That micro-credit is an effective tool in expanding economic opportunities for millions of Ghanaians without access to traditional financial markets, is a settled argument. With over 500 micro-credit institutions spread across Ghana’s 16 regions, it is estimated that their aggregate portfolio may well exceed USD 10 million. The sector’s immense contribution to economic growth in general, and to the resilience of Ghana’s downstream agricultural supply chain poses interesting questions that merit a more rigorous empirical inquiry.

That notwithstanding, the COVID-19 crises have exposed some disturbing fault lines in how finance is conducted at the lower tiers of Ghana’s financial markets. It is not an understatement nor even contestable (though not empirical), the claim that majority (if not all) of micro-credit businesses have had to reschedule credit facilities at the pinnacle of the pandemic. In some instances, micro-credit institutions have had to breach their own credit policy to extend facility tenors beyond 12 months, with adverse impact on liquidity. But as rightly acknowledged by some researchers, debt moratoria and other restructurings amidst the COVID-19 pandemic have helped millions of people rebound from the shock.

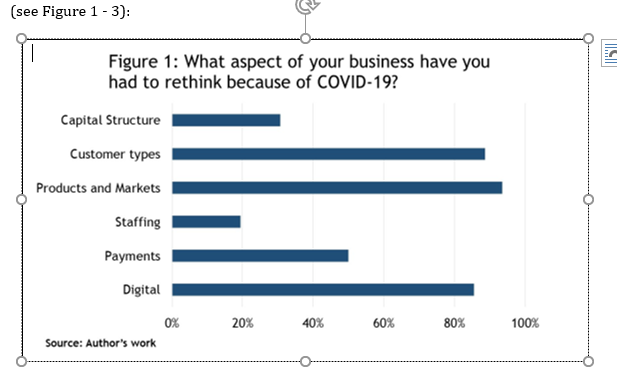

Thankfully, the markets are stabilizing, functionality is being restored across supply chains, and micro-credit is positioned to rebound and refocus its effort in support of the financial inclusion agenda. But really, going forward, what are the key lessons from this COVID crises that ought to shape portfolio strategy at the institutional level, or even policy strategy at the regulatory level? I posed this very question to sixty-three (63) randomly selected micro-credit operators during my research, and this is what I found (see Figure 1 – 3):

In my research, respondents were asked what aspect of their businesses they have had to review as a result of the COVID crises. Majority (94%) indicated that current products and market segments is a key area they are considering in terms of review. Some of the respondents had exposures to sectors that were hit the hardest by the pandemic, for instance primary education. Micro-credit loans to primary level teachers, particularly in private schools formed a chunk of portfolios for those respondents within this category.

There were some also who expressed concerns about their excessive credit exposure to market traders. When asked if they believed that their current target customer segments per se may have contributed to the unraveling of their balance sheet amidst the pandemic, majority answered in the affirmative. In response to the question of what they will do differently going forward, majority of the respondents expressed the need to raise additional capital (95%), compared to 92% that felt that targeting new customer segments was equally a priority issue. What is interesting however, is that views about payment platforms and digital engagement is gaining momentum across the sector. As remarked by one respondent, “about 95% of our repayments are now received via Mobile Money, unlike before when we spent so much on transport walking the markets under the hot Sun.” Another micro-credit owner was also considering the idea of a digital platform to collect KYC data and store same in cloud servers, instead of the old approach that is carbon-unfriendly. These are interesting new trends that if supported, will help the micro-credit sector achieve a critical mass of actors that can push further the frontiers of financial inclusion in Ghana. To reach that level however, there are some uncomfortable questions that practitioners, regulators and monetary policy managers must wrestle with. I will pose just three of them, and attempt to delve a bit deeper. My goal is to start an intellectual conversation on how to ensure that micro-credit practice in Ghana is aligned with evolving trends in global finance. So here are the three questions:

- Do the prevalent business models in the micro-credit sector exacerbate the impact of shocks (such as COVID-19) on portfolio quality? Is so, what can be done?

- Has the pandemic made a good case for digitalization across the sector? If so, how can institutions adapt?

- Does the current regulatory model constrain or promote innovation? Is so, what reforms are required?

Why are these questions important? Three reasons. First, it will help to ascertain if credit risks (or general business risks) can be mitigated through business model innovation. That will in itself challenge the proposition that “how it has always been done is how it should always be done”. Secondly, digitalization, whether we like or not has come to stay. It is better to align our business philosophies and systems than engage in the futility of sailing against the headwind. And then thirdly – a correct worldview held by those with responsibility for regulating the sector cannot be overemphasized. Those who seek to maintain the status quo with antiquated brick-and-mortar ideas may not appreciate the strategic importance of digitalization. Such worldview, unfortunately, may hold tremendous sway in shaping the Business Rules within which economic resources must be organized and channeled for growth. Let’s delve deeper.

Question 1: Do the prevalent business models in the micro-credit sector exacerbate the impact of shocks (such as COVID-19) on portfolio quality?

To answer this question, we need to ask a more fundamental question: what is the “prevailing business model” in the micro-credit sector?

Here is my semi-educated view: A typical micro-credit business model rely on brick-and-mortar channels to reach market traders, artisans or other related occupation types with loan products that have tenors not more than 6 months (usually) and priced at interest rates between 4-7% per month. Fair? Now let’s unpack that.

Brick-and-mortar: It means service delivery and promotional activities are predominantly face-to-face. One cannot forget the experience of lock-downs during the early stages of the pandemic, and how that affected normal business operations. The increasing use of Mobile Money as means of managing client repayments attest to limitation of the brick-and-mortar business mindset.

Market segments: Its not uncommon to find about 90%+ of micro-credit portfolios concentrated in the retail trade sector and allied sectors such as food vending. Minority assets include private transport operators and other petty traders. There is no gainsaying the level of exposure to volatilities in the macro environment. During the height of the crises, certain sectors like retail trade, artisanal work and salaried employment, suffered rapid deterioration compared to say e-commerce, logistics and delivery (Okada). It goes to show how volatile certain market segments respond to macro-economic swings. Shifts in currency valuation and its consequent impact on consumer price trends inevitably affects margins in the retail trade sector, thereby increasing default risk on assets in this category. This is the principal argument in favour of ensuring portfolio diversification. More importantly, the pandemic has shown that in order to achieve resilience, quality and variety must be given equal weighting when constructing credit portfolios. So, in summary, to reduce your overall risk, ensure that your portfolio reflects a wide spectrum of economic sectors that have varying degrees of covariance with macro-economic behavior.

Facility Structure: On average, interest rate in the Tier 3 and 4 segments of licensed Non-Bank Financial Institutions (NBFIs) is about 4% per month. Processing fees of 3.5% are common place. Given such pricing structures and credit conditions (such as cash collateral), some critics have argued that the country faces an uphill battle against poverty and inequality. But that’s not the only problem. There is evidence in the literature (for instance see Okpugie, 2009; Vandel, 2013) that high interest rates are one of the causes of loan default. It was not surprising therefore the behavior of borrowers during the height of the pandemic, around March-April last year when things were intense. Many borrowers couldn’t wait to use Corona virus as an excuse to ask for repayment moratorium. The brazen ones even demanded total debt cancellation. Pricing is an area to watch.

Question 2: Has the pandemic made a good case for digitalization across the sector?

There is no doubt whatsoever in my mind that this is the case. If one thing is for certain, Gen Z cohorts will remember that a new lexicon, Zoom, entered the repertoire of vocabulary in 2020. Virtuality has become the new reality, at least for middle class professionals and business owners, who, amidst the pressures of social distancing, have to conduct meetings, sign deals, submit reports, and so on. This new approach to socialization has revived old work models such as telework, or in modern parlance, “Work-From-Home”. Technology has assumed a central role in how economic resources are organized, and institutions that hitherto were averse, one way or another to digitalization, are beginning to adapt. For micro-credit institutions, what should even convince skeptics are the juicy benefits that may accrue to those who adapt. Here are some interesting numbers: According to a report (Global Funder Survey, 2019 report) by the Consultative Group to Assist the Poor (CAGP), International funders committed approximately US$7.5 billion to 833 financial inclusion projects in sub-Saharan Africa in 2019, a 41.5 percent increase from the 2017 flows (US$5.3 billion). It is important to mention that a significant chunk of these flows went to support digital financial services. Of the amount committed in 2019, 38 percent was channeled through Financial Service Providers (FSPs) with 21 percent going through government account. The support came in different forms; grant (30 percent), equity (11 percent) and debt (34 percent). At the country level, Ethiopia led the pack with USD 634.31 million inflows in 2019. See Figure 3 for Ghana’s slice of the cake. So here is a simple way to interpret these numbers: a tail wind is blowing across sub-Saharan Africa. There is evidence that it has reached the shores of Ghana, ready to carry along institutions that are digital-ready. Question is, are we ready? Fortunately, the policy makers know what time it is. The introduction of a Digital Financial services Policy by the current administration is what spawned regulatory initiatives like the Payment Systems and Services Act, 2019 (Act 987) and a plethora of other directives designed to create an enabling environment.

Question 3: Does the current regulatory model constrain or promote innovation?

In order to answer this question, it is important to do a quick review of the regulatory environment. The central legal framework governing the MFI sector is the Non-Bank Financial Institution Act 2008, Act 774. The Act, in Section 44, and 45, provides the legal basis for Bank of Ghana to issue regulations and Notices in furtherance of their regulatory responsibilities. Also deriving authority from Section 45 of Act 774, the Business Rules and Sanctions for Microfinance Institutions is a compendium of dos and don’ts for microfinance operators, which includes micro-credit. Another piece of relevant legislation is the Borrowers and Lenders Act, 2008 (Act 773), which provides a broad framework to safeguard the rights of counterparties to a credit agreement, among other things. There are other Rules that shape operating norms in the sector, for instance Disclosure and Transparency Rules for Credit Products and Services 2017. But for now, let’s discuss the Business Rules.

The critique usually leveled against the Business Rules come in two forms. First, there is no gainsaying the fact that some aspects lack practical application, especially across Tier 4 micro-credit. Areas such as boards, meetings, and audit, just to name a few, carry the implicit assumption of a governance structure that characterizes limited liability concerns. This is curious considering that majority of micro-credit institutions fall within the Tier 4 category, sole proprietorship. The second critique is that certain aspects of the Rules fail to acknowledge the impact of technology on business model design. Case in point is the Rule 45(1), which mandates that a licensed MFI shall operate only in the administrative region in which its head office is registered. This undoubtedly raises policy questions about how the regulator seeks to promote and enable digital innovation (branchless channels) while ensuring that rules associated with brick-and-mortar channels are adhered to. This is just one of the hydra-headed challenges that confronts Bank of Ghana and its agent bodies.

Now let’s wrap this up nicely. There are five main conclusions to take away:

- Digitalization is a key tool in advancing the financial inclusion agenda.

- Public policy has gradually aligned with the priorities of Overseas Development Assistance in an effort to promote greater financial inclusion in sub-Saharan Africa. This is evident in Ghana’s Digital Financial Services Policy, which has brought us the Payments Act and other regulatory initiatives.

- Micro-credit institutions in Ghana face a Darwinian dilemma: adapt or become irrelevant.

- In order for a transformation to occur, Institutions within the sector have to re-think their business models, re-orient their culture and re-engineer their processes. The traditional refrain that digital processes and market women don’t mix is untenable.

- The future of micro-credit is digital.

About Author

The author is a policy analyst and a Director of Metis Decisions Limited. He is also the founder and Executive Director of Rural Heights Foundation, a social impact organization in Ghana. Visit Metis Decisions Limited at metisdecisions.com. Visit Rural Heights Foundation at ruralheights.org

Works cited:

Okpugie, G. (2009). High Microfinance Interest Rates Cause Loan Defaults in Nigeria, The Guardian, Nigeria.

Vandel, K., (1993). A perspective on Mortgage Default Research. Journal of the American Real Estate and Urban Economics. Vol 23 (4).