- Further increases in output and new orders

- Overall input prices rise at sharpest pace since June 2015

- Employment growth sustained

The opening month of 2021 proved positive for the private sector, with further expansions in output, new orders and employment recorded. Companies remain hopeful that business activity will continue to rise over the coming year. Inflationary pressures built-up however, with both input costs and output prices increasing at sharper rates than in December.

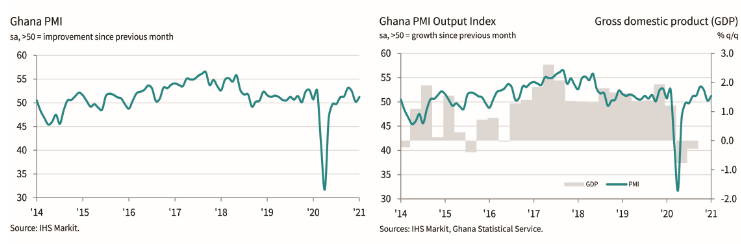

The headline seasonally adjusted Ghana PMI rose to 51.2 in January, up from 50.3 in December and signalling a sixth successive improvement in the private sector’s health in as many months.

January data pointed to a solid increase in business activity that was more marked than in the previous month. Rising new orders and the reopening of schools following a nine-month shutdown due to the coronavirus disease (COVID-19) pandemic were reportedly behind the improvement in activity.

New orders were also supported by the reopening of schools. New business expanded for the eighth consecutive month – albeit at a modest pace, as some firms indicated that customers were struggling to fund new orders. Price rises exacerbated these customer issues, and made new business harder to secure in some cases.

Firms increased their charges for the ninth month running, and to the greatest extent since November 2018. The rise in selling prices was in response to higher input costs, which increased at the fastest pace since June 2015 amid sharper rises in both purchase prices and staff costs. Purchase costs rose at the steepest pace in almost two years, due to a range of factors including higher prices for raw materials, freight and fuel, as well as currency weakness. Staff costs meanwhile increased at the fastest pace in just over two-and-a-half years.

The increase in raw material costs was often linked to supply shortages, which also resulted in a slight lengthening of suppliers’ delivery times.

Challenges sourcing items contributed to a second successive monthly fall in stocks of purchases, as did a slower rise in purchasing activity. In fact, input-buying increased at the weakest pace in six months as price rises and sustained purchasing in previous months discouraged some firms from their procurement plans.

Backlogs of work increased for the sixth successive month in January, with issues around cash-flow and raw material supplies reportedly contributing to delays in the completion of orders.

Rising workloads encouraged companies to fill vacancies at the start of the year. Employment continued to increase steadily, extending the current sequence of job creation to six months.

Companies remained hopeful that business activity will rise over the coming year. Sentiment was broadly in line with that seen in December, with more than three-quarters of respondents expecting growth over the next 12 months.

Commenting on the latest survey results, Andrew Harker – Economics Director at IHS Markit said: “Ghana’s private sector started 2021 on the front-foot, with latest PMI data pointing to a pick-up in growth during January. The recent rise in COVID-19 case numbers, however, throws sustainability of the current upturn into doubt. February PMI data will show how this renewed wave of infections impacts the private sector economy. One further headwind is rising inflationary pressures, with firms increasing their selling prices at the quickest pace in just over two years in response to sharply higher cost burdens”.