On 30 March 2021, the government of Ghana announced a successful issuance of a $3.025 billion Eurobond to international investors in four different tranches, which was over-subscribed. The tranches include 4-year, 7-year, 12-year, and 20-year bonds at coupon rates of 0 percent, 7.75 percent, 8.625 percent, and 8.875 percent.

The four-year US$525m zero-coupon bond, the first by a Sub-Saharan African country in 2021, is receiving the highest acclaim by analysts and watchers.

Ghana’s success in securing the desired amount amidst a pandemic and a significantly high debt to GDP (76%, Dec.2020) level will likely spur other African Issuers, notably Kenya and Angola, since Ghana’s issuance served as a barometer for investors’ appetite towards African sovereign bonds a raft of African states seeking debt reliefs or facing defaults

Also, the strong demand for Ghana’s auction despite its current status of being at high risk of debt distress (Ghana’s Debt Sustainability Analysis by the IMF – World Bank – 2020) signifies the continuous search for higher yields by foreign investors in the generally low global interest rates environment. Ghana’s continued access to the international capital market will delight not only managers of the Ghanaian economy but other African countries.

The question is whether this over-subscription of Ghana’s 2021 Eurobond is investors’ vote of confidence in the direction and medium to long term viability of the Ghanaian economy as suggested by the Finance Ministry? Our review of the just-ended Eurobond issuance instead paints a different picture: We observe that Ghana benefitted from the first-mover advantage and provided a deal too sweet for investors who are hungry for returns.

| Tranche | FV (US$’m) | Gross Proceeds (US$’m) | Discount (US$’m) | Tenor (Years) | Coupon Rate (p.a)* | Yield (p.a)* | US (UST Yield)* | UK** | Germany** | Japan** |

| 1 | 525.00 | 409.50 | 115.50 | 4 | 0 | 6.309% | 0.94%** | 0.39% (5yrs) | -0.63% | -0.10% |

| 2 | 1,000.00 | 1,000.00 | – | 7 | 7.750% | 7.750% | 1.367% | 0.84% (10yrs) | -0.29% | 0.08% |

| 3 | 1,000.00 | 990.84 | 9.16 | 12 | 8.625% | 8.750% | 1.712% | 1.39% (30yrs) | 0.25% | 0.47% (20yrs) |

| 4 | 500.00 | 482.95 | 17.06 | 20 | 8.875% | 9.250% | 2.304% | 1.39% (30yrs) | 0.25% | 0.47% (20yrs) |

| Total | 3,025.00 | 2,883.29 | 141.72 |

Sources: *Bond issuance term sheets from Ministry of Finance **https://www.bloomberg.com/markets/rates-bonds/government-bonds accessed 31 March 2021.

Ghana got the timing right as it entered the market during a high liquidity period. When fund managers and other investors in developed economies are grappling with negative to very low yields in advanced markets. More importantly, the yields on offer on Ghana’s bonds were too tempting to ignore.

These strategic wins notwithstanding, the CSJ notes the following challenges with each of the issued bonds.

- 4-year zero-coupon bond: while Ghana will not be making any payments with respect to this bond until 7 April 2025; thus, providing short-term cashflow reprieve, the bond did not come cheap. The bond was sold at a discount of 22 percent, implying an inbuilt cost of US$115.5 million or approximately 5.5 percent p.a coupon rate. Unlike the 6.309% p.a yield holders of this bond are making, if held to maturity, a similar investment in a 5-year US Treasury bond will have yielded 0.94% p.a and 0.39% p.a in a UK government debt. For Germany and Japan, the return will have been negative.

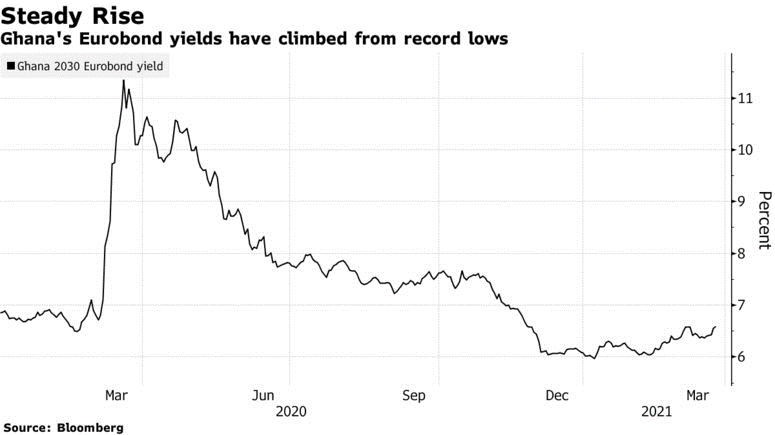

- 7-year: 7.75 percent coupon bond: This bond was issued at par, producing a yield equal to the coupon. The bond is considered highly-priced and costly relative to similar instruments in the market. The benchmark UST bond is at a coupon of 1.25% p.a and yield of 1.367%, while a 10-year UK bond has a yield of 0.84% p.a. In February 2020, Ghana issued a US$1.25 billion 6-year bond at 6.375% and a 14-year US$1.00 billion Eurobond at 7.875% so to issue a bond half the tenor of last year’s at the current rate makes this bond relatively expensive. At the time of the 2021 bond issuance, Ghana’s bond maturing in 2030 was trading at a less than 7.00% yield.

- Tranches 3 & 4 were issued at a discount, with coupons approaching 9% p.a. These bonds are very far above rates obtainable in developed markets. They also do not compare favourably against Ghana’s issuance in Feb 2020 and Ivory Coast’s post-covid-19 issuance. The yield of 8.750% on the 12-year 3rd tranche bond is the same as the 41-year bond issued by the country last year, and this defies the canon of lower risks with relatively lower tenor transactions. In February 2021, Ivory Coast raised 850 million euros, equivalent to US$1.03 billion in two tranches of 600 million euros maturing in 2032 and 250 million euros maturing in 2048 at yields of 4.30% p.a and 5.75% p.a, respectively. Ivory Coast’s issuance followed a November 2020 1 billion euros bond issuance at a yield of 5% p.a.

An important driver of Ghana’s debt burden acceleration has been a rapid increase in interest payments over recent years. The key driver in the increase in interest payments is the domestic debt component of total debt. According to the government, the proceeds from the four-year US$525m zero-coupon bond would be used to pay the expensive existing domestic debt (domestic bonds attract an average interest rate of about 19%) and even create a net savings of $184.2 million for the country. While it may seem to be a smart move, the managers of the country’s public debt must recognize that, overall, Ghana’s 2021 Eurobond issuance represents additions of relatively expensive bonds to our existing public debt.

The human cost of the rising public debt cannot be overemphasised. High debt servicing cost drains our limited resources. It reduces allocations to critical social services, including education, health, and support to the most vulnerable in our society. Debt juggling is only a short-term solution for addressing the rising public debt burden.

The CSJ, therefore, suggests that the government must exercise caution in tapping international private debt markets. When they do, the country’s public debt managers need to strategize to reduce the high costs of borrowing the country faces. More importantly, long-term solutions are required to reduce the level of public debt. The overall long-term strategy must include increased efforts to strengthen domestic resource mobilization; reforming and strengthening governance with an emphasis on increasing transparency and accountability in decisions regarding borrowing and public debt utilization; setting up and enforcing effective rules on parasternal sector management to reign in borrowing by state-owned enterprises.

The authors belong to the Economic and Finance Pillar of the Centre for Social Justice. Theresa is a Professor at the University of North Carolina, whiles Haruna is a Financial Specialist.