More needs to be done to narrow the gap between the rate at which banks borrow from the central bank and the rate businesses borrow from banks, Yaw Osafo-Maafo – Senior Advisor to the president, has advocated.

Following the banking sector clean-up exercise, he said he expected the disparity to narrow, given that the risk element to banks’ lending had been addressed by the clean-up; but that has not been the case.

“If Bank of Ghana is lending to banks at 13.5 percent; what reason do banks have for lending in the 20s? What should be the margin, the spread between the bank rate and the lending rate? We have not been able, as a country, to do justice to this,” he said.

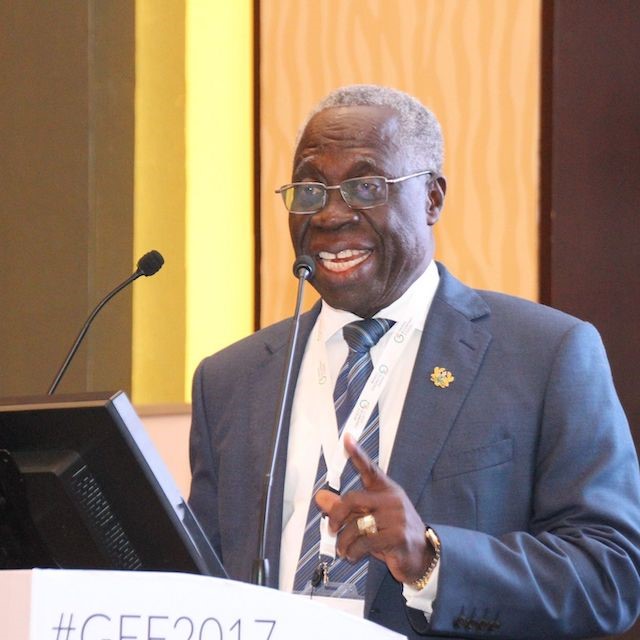

Mr. Osafo-Maafo spoke in Accra during the opening event of the Ghana Industrial Summit and Exhibition 2021, organised by the Association of Ghana Industries (AGI), and observed that at first banks attributed the huge difference to inherent risks – which he said have been considerably reduced after the banking sector reforms, yet the rate of lending remains high.

He also said most factors affecting lending rate – such as exchange rate, policy rate and inflation, among others – had all been on a positive trend for some time now, and that it is simply inexplicable as to why banks have failed to lend to businesses, particularly manufacturers, at reasonable rates.

“Government spent billions undertaking these reforms, so why should the spread between the bank’s rate and lending remain at this level?” he asked, adding: “This is a problem that we must collectively look at”.

Publishing good balance sheets not enough

He said one of the government’s main goals is to create the needed environment for businesses to thrive and be able to create jobs, especially within the context of the African free market agreement.

He however noted that this will not materialise if banks fail to move away from focusing mainly on publishing good balance sheets at the end of each financial year, to supporting the country’s industrialisation agenda. This is because – apart from government creating the right operating environment and access to electricity he said – the next most important ingredient for Ghana’s industrial ambition is access to credit at reasonable prices.

Ghana Industrial Summit and Exhibition 2021

Organised by the AGI in partnership with the Volta River Authority (VRA) under the theme ‘Repositioning Ghanaian industries to leverage the AfCFTA’, the event runs from August 17 to 19, 2021. The summit provides a platform to chart and shape the country’s industrialisation agenda, with particular focus on how domestic producers can take full advantage of the continental free trade area.

Issues like affordable electricity, Ghana’s tariff negotiations and liberalisation strategy within AFCFTA, and incentives for industry remain major concerns for industry according to the AGI President, Dr. Yaw Adu Gyamfi, as they impact on local production and export capacity.

Meanwhile, corroborating the presidential advisor, Dr. Adu Gyamfi said: “Efforts to renegotiate or restructure loans last year were met with difficulty, let alone getting access to financing. Financing becomes more crucial as trading in AfCFTA has already begun.

“Therefore, the AGI commends government for this initiative of a bank that will come to address the medium- to long-term financing needs of businesses.”

He added that it is important for government to prioritise its policy interventions and stimulus support for industry within the overarching framework of Ghana’s Industrial Transformation Agenda.

“To do well in AfCFTA, AGI understands the importance of cost of doing business. Leveraging AfCFTA becomes more difficult if our local production and competitiveness is weak,” he further said.