New research highlights a $200 billion climate investment market opportunity for climate-first investors to help achieve universal access to energy in Africa and avoid 626 m/t CO2e by 2030.

In the newly released A Green Energy Future for Rural Africa report, opportunities for climate-first funders to avoid carbon emission – and provide energy access in Africa by 2030 – have been outlined.

Produced by the Shell Foundation and the Rockefeller Foundation and with technical advice from the IKEA Foundation, the Rocky Mountain Institute and Sustainable Energy for All, the report combines “historical trends analysis, extensive financial modelling and a full lifecycle analysis of energy sources to produce three feasible scenarios to meet the energy needs of rural households and small and medium enterprises in Africa, with varying levels of reliance on DRE and grid extension.”

Examining market scenarios

In the business-as-usual scenario, 31% of African households would remain un-electrified in 2030, and the use of backup generation by way of fossil fuels will increase. Household cooking will still be undertaken using solid fuels, claiming 600,000 lives each year and leading to deforestation.

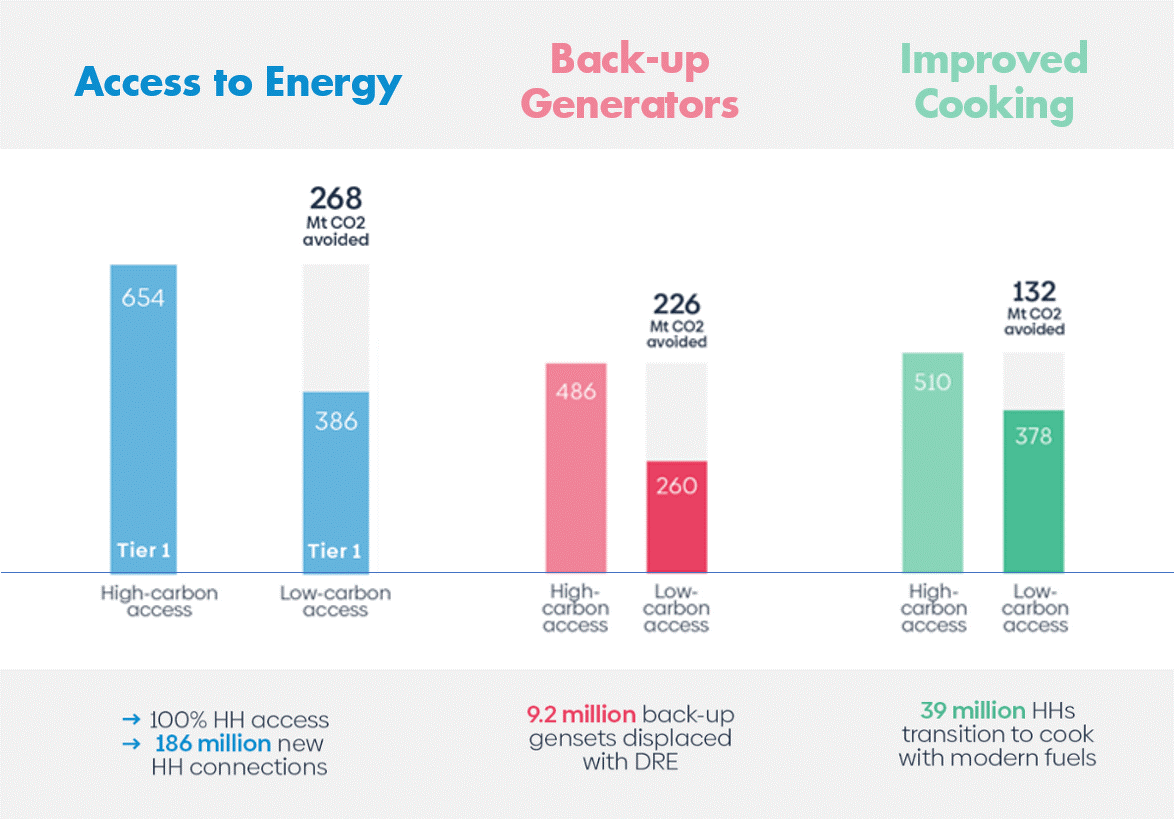

However, the low-carbon scenario provides alternative options for Africa. The low-carbon scenario “relies on more extensive use of DRE technology to achieve 100% household electricity access and replaces 9.2 million fossil-fuel powered backup gensets with solar alternatives,” according to the Shell Foundation.

Despite its difficulty, researchers believe it is feasible to shift at least 39 million households from cooking with charcoal to using modern, less CO2-intensive energy sources like LPG or electricity.

Under this scenario, Africa avoids up to 626 m/t CO2e emissions compared to a high-carbon scenario − the approximate equivalent to the annual emissions of 160 coal-fired power plants, or 933 million round-trip flights between London and New York City. This is also the lowest-cost way to generate inclusive economic growth.

A $200 billion opportunity

According to the report’s authors: “The low-carbon scenario represents a significant investment opportunity of over $200 billion by 2030 for climate-first investors with a social mandate. This includes $20 billion to $67 billion (depending on the level of power provided) in funding to scale and replicate businesses providing standalone solar and mini-grid power for residential use, $130 billion to increase the prevalence of affordable solar alternatives to diesel gensets, and a $7.5 billion injection to improve the affordability and availability of modern cooking options for low-income families.

“For grant-makers and governments, the low-carbon scenario also relies on the provision of $2.4 billion in demand-side subsidies to 42 million households that lack sufficient means to pay for energy.”

Over the last decade, $3.5 billion has been invested into the DRE sector – and the figures proposed, represent a substantial increase which “represents an untapped opportunity for climate-first investors who have a dual mandate to deliver the SDGs by 2030, or those that wish to catalyse the green growth in Africa that makes the Paris Agreement achievable”ESI Africa