The Agricultural Development Bank Limited (ADB) is the lead bank for agricultural financing in the country. Set up for the purpose of developing the agricultural sector, ADB has over time used various avenues to channel financial resources into the sector to propel it to higher heights.

With about 83 network branches nationwide, ADB is the only bank in the country with branch locations in mainly agricultural prone areas.

The Bank has witnessed a steady growth in its financial performance since 2017 from a loss making position to a relatively profit making position. The bank last year launched a new three-year Strategic Plan, re-emphasizing the bank’s agricultural focus. The primary aim of the new strategy is to increase the share of agriculture in the total loan portfolio of the Bank to 50% by 2022 from the current 28%.

According to the Managing Director, Dr. John Kofi Mensah, the Bank has assessed the prospects of various value chains using factors such as potential for growth, value addition potential, size of the value chain, demand for produce/product, export potential, import substitution potential as well as financial viability and has earmarked the following value chains as priority areas for financing.

He indicates that the areas of agribusiness to be focused on include, Poultry Value Chain, Fish value chain, Maize Value Chain, Cassava Value Chain, Potato Value Chain, Rice Value Chain, Oil Palm Value Chain and Exportable Vegetables. “The bank would provide working capital for the production and processing of these commodities as well as medium to long term funds to finance production and processing infrastructure,” he said.

The Bank recognizes the fact that the most prudent and sustainable approach to agricultural and rural development is the adoption of a well-balanced and integrated social and economic development programmes and policies which enhance both agricultural and non-agricultural activities such as cottage level industries, education, health and social welfare.

To this end the bank would continue to support industries, education and health programmes through its lending and social responsibility programmes.

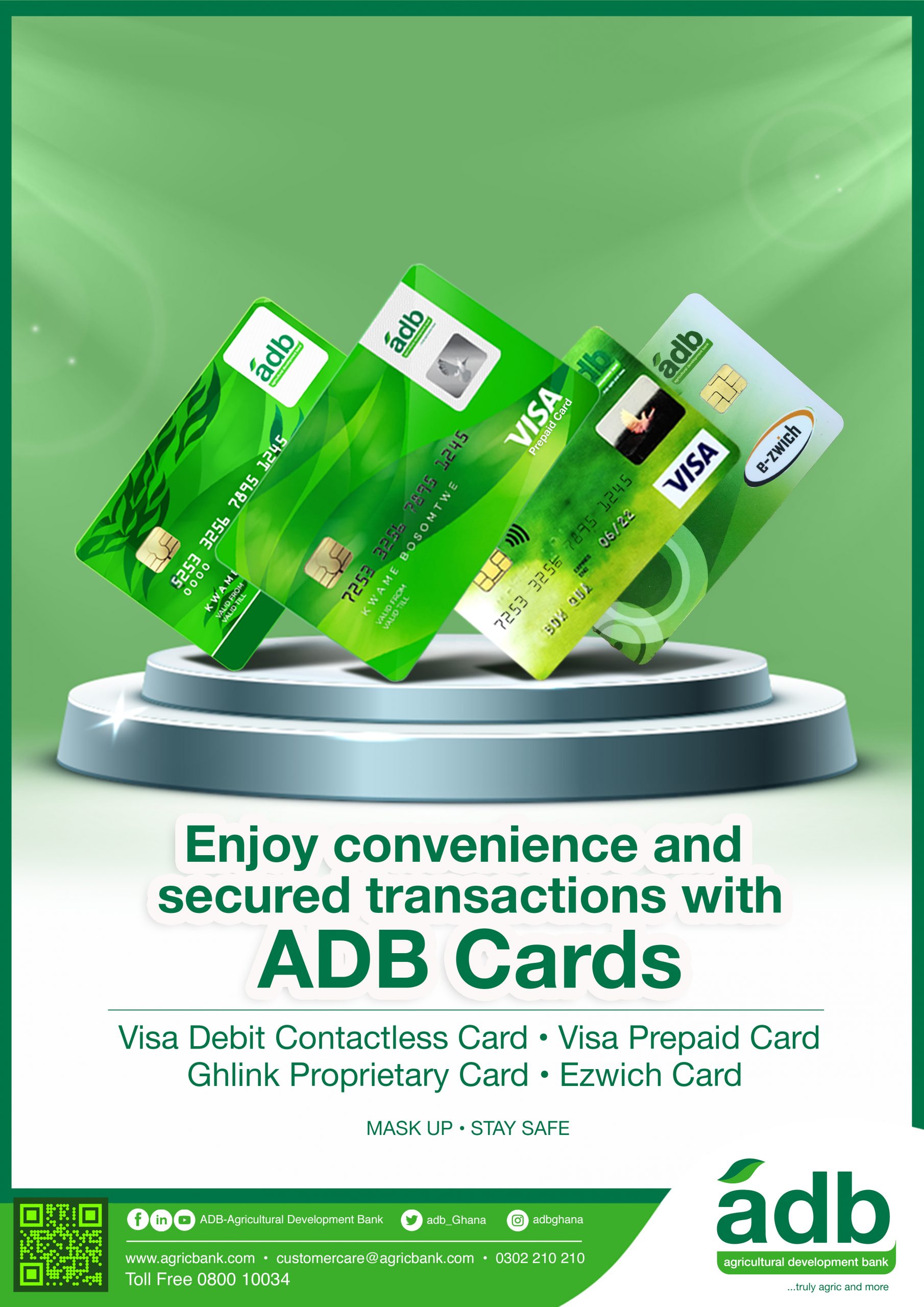

Aside focusing on agribusiness, other key areas will include improving on their E-business infrastructure for the benefit of customers. The Bank hopes to ensure customers can transact more businesses on the Banks USSD *767# and Mobile App so as to decongest the banking halls.

According to the Managing Director, providing convenience for customers will continue to be a major priority of the Bank. “With coronavirus still around, we are working to provide convenience and secured banking to our customers without them necessarily visiting our banking halls,” he said.

Dr. Kofi Mensah further said the Bank will this year also place premium on Small and Medium Enterprises (SMEs) to ensure they grow and remain in business especially in the midst of the current pandemic.