Last week, we examined the changing role of the branch manager of today. The present-day branch managers, sometimes known as Business Managers or Branch Sales and Service Managers, are no longer the stereotype of an unseen and illusive boss behind a closed door. The image of the bank manager is changing rapidly as a result of the Fourth Industrial Revolution, with its intrusive digital technology powered by Artificial Intelligence. They now need to be dynamic leaders with great technical as well as soft skills. However, a manager needs to appreciate the foundations of branch banking and how the various roles work together, to enable him or her blend into the digital banking space. They will notice that there is nothing new. The only new thing is that all traditional banking activities have been creatively digitized embedding all controls to protect both the bank as well as the customers.

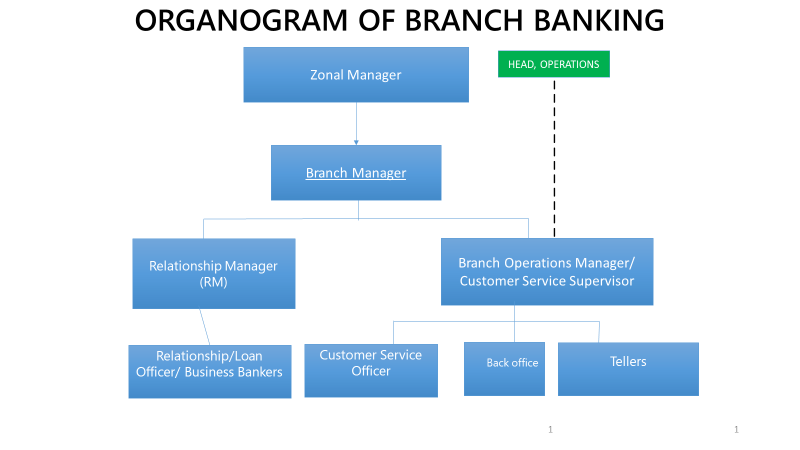

Let us now look at a typical branch banking set-up as depicted below and compare it with the digital branch depicted by Mackinsey. While the traditional one focuses on the authority levels, Mackinsey’s model depicts the customer journey in the digital branch and is more service-focused.

The Typical Job Description of a Branch Manager

The Typical Job Description of a Branch Manager

As managers wade through the new dispensation, let us refresh our minds on their roles and job descriptions. Whether in traditional or digital banking, the branch manager’s functions have not changed much. With assistance from the operations manager, he or she bears full responsibility for the branch. As the team leader of branch management and a member of the bank’s management team the manager ensures that institutional business strategies, business model, and core values are implemented in his/her branch. Specific broad responsibilities include:

- Ensuring the corporate goals are always embedded within the branch’s developmental plans.

- Managing and developing staff.

- Ensuring excellent customer care and relationship management

- Ensuring a healthy loan portfolio for the branch.

- Submission of reports and returns to the appropriate departments in Head Office.

Let us examine how this job description can be executed:

Staff Management and Development:

- Ensure that recruited/confirmed branch staff have the right attitude, skills and knowledge to perform their duties.

- Ensure (through communication and good example) that staff live the Bank’s corporate values always.

- Hold regular meetings with staff to update them on institutional development.

- Give regular and timely feedback to staff on attitude, skills and knowledge in relation to their work.

- Set and maintain high performance standards in accordance with institutional standards.

- Sustain staff motivation.

- Take timely and appropriate disciplinary measures in accordance with the HR policies.

- Carry out regular staff evaluation according to HR policy.

- Coach and develop staff capacity to perform their roles effectively and efficiently.

- Communicate regularly and promptly on staff development to Head Office Management, Human Capital and other related departments.

Executing Corporate and Branch goals:

To ensure that the branch meets its corporate and branch goals, managers must:

- Ensure that the branch business plan is achieved (every month).

- Ensure that the branch serves as a service point for delivering financial services to customers.

- Conduct regular research into products and services required by the customers in the local community, examine the competitive products and services, and when relevant, prepare recommendations to the Head of business in head office.

- Regular follow-ups with relationship managers to mobilize funds and to expand catchment zones to acquire new businesses.

- Critically assess and identify opportunities and threats in the locality, and take proactive steps to leverage opportunities and minimize threats.

- Ensure that branch capacity (ability and numbers) is commensurate with demand and market potential. As new expectations emerge, the manager should make recommendations for the human capital required for that.

Customer Care and Relationship Management

This is the differentiating factor which managers must never underrate. The following expectations are key:

- Ensure that staff understand and maintain high standards of professionalism and customer care.

- Take proactive steps to ensure that customer needs are met in your branch.

- Collaborate with relevant branches and departments to meet customer requirements when necessary.

- Maintain good professional relations with all customers.

Ensuring a Healthy Loan Portfolio for the branch

Since most Bank’s earnings are from interest received and repayment of loans, the following functions are critical to the success of the branch and bank as a whole:

- Ensure that loans approved and disbursed within the branch meet required procedural and risk mitigation standards.

- Implement good portfolio management measures at all times.

- Ensure that all loans are monitored effectively by client relationship officers and branch management.

- Implement measures and structures to follow up on arrears to maintain good portfolio quality of each relationship officer.

- Liaise with relevant head office departments to keep all risky and potential defaulters in check and well structured, and to recommend the appropriate impairment measures or loan structuring.

Submission of Timely Reports/Returns

- Ensure timely and quality reporting by your branch to the relevant offices/departments at all times.

- Perform any other duty as required by supervisor, zonal managers and Head Office.

We now have insights into the functions of the bank branch and the roles that branch managers play. In this era of digital banking, let us examine one important function which is sometimes overlooked.

Boosting Digital Adoption

Modern banking involves using artificial intelligence to increase sales and cross-selling in digital banking. It is not enough to build amazing digital products. You also need to convince consumers to use them, considering the following general findings:

- Awareness and education alone do not drive adoption

- 25% of customers who use traditional channels are interested in doing the same task digitally

- 84% of customers are aware of digital banking products but only 33% have adopted them

- Competition from non-banks could erode 1/3 of traditional bank revenues.

- Process can be quite complicated.

Branch managers therefore need to go beyond awareness and education, and actually influence customer behaviour. How can this be done? This involves the use of a combination of both traditional and online means. For example, the following have to be done:

- Educate customers on the benefits, encourage them to adopt a change in the way they view and use the new concepts, and demonstrate how the products are actually used. Many banks rely on video training to make the sale very practical.

- Using AI and machine learning: Segment and identify the customers need of the varying levels of help and incentives to go digital. This information needs to be provided in the various channels to appeal to each customer group.

- Product walkthroughs are a quick and easy way for both your customers and your staff to learn how to use products. They quickly walk you through a product, highlighting key features, and letting customers (or staff) learn by doing — without the risk of a live environment.

- You can use some of your bank’s product walkthroughs on your website to appeal to digitally savvy customers looking for self-serve support. Managers can also use product simulators to walk both staff and customers in-branch. In modern branches, sales ambassadors walk around with tablets to aid customers and sell products and services.

After customers try your product for the first time, you need to ensure they continue using it. The onboarding process should encourage customers to habitually use your product for at least two months. This will gradually make them a habit and create loyalty to the bank’s brand.

If banks have a low level of digital sales strategy, then it should be made a priority. This should make the branch manager coordinate the branch team to increase their readiness to sell more products digitally. However, with every passing day, your customers’ expectations of a great digital experience are increasing. The right approach depends on your bank’s strategy, customer base, and technology roadmap.

I wish you good experiences on your digital sales journey. For more insights please book a copy of my new book, “THE MODERN BRANCH MANAGER’S COMPANION” which involves the adoption of a multi-disciplinary approach in the practice of today’s branch management. It also shares invaluable insights on the mindset needed to navigate and make a difference in the changing dynamics of the banking industry. Call 0244333051 for your copy.

To be continued

ABOUT THE AUTHOR

Alberta Quarcoopome is a Fellow of the Institute of Bankers, and CEO of ALKAN Business Consult Ltd. She is the Author of two books: “The 21st Century Bank Teller: A Strategic Partner” and “My Front Desk Experience: A Young Banker’s Story”. She uses her experience and practical case studies, training young bankers in operational risk management, sales, customer service, banking operations and fraud.

CONTACT

Website www.alkanbiz.com

Email:alberta@alkanbiz.com or [email protected]