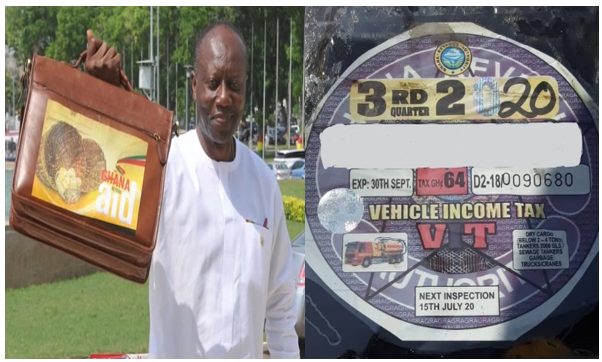

In Ghana where 15-seater commercial “Trotro” vehicle owners pay only GHS16 Income Tax per quarter on their total Revenue must certainly need to look for drastic measures to tax taxpayers in the informal sector. Critics say the tax imposed on operators in the informal sector does not reflect the income they earn from their operations compared to the salaried worker. Some do not get taxed at all, for instance it is said that, Uber and Bolt operators do not acquire VIT stickers hence they do not pay tax on their income.

The Finance Minister will this July present the mid-year budget as required under thePublic Financial Management Act, 2016 (Act 921). Section 28 of Act 921 provides that: “The Minister shall, not later than the 31st of July of each financial year, prepare and submit to Parliament a mid-year fiscal policy review”

Are we going to see some mid-year tax policy changes? One expectation is the overhaul of the taxation of the informal sector since that has been one of the biggest challenges for tax administrators.

The informal sector is the largest employer in Ghana, even though it is composed of small units in a very disorganized way, ranging from tabletop sellers to artisans, taxis and commercial “trotro” vehicles. But how much taxes do commercial vehicle owners pay on their income?

THE VEHICLE INCOME TAX

Commercial Car owners earn income from their operations and are required to pay Income Tax. Something which started as a standard tax assessment under section 44 of the Income Tax Decree 1975 (SMCD 5) received further legal backing in 2001 under the Internal Revenue Regulation 2001 (L.I 1675).

Regulations 25 provided tax installments payable by members of certain tax categories including the GPRTU and other transport unions who operates in lorry parks and taxi ranks. Under this arrangement, owners of specified vehicles were required to pay a flat rate per week ranging between GHS 0.05 and GHS 0.20. The leadership of these unions were collecting the taxes on behalf of the GRA and paying it over to the GRA at the end of each week.

THE INTRODUCTION OF THE VIT STICKERS

In 2003, the system was replaced by the VIT stickers under L.I 1729. Under the sticker system

- The VIT stickers were mandatory for all commercial vehicles and owners are required to purchase the stickers quarterly in advance.

- The stickers are to be displayed on the windscreen of the commercial vehicles.

- The Ghana Police Service MTTU enforces compliance on behalf of GRA.

The 2016 Income Tax Regulations (L.I 2244) Regulation 22 revised the taxes and below are the current taxes payable by commercial vehicles, depending on the type of vehicle.

THE CURRENT COST OF VIT STICKERS

Below are the taxes payable by some commercial vehicles (quarterly and annual basis)

| CLASS A | Description | Annual rates (GH₵) | Quarterly (GH₵) |

| A1 | Tractor, power tillers and tanker | 40.00 | 10.00 |

| A2 | Taxis/ private taxis | 48.00 | 12.00 |

| A3 | One pound, Peugeot cars/ fork-lift, recovery towing trucks | 60.00 | 15.00 |

| A4 | Trotro (up to 15 persons) | 64.00 | 16.00 |

| CLASS B | Description | Annual rates (GH₵) | Quarterly (GH₵) |

| B1 | Hiring cars (saloon, caravan) | 320.00 | 80.00 |

| B2 | Hiring cars (4×4) four wheel | 480.00 | 120.00 |

| B3 | Trotro (up to 19 persons) | 80.00 | 20.00 |

| B4 | Trotro (20-23 persons) | 88.00 | 22.00 |

| B5 | Trotro (24-32 persons) | 120.00 | 30.00 |

| CLASS C | Description | Annual rates (GH₵) | Quarterly (GH₵) |

| C1 | Commuter (up to 15 persons) | 80.00 | 20.00 |

| C2 | Commuter (16-19 persons) | 100.00 | 25.00 |

| C3 | Ford buses, commuter (up to 23 persons) | 80.00 | 20.00 |

| C4 | Tour operator (up to 15 persons) | 320.00 | 80.00 |

| C5 | Commuter (up to 38 persons) | 160.00 | 40.00 |

| C6 | Tour operator (16-23 persons) | 400.00 | 100.00 |

| C7 | Commuter (39-45 persons) | 200.00 | 50.00 |

| C8 | Tour operator (24-38) | 280.00 | 70.00 |

| C9 | Tour operators (above 45 persons) | 600.00 | 150.00 |

| C10 | Commuter (46 and above persons) | 240.00 | 60.00 |

| CLASS D | Description | Annual rates (GH₵) | Quarterly (GH₵) |

| D1 | Dry cargo (below 2 tons) pay loaders/ pickups 2-3.5 tons | 140.00 | 35.00 |

| D2 | Cargo (2-4 tons) tankers 2000gallons/ sewage tankers garbage trucks | 256.00 | 64.00 |

| D3 | Tankers above gallons/grades/ bulldozer | 404.00 | 101.00 |

| D4 | Dry cargo (4-7 tons) | 480.00 | 120.00 |

| D5 | Tipper truck (single axle) | 320.00 | 80.00 |

| D6 | Tipper truck (double axel) | 480.00 | 120.00 |

| D7 | Articulated truck trailers (18 cubic)/timber truck | 800.00 | 200.00 |

| D8 | Tipper truck (12-14 wheelers) | 600.00 | 150.00 |

| D9 | Ambulance/motor hearse | 88.00 | 22.00 |

| D10 | Articulated truck trailers (single axle) | 800.00 | 200.00 |

THE NEED TO INCREASE VIT RATES

Critics say the amount of tax paid by commercial vehicle operators does not reflect their actual income. Many commercial vehicle owners do not file their tax returns to declare the actual income earned. What they pay is only the quarterly taxes which is clearly inadequate and does not reflect the reality with regards to the income they earn.

CONCLUSION

These inequities under our current tax system are unfair to those in the formal sector, especially salaried workers who get taxed on every amount of income earned. It is expected that, the Minister of Finance will introduce practical measures to deal with the issue of taxing the informal sector properly. The Mid-year budget should revise the taxes paid by commercial car owners on quarterly basis to reflect the reality in Ghana.

The Writer is an Associate Tax Consultant at MTC

Tel: 0241-426948

Email: [email protected]