Krampa, the founder and CEO of an agro-processing company, sat in his office and wondered what he was going to do. He had been part of a workshop under the aegis of an international trade promotion organization the week before. It was evident that there was a huge potential and identified markets for the output of his factory.

However, his processing plant did not have enough capacity to deliver products the market sought –products the plant could deliver, if it were big enough. His deep pondering caused him to miss a message alert on his phone several minutes past. He grabbed his phone and, almost mechanically, flipped through his messages. One of his managers had requested for a brief meeting with him. This meeting would, as it were, transform the company’s prospects.

Going Public?

That was a year ago. The manager had discussed with him the option of raising capital through a public offering and listing on the Ghana Stock Exchange (GSE). He was getting ready to begin a process that would take his company public, list it on the Exchange and deliver much needed long-term financing to further expand. It would offer the company good publicity too. Interestingly, though his share proportion would diminish significantly, the value of his holdings would potentially increase substantially.

Listing a company’s shares on an exchange involves principally:

- First changing the company from private to a public entity

- Applying to the stock exchange and the Securities and Exchange Commission for listing

- The initial public offer (IPO)

GSE Listing Requirements

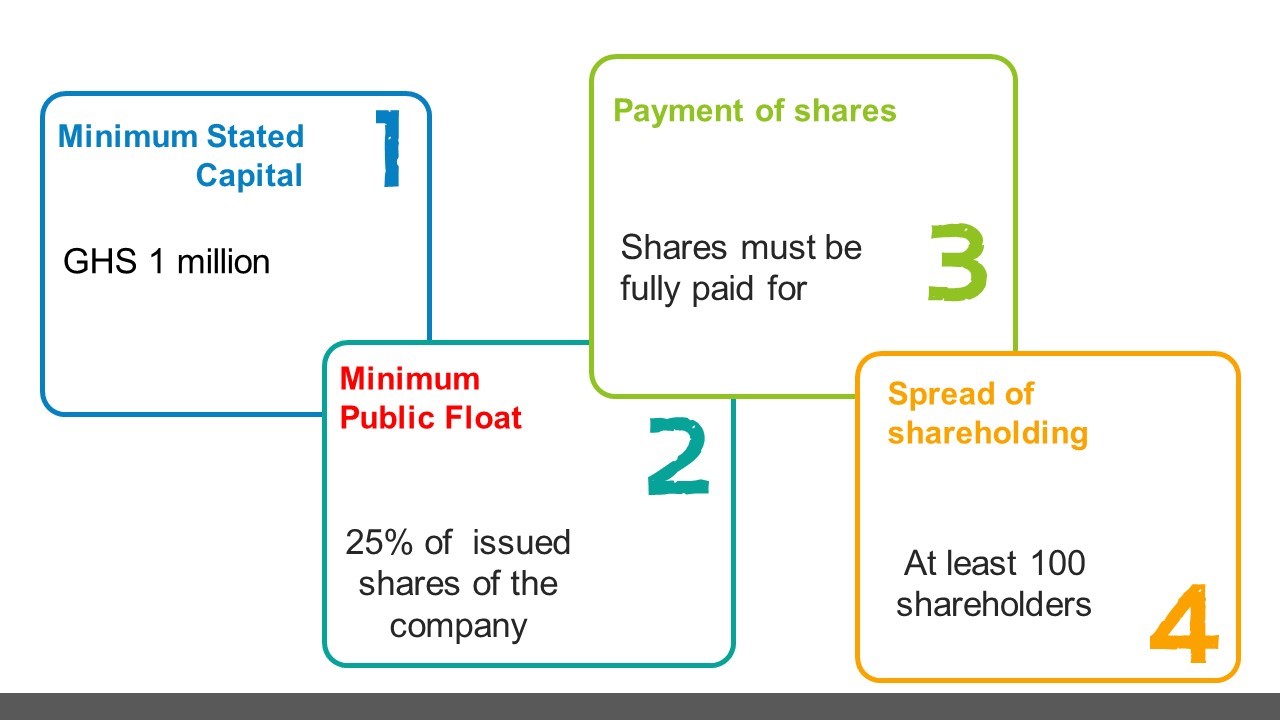

The Ghana Stock Exchange requirements for listing are:

- Minimum Stated Capital: The company must have a stated capital after the public floatation of at least GHS 1million in the case of an application relating to the First Official List and GHS 0.25 million for the Ghana Alternative Market (GAX).

- Minimum Public Float: Shares issued to the public must not be less than twenty-five per cent (25%) of the number of issued shares of the company.

- Payment of Shares: Shares must be fully paid for. Except in very exceptional circumstances, the Exchange will refuse listing in respect of partly paid shares.

- Spread of Shares: The spread of shareholders existing at the close of an offer should be, in the GSE’s opinion, adequate, with at least 100 shareholders after the public offer for the Main Board and 20 shareholders for the GAX.

Back to Mr. Krampa

Exchanges usually list both equities and fixed income instruments like bonds, as well as collective investment schemes (mutual funds, unit trusts) and exchange-traded funds (ETFs). The CEO, Krampa, could, therefore, decide to raise either equity or debt (or both). His advisors, however, pointed out to him that he could open up ownership of his company to the general public and their reasons sounded good enough. He then decided to list 55% of the company’s shares (he owns 98%) and invite the general public to share in the company’s ownership. If things went well (and he had every reason to believe they would), in less than 3 years, his share could be as valuable as they were at 98%.

The shareholders were required to meet and pass a resolution to become a public company limited by shares. The company would then be registered at the Registrar-General’s as a ‘Plc’, a public company with limited liability. This would entail the preparation of new company regulations to conform with the Companies’ Code and the stock exchange’s own listing requirements. The stated capital after the floating of shares was planned to be GHS 25 million, up from the present GHS 10 million.

Mr. Krampa and his team would go on to file the new regulations with the Exchange. If the Exchange found it satisfactory, the company would then file them at the Registrar-General’s.

The company’s board was going to get busy for the next couple of weeks, selecting advisors for the whole deal. A brokerage firm would be engaged to execute trades of the company’s listed shares, provide information support about the Exchange, transactions and regulatory compliance. Reporting accountants and auditors would be engaged to prepare and audit the company’s financial statements and financial valuers would prepare an independent valuation of the company. The lawyers would also ensure that all documentations are done according to law and without any future legal ramifications against the company.

Draft reports of all advisors shall be presented to the directors to discuss extensively and provide input. These shall then be presented to the shareholders to take decisions like the proportion of shares to sell, the price of each share and the use to which the capital raised shall be put.

Submission of Application

At this point, the company shall submit an application to list on the stock exchange. The application shall be submitted same time as a draft public offer prospectus is submitted to the Securities and Exchange Commission (SEC) for its approval of the proposed offer. Krampa intends to work with the brokers to begin to sound the offer off a few prospective investors without specifics- pension fund trustees, fund managers and other brokers.

A public offer prospectus is a detailed document. Investors are going to be guided by this document as concerns the company’s shares– reasons for a buy (or other) decision. It should contain concise details on:

- general information of the company, its capital structure and history

- an overview of the company’s business,

- the company’s organisational structure, directors, senior management and employees

- significant fixed assets of the company,

- remuneration and compensation

- share ownership, including details on major shareholders

- the issue-purpose, details of the share offer, timetable, planned distribution, financial details

- financial information about the company, its future prospects and risks

- information on future prospects and risks of the issue

- any other information

The granting of approvals by the regulator (SEC) and the GSE would probably signal the achievement of the first major milestone for the process. A date for the launch of the IPO would be set at this point. The CEO (or management) would roll out a number of advertising campaigns for the launch of the IPO, employing technology rather than traditional advertising channels. At this stage, a number of roadshows would be undertaken to whip up interest for the offer and explain to investors the investment prospect of owning the company’s shares. The CEO had also shared with senior management his desire to reward all employees with share ownership and have an Employee Stock Ownership Plan (ESOP) incorporated in their remuneration package.

As he stood up slowly from his seat, Mr. Krampa sighed, relieved. There was hard work ahead and he was all for it. He smiled softly and imagined what the new public company would look like. Alas, his company is listed!