– The Coronation Insurance way

Losses or damages are incurred continuously by motorists, business owners, workers, property owners etc. These damages or losses should have a financial cover which will protect them from the cost of damage or loss incurred. The process of getting this financial cushion is known as getting an insurance policy/cover. This is a contract between an individual or entity and an insurance company to manage the risk. The entity or individual receives protection from a potential loss and pays a fee known as a premium to the insurance company. This is done in preparation for a contingency such as the death of the policyholder or damage/destruction of their property.

What shapes public perception on claims

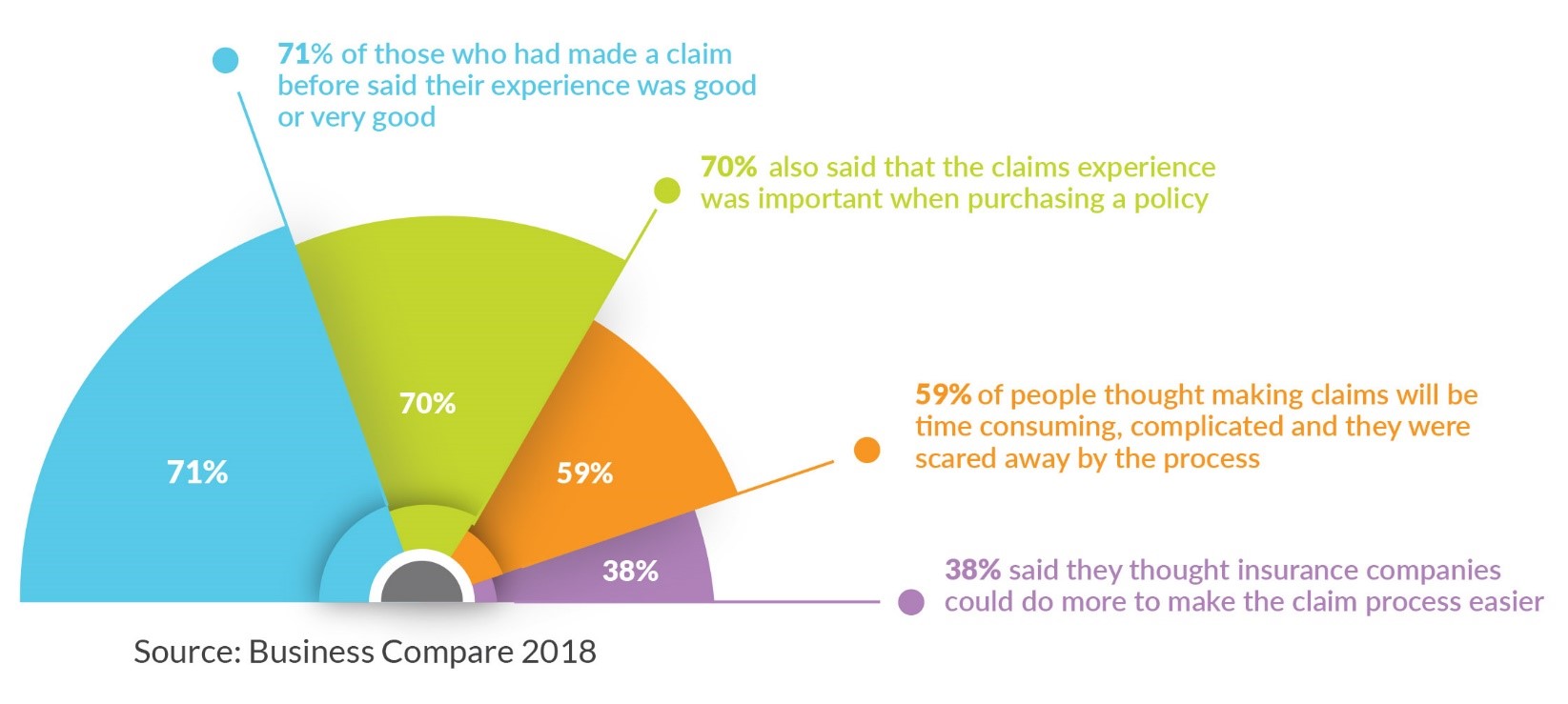

In a recent study commissioned by claimsrated.com and conducted by Online Opinions, it was revealed that the insurance claims process has an undeserved bad reputation. The online survey of 1,000 people found that:

Despite these figures depicting a better-than-expected result for the quality of the claims

process, more is being done to improve the process further.

Major areas of contention

Notwithstanding the huge number of claims paid by insurance companies on a daily basis, people still dread going through the insurance claims process. Some of the factors that people believe compound their woes of making a claim include:

- delay due to communication

- misunderstanding about the insurance coverage dissatisfaction with the repair done on one’s property

- dissatisfaction with the amount paid

- Quite apart from the above, the most common complaints insurers receive about claims involve;

- Unsatisfactory settlement offers Delays in the claim process

- How some adjusters handle claims

The NIC and its interventions

The National Insurance Commission (NIC) is the regulatory body of the insurance industry in Ghana. Due to the low confidence of people in insurance and how the claims process is dreaded by many, the NIC has put a lot of initiatives in place to help curb the situation.

Serves as intermediary between insurance companies and the insuring public

The NIC serves as the main intermediary between insurance companies and the insuring public. In situations where there are delays in the settlement of a claim by an insurance company, or there are disagreements in the claim amount to be paid, the NIC comes in to mediate a smooth resolution if the issue is escalated to them.

Motor Compensation Fund

The Motor Compensation Fund was created by the NIC to provide compensation to persons or relations of persons who were injured or died in motor accidents involving hit-and-run and uninsured vehicles. This fund has experienced a daily average pay-out of GHS 5,158 in 2014 to GHS 13,829 in 2019.

Client Rescue Fund

The NIC created the Client Rescue Fund purposely to compensate clients of insurance companies declared bankrupt.

Making your insurance claim, step-by-step

Every claim is different, and although the claims process can vary slightly according to the situation, your insurer will devote the time and attention it takes to resolve your claim. Unfortunately, many people dread making an insurance claim to recoup their costs as they consider the process to be too complex. Who wouldn’t? However, you may be surprised to hear that making an insurance claim is actually easier than you may think. In the event of a loss or damage, knowing what to do will save you a lot of stress. Let’s take a look at what you need to know before filing an insurance claim:

Connect with your Broker or Relationship/Sales Officer

In the event of a loss, your first point of contact should be Relationship Officer or Broker. He/she would understand your situation and advise on how to proceed. Your Broker or Relationship Officer will ask you to provide a detailed list of all the items that were damaged or lost, and any photos or videos that help to explain the circumstances of the damage. You should have this readily available as there will be delay in processing your claim if you don’t have them available.

Claim investigation begins

After the claim has been reported, it will then be investigated by an adjuster to determine the amount of loss or damages covered by your insurance policy. The adjuster will also identify any liable parties, and you can help the process by providing any witness information or other parties’ contact information.

Your policy is reviewed

Once the investigation is complete, the adjuster will go through your policy to determine what is and isn’t covered under your policy, and inform you.

Payment is arranged

After the above steps have been concluded, your insurer will contact you regarding the settlement of your claim and payment. The amount of time it takes to receive payment will.

Improved claims process: The Coronation Insurance way

At Coronation Insurance, we understand the hassle many claimants go through when making insurance claim. In view of that we continuously review our claims process to ensure our customers have a very smooth journey through their claims process.

Bancassurance

We have revolutionised our Bancassurance partnership with Access Bank to ensure that our customers and that of Access Bank have easy access to insurance solutions. With our Bancassurance partnership, we guarantee a same day claim payment for all our customers with claims amount up to GHS 3,000.00. All other claims are paid within 48 hours after execution of Discharge Voucher (DV) irrespective of the amount involved.

Excellent Customer Experience

At Coronation, we believe insurers are judged by their claim payment process. In view of that, as an insurance company, we ensure that, all policy documents, instructions, claims payment procedures and documents are made available to our customers in all our branches and agency offices. A recent survey conducted showed a satisfactory rating of 91% by our claimants. This is partly because we pay all our claims within 48 hours after DV.

Adequate claims reserves

Coronation is among the top companies well placed in paying claims. A recent publication by the NIC on the claims reserves by companies showed that Coronation is among the top 5 companies well placed in paying claims according to our claims reserve.

Conclusion

Every claim is different, and although the claims process can vary slightly according to the situation, your insurer will devote the time and attention it takes to resolve your particular case. Coronation Insurance is committed to ensuring every claim is handled as fairly, professionally, and as carefully as possible. If you run into questions or concerns during your claims process with us, you can always contact us to get the answers you’re looking for.

Email: [email protected]

Tel: 0302 772 606/0302 773 616