The comparatively high cost of money transfer, particularly of overseas remittances, across digital channels remains a significant barrier to its wholesale adoption in sub-Saharan Africa (SSA) and could be detrimental to the collective economy, Vice President and General Manager-Xoom, Julian King, has noted.

According to the World Bank, SSA is placed first in terms of cost of money transfer between countries. For example, the cost of sending US$200 to the SSA region averaged 9 percent in 2018; and in the SSA region, the average cost was 18.7 percent, almost three times higher than the global average.

Concrete measures must therefore be taken to address the situation, with the underlying factors taken into consideration, if the region is to harness the digital economy’s potential, he told the B&FT in an interview on the occasion of Xoom’s announcement of expansion in the region.

“The cost of sending money through traditional channels to Africa is one of the most expensive in the world, with an average cost of 9.3 percent,” he explained.

Explaining the primary solution Xoom – the money-transfer service of PayPal – offers, he said: “Xoom is helping to change this story by bringing down the cost significantly and speeding-up the process to boost financial inclusion. With Xoom, the average cost of sending money to mobile wallets in select African markets ranges from 2-4 percent of the transaction”.

He added that his outfit is in a strong position to help shape a future where everyone, not just the affluent, can participate in the new digital economy, in so doing improve financial health across the board.

On the timing of its new service – which allows the company’s customers in the US, UK, Canada and Europe to now send secure and convenient money transfers directly to mobile wallets in key markets across Africa with a focus on the under-banked segment – he stated that Xoom has been present in the African market for over a decade, and highlighted the increasing use of mobile wallet services as providing the needed impetus.

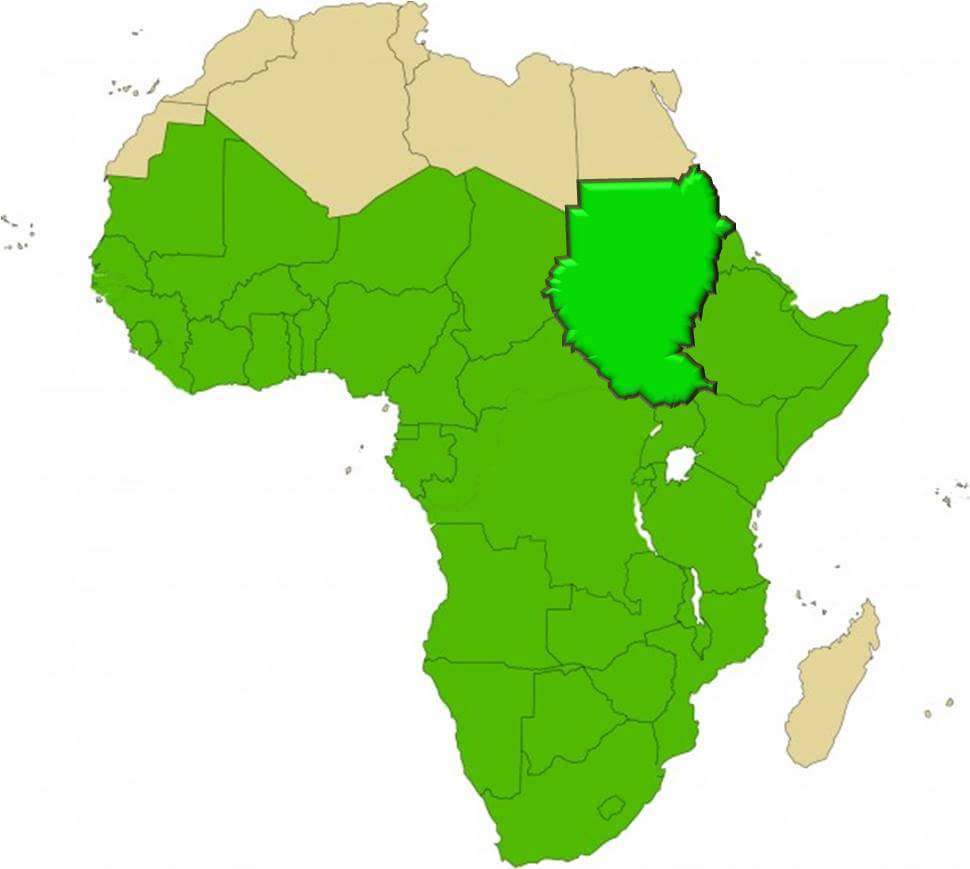

He explained that the service will be implemented in countries with maturing mobile money wallet services, such as Ghana and Kenya. The others are Cameroon, Madagascar, Malawi, Mozambique, Rwanda, Tanzania, Uganda, Zambia and Zimbabwe – with plans to include more markets in 2021.

“There is nowhere else in the world that moves more money on mobile phones than sub-Saharan Africa. While there are only five bank branches per 100,000 people as of 2019, there are 1.04 billion registered mobile money accounts in sub-Saharan Africa.”

Mr. King offered assurance of Xoom’s commitment to customer data security, saying the company is well aware of the cyber-security dangers which abound, as well as the untold damage to brand goodwill that a security breach would lead to.

“Security is at the core of PayPal and Xoom’s services. Our service is digital and reliable, as there are no multiple steps or middlemen involved in these cross-border payments,” he said.