Highlight of Main Arguments

- Registration of Business Names Act 1962 (Act 151) is the statutory framework for regulating sole proprietorship businesses in Ghana

- About 90 percent of all businesses in Ghana are registered as sole proprietorships.

- Majority of business that are categorized as Micro, Small and Medium Enterprises (MSME) are registered as sole proprietorships.

- Access to finance is the biggest obstacle (accounting for 13.51 percent of all factors) for the growth of SMEs in developing countries (World Bank Enterprise Survey Data, 2006-2014)

- Lenders face immense credit risks due to moral hazard and adverse selection that characterize SME businesses.

- Information asymmetry is the underlying cause of adverse selection, which negatively impacts the credit management process, from underwriting to post-transaction monitoring.

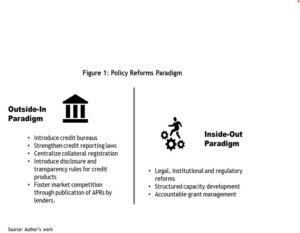

- Historically, reforms targeted at improving SME financing has adopted the outside-in approach (secured transactions reforms, credit reporting, etc.). An Outside-In approach, i.e., reforming the legal, institutional and regulatory framework for MSMEs has become an urgent imperative.

The significance of SMEs to the global economy is one of the few economic questions that seems to enjoy overwhelming consensus both within the academic and policy domains. SMEs are reported to account for about 90 percent of global firms. In Ghana, MSMEs are estimated to generate about 70 percent of private employment and about 50 percent of GDP. This notwithstanding, the sector faces several obstacles, with the biggest being access to finance.

Lenders to Micro, Small and Medium Enterprises (MSMEs) face immense credit risk due to adverse selection and moral hazard. Adverse selection arises where a party to a transaction has more information than the other, thereby distorting pricing decisions due to lack of understanding about risks. Information asymmetry typically characterizes the MSME transactions due to informality and opaqueness of their operations.

As a result, it becomes difficult for lenders to accurately assess and price credit risk. The situation is even worse due to lack of information on the credit history of borrowers. The result is a situation where borrowers with high default probabilities are granted credit facilities while potentially good customers are turned away. Welcome to the world of adverse selection! In addition, the MSME segment possess certain peculiar characteristics that present moral hazard risks for lenders; inadequate collateral, regulatory oversight, lack of internal accountability mechanisms, etc.

The question of how to solve the ‘access to finance’ problem has preoccupied policy makers and international development institutions for years. The policy responses have ranged from improving credit reporting to establishing collateral registries, and everything in between. Commendable as these reforms are, they address the moral hazard and adverse selection problem partially from an outside-in perspective.

There is evidence in the literature bear this out. Take for instance, Peria and Singh (2014). In investigating the impact of credit information-sharing systems on access to finance by firms, they surveyed more than 75,000 firms across 63 countries between 2002-2013. Their findings? “[…] credit bureau reforms, but not credit registry reforms, have a significant and robust effect on firm financing.” It is fair to add however that other studies have reached different conclusions.

In this article, I argue, that an Inside-Out approach to addressing the information asymmetry problem is warranted. More specifically, I advocate for a change in the law, i.e., the Registration of Business Names Act 1962 (Act 151), so as to make it more responsive to the current demands of Ghana’s evolving entrepreneurial ecosystem. Here are four questions that this article will attempt to answer:

- What is a micro, small and medium enterprise?

- What do we mean by informality and opacity and how does it affect lending decisions?

- What are some examples of adverse selection and moral hazard situations in lending?

- How can regulatory reforms mitigate against the risk of adverse selection and moral hazard?

I conclude by offering some thoughts on what priority areas to pay attention to, in order to help mitigate the risk of adverse selection and moral hazard that lenders face in constructing SME portfolios.

What is a Micro, Small and Medium Enterprise?

There are broadly three pillars for MSME classification; employment, turnover and asset size.

The Informality Problem

Here is the thing – by and large, lenders are comfortable transacting with enterprises (be they micro, small or medium) that are formal (Bf), have stable and predictable cashflow (CFsb) and possess collateralizable asset (Ac). The only way to assess the predictability of cashflow is when there is some level of formality in business operations.

An understanding of where an enterprise is situated along the informality/formality continuum is critical in developing risk mitigation strategies. Question – what is an informal business? Admittedly, there is no global standard, but a growing consensus is emerging around certain factors with varying emphasis depending on country-specific context.

Four primary issues come to play in defining informality, (a) is the enterprise legally registered or incorporated? (b) Is it licensed and regulated/supervised by a government institution? does it operate with accounts separate from the owner? Does it have official relationship with other economic actors such as banks, insurance, social security, tax authorities, etc.?

The outside-in approach to SME financing reforms implicitly assumes that all or most SMEs ticks the boxes in terms of formality? In reality, most MSMEs don’t. It is very common to find micro-enterprises that may be registered with registrar-general’s department and managed by a ‘competent’ MBA-wielding graduate, but keeps no proper books of accounts and uses personal savings account to manage cashflows from business operations. No controls, zero checks and balance, and scores poorly on compliance.

The lack of reliable information to assess the earnings potential of the business makes it opaque. Let’s face it, offering credit facilities to such counterparties will be an exercise in miracle lending. So, to compensate for the risk of adverse selection, some lenders place significant weight on collateral (mostly immovable types) in making favorable lending decisions. In summary – business informality leads to lack of transparency (opacity), which leads to adverse selection, which leads to high credit defaults, which leads to lenders insisting on collateral, which raises barriers to SME’s accessing credit.

Adverse selection and Moral hazard: Practical Examples

Over the last few years, I have done some work in the credit space managing a portfolio with credit assets that were diversified across four economic sectors; finance, transport, food and beverage, logistics and haulage. Post COVID lockdown, my team and I engaged in a portfolio review exercise to inform our annual credit policy review.

What really peaked my interesting during this exercise was the trend that was beginning to emerge. Without exception, all SME assets that went into delinquency (traveled beyond PAR 30) had similar characteristics. The converse is true for the good performers. Some of the shared personal characteristics identified were these:

- Overly ambitious: Requested amounts far in excess of working capital needs)

- Process circumvention: Used third-party introductions as basis to justify non-compliance with credit policy

- Story-telling: Always told tall tales about payments were missed.

- Attitude towards contract: Deemed credit agreements as just ‘loan papers’.

Interesting as the shared personal characteristics were, what struck a chord were these facts:

- None had ‘skin in the game’. The collateral was in effect a paper security – fixed charge of office furniture and floating charge over account receivables. This is in spite of the fact that it was registered with Bank of Ghana collateral registry. The result? Moral hazard.

- Not a single one of them belonged to any association or was regulated by an industry body. This eliminated the possibility of obtaining corroborating information from third-party sources during the credit research phase. The result? Adverse selection. On top of that was a moral hazard risk, which crystallized because the social cost of default (fear of being sanctioned, loss of privilege, disgrace, etc.) was zero.

- During debt recovery, it came to light that part of the funds were indeed diverted for purposes that were not sanctioned.

- No clear strategy for managing working capital leading to long cash operating cycles.

How did this happen? How did they make their way past the gate, into the portfolio? Blind spots – created through an interplay of adverse selection and moral hazard risks that belies a more fundamental problem of information asymmetry. Can a borrower’s default probability be estimated from the outset with reasonable accuracy? Certainly, but with more relevant and timely information. It is especially useful (and less costly to obtain) if this information is mandated by law. This is where Act 151 comes in.

Conclusion

In this article, I have argued that an outside-in approach to reforms (be it secured transactions reforms or credit reporting) addresses part of the problem. The other part is improving the regulatory framework that governs sole proprietorships (which are mainly MSMEs). In my view, a comprehensive legal, institutional and regulatory reforms deserve equal attention from policy makers because it presents a unique opportunity to use the law as a tool to force transparency at the firm level.

In this regard I conclude with six (6) recommendations for reforming the Registration of Business Names Act 1962 (Act 151):

- Under the new Act, mandate affiliation with sector-based association or chamber as part of licensing regime.

- All associations or chambers that are not regulated by a substantive government institution must be registered with Ghana Enterprises Agency and certified as the pseudo-regulatory body for that sector.

- Institute periodic reporting obligations for members of every association to their parent body, for onward transmission to GEA or the relevant MMDA for performance tracking purposes.

- In the new Act, allowance should be created to allow the Minister of Justice (as currently mandated by Section 16) to delegate some powers to the Ministry of Business Development, for purposes of making legislative instruments in a bid to regulate the sector-based associations or Chambers.

- Institute mandatory participation of members in periodic trainings as precondition for annual license renewal.

- Link SMEs’ eligibility for accountable grant to compliance, reporting and training.

—

The author is a policy analyst. Works at Metis Decisions Limited as a managing consultant overseeing risk, governance and strategy. He has consulted for a wide array of international development organizations and private sector businesses across several verticals. He is also the founder of Rural Heights Foundation, a grant-making organization that promotes sound evaluation practices in the non-profit sector. Email: [email protected]