good cause.

Since its inception, green bonds have chalked impressive milestones. Data from the Climate Bond Initiative (CBI), indicates that in 2020 the green bond market reached US$1 trillion. Even in the midst of the global pandemic, the global green bond market had a strong finish.

Green bonds has helped meet the financing requirements needed to complete eco-friendly projects. One of the largest solar plants in the world – the Noor-Ouarzazate Solar Power Station, in Morocco – leveraged more than US$2.5 billion in financing, in part through green bonds. Recently, green bonds issued have experienced over-subscription.

H & M Group, a corporate giant in the fashion and apparel industry issued a EUR500 million (€500m) sustainability-linked bond (SLB), with a maturity of 8.5 years and a coupon rate of 0.25 percent, which generated a lot of investor interest and was 7.6 times oversubscribed. Indeed, global investor appetite for green bond is high!

Significance for Ghana

The partnership between IFC and SEC Ghana, will facilitate the development of a green bond market, which will in turn serve as a source of raising funds purposely for sustainable projects in Ghana. These projects cut across divers sectors of the economy, from energy and power generation, transportation, agriculture, to infrastructure and construction; exhibiting the potential to revolutionize Ghana’s economy. A green bond market will be a game changer for Ghana. How? Here is an example:

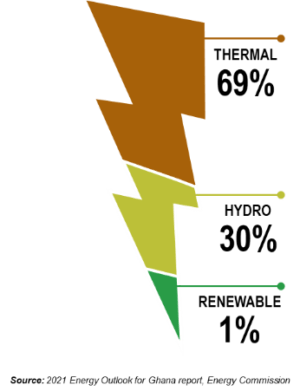

Currently, Ghana’s energy/power generation mix shows that thermal power generation constitute 69 percent, hydroelectric power generation 30 percent, and 1 percent renewable source. A typical profile as this depicts the country’s over-reliance on thermal plants for the supply of electricity. Coupled with inefficiency in the power distribution network and system losses, both hydro and thermal sources of electricity are not sustainable in the long term. Besides, thermal engines and plants consume huge volumes of petrol and diesel, polluting climate and environment in the process of power generation. How will a green bond solve this?

With the development of a well-functioning green bond market, green bonds can be issued, with the proceeds channeled to finance the installation of wind turbines. Wind turbines have the potential to supply clean energy and shore up the country’s power generation. A study commissioned by the IFC, on the potentials of wind power in Africa, revealed that wind power possesses an enormous potential of almost 180,000 terawatts hours (TWh) per year. This is enough to power the entire continent over 250 times!

However, for green bonds to serve its intended purpose, there is a need to establish legal framework and standards. Standards in green bond market prevents greenwashing, a practice where corporate organizations create a false impression or provide misleading information about how their products are more environmentally sound, while in reality make no meaningful commitment to green initiatives.

To curb the threat of greenwashing (aka “green sheen”), the European Union (EU) proposed a standard, called the European Green Bond Standard (EU GBS). Additionally, the International Capital Market Association (ICMA) updated its Green Bond principles, spelling out the best practices when issuing bonds serving social and/or environmental purposes.

The looming threat of climate change is devastating for a middle-income country like Ghana, without adequate financial and technological resources to tackle it. A green bond market in Ghana will serve as a catalyst for driving the country’s sustainable investment goal and climate change mitigation strategy.

To achieve this feat, requires a holistic approach to support this partnership between the IFC and SEC Ghana. In the long-term, sustainable investment and ESG topics must be included in Ghana’s educational architecture, to educate and sensitize the younger generation about the importance of sustainable investment. It would mobilize support for climate protection initiatives and contribute to the sustainable investment drive of the nation. This is for a greener Ghana, for the future they say, is green!

The writer is enthusiastic about finance, sustainable investment and data. Views, comments and suggestions on this article can be shared via:

M: 0547 300 489

E: [email protected]

LinkedIn: Michael Gameli Dzivenu | Twitter: @iamgameli

References:

Investopedia, Green Bond: https://www.investopedia.com/terms/g/green-bond.asp

Investopedia, Greenwahsing: https://www.investopedia.com/terms/g/greenwashing.asp

ICMA, the Green Bond Principles: https://www.icmagroup.org/assets/documents/Sustainable-finance/2021-updates/Green-Bond-Principles-June-2021-140621.pdf

Linda Munyengetewerwa & Sean Whittaker; Powering Africa’s sustainable development through wind, World Bank, June 2021: https://blogs.worldbank.org/climatechange/powering-africas-sustainable-development-through-wind?cid=ccg_tt_climatechange_en_ext

Climate Bond Initiative, Sustainable Debt, Global State of the Market report 2020: https://www.climatebonds.net/files/reports/cbi_sd_sotm_2020_04d.pdf

Energy Commission, Ghana: 2021 Energy Outlook for Ghana: http://energycom.gov.gh/files/National%20Energy%20Statistics%202021.pdf

Marcello Estevão; Fiscal Policies for Low-Carbon economy, World Bank, June 2021, https://blogs.worldbank.org/climatechange/fiscal-policies-low-carbon-economy

World Bank, IBRD Funding program, Green Bond: https://treasury.worldbank.org/en/about/unit/treasury/ibrd/ibrd-green-bonds#1

CNN-World News, Scientists are worried by how fast the climate crisis has amplified extreme weather: https://edition.cnn.com/2021/07/20/world/climate-change-extreme-weather-speed-cmd-intl/index.html

Fiscal Policies for a Low-Carbon Economy, World Bank, June 2021: https://documents1.worldbank.org/curated/en/998821623308445356/pdf/Fiscal-Policies-for-a-Low-Carbon-Economy.pdf

H&M Group, H&M Group’s sustainability work attracts bond market attention: https://hmgroup.com/news/hm-groups-sustainability-work-attracts-bond-market-attention/