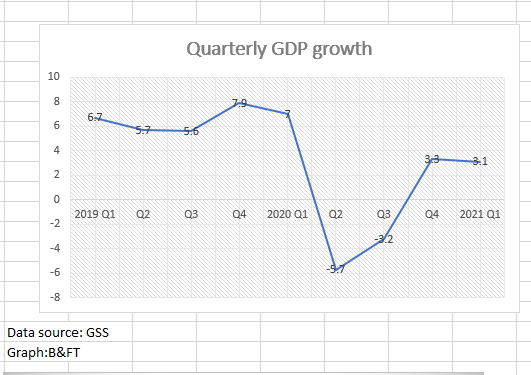

Even though the global economy is still suffering from impacts of the coronavirus pandemic, as countries have not opened up fully, data published by the Ghana Statistical Service (GSS) indicate that the country’s economy is recovering – as it has recorded 3.1 percent growth in the first three months of the year.

From the data, the agriculture sector continued to save the country’s blushes as it once again toppled the industry and services sectors, by recording 4.3 percent growth. Industry and Services, on the hand, grew by 1.3 percent and 4 percent respectively – meaning the economy is not back to its pre-pandemic status, as the services sector has for more than a decade led growth of the economy and become the main dominant force.

That notwithstanding, the services sector is still the largest contributor to the country’s GDP with 53 percent, followed by industry with 25 percent while agriculture contributed to 22 percent.

In terms of value, the GDP (Including Oil & Gas) estimate at constant 2013 prices for the first quarter of 2021 was GH¢45.3billion compared to GH¢43.9billion in the same period 2020.

The information and communication sector regained its position from the real estate sector as main driver of the economy with 22.1 percent growth, followed by the latter with 10.6 percent growth. On the other hand, the mining and quarrying sector saw the highest contraction of 11.2 percent, followed by hotels and restaurants with 10.7 percent contraction.

This indicates the two sectors have still not come out of the woods yet, despite government lifting many of the restrictions that affected their operations.

Recovery plan

Meanwhile, government has targetted 5 percent growth by end of the year. To achieve this, it has outlined some key strategies to aid in recovery from the pandemic’s devastation. These include the Ghana Coronavirus Alleviation and Revitalisation of Enterprises Support (Ghana CARES) programme, which is expected to raise GH¢100billion to assist businesses and key sectors boost their productive capacities.

Another one is the establishment of a new Development Bank of Ghana, which government recently secured a €170million facility from the European Investment Bank to set up.

And to boost domestic revenue, government introduced new taxes in the 2021 budget aimed at raising more cash to take care of COVID-19-related expenditure and provide support to other sectors.

Some of the taxes introduced include a new tax dubbed the ‘COVID-19 Health Levy’, which will see a one percentage point increase in the National Health Insurance Levy and a one percentage point increase in the VAT Flat Rate to support expenditures related to COVID-19.

In addition to this, government said it is proposing a Sanitation and Pollution Levy (SPL) of 10 pesewas on the price per litre of petrol/diesel under the Energy Sector Levies Act (ESLA); and a further Energy Sector Recovery Levy of 20 pesewas per litre on petrol/diesel under the ESLA as a means of finding additional resources to cover the excess capacity charges which have resulted from the Power Purchase Agreements (PPAs).

The implementation of these two proposed levies for sanitation and pollution as well as to pay for excess capacity charges, according to the budget statement, will result in a 5.7 percent increase in petroleum prices at the pump. What this essentially means is that prices of goods and services are likely to go up, as the increment’s effect will be to affect transport fares – which will be directly passed on to consumers.

Besides these taxes, government has further slapped a financial sector clean-up levy of 5 percent on profit-before-tax of banks to help defray outstanding commitments stemming from the financial sector clean-up. The levy, the budget states, will be reviewed in 2024.