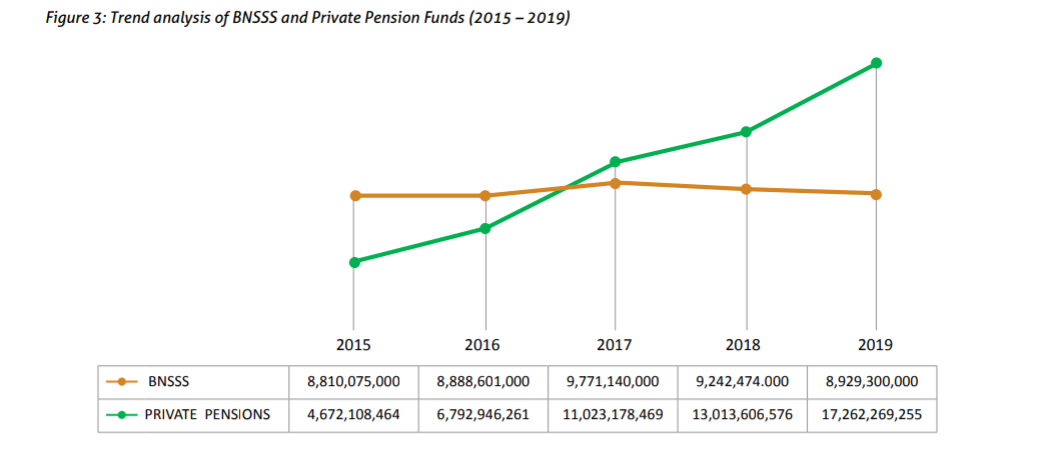

Private pension funds have maintained their strong growth over the years – reaching a record high of GH¢17.3billion in 2019 from GH¢13-billion in the previous year, exactly a decade on since introduction of the three-tier pension system.

The impressive growth of private pension funds over the years, according to the National Pensions Regulatory Authority (NPRA), can be attributed to three factors: namely the accumulation of contributions without significant draw-downs; enforcement of the 5 percent mandatory contribution; and favourable investment outcomes.

The Basic National Social Security Scheme (BNSSS), which is a statutory public trust managed by the Social Security and National Insurance Trust ((SSNIT), meanwhile ended 2019 with net assets of GH¢8.9billion – a negative growth of about 3 percent, which is an improvement on the 2018 growth of negative 5 percent.

Per the National Pensions Act, Act 766, the first tier – or the BNSSS – is managed by the SSNIT, while the second tier is a defined contributory Occupational Pension Scheme mandatory for workers with 5 percent contribution made on behalf of members; and the third tier, which is a voluntary scheme and includes all Provident Funds and all other pension funds outside Tiers I and II, is privately managed by both corporate trustees and fund managers.

The figures contained in the 2019 report of the NPRA show that the country’s total net assets available for benefits in the pensions industry now stands at GH¢26.3billion (US$4.8billion) by the end of last year. This value represents a significant increase in pension funds of 18 percent compared to the 7 percent recorded in 2018.

In nominal terms, the total value of pension funds – GH¢26.3billion – represents about 7.6 percent of Gross Domestic Product (GDP). An analysis of the growth of funds under the 3-Tier Pension Scheme from 2015 to 2019 shows an average growth rate of about 39 percent over the past five years.

Commenting on the report, NPRA’s Chief Executive Officer, Hayford Atta Krufi said: “On the whole, private pension funds posted impressive growth and the pensions industry in general remained vibrant and stable, with the major reforms by other financial sector regulators having minimal effects on the pensions industry.”

He credited this performance to the authority’s efforts toward ensuring compliance with the mandatory second tier in the formal sector – adding that the activation of public sector schemes and the acquisition of prosecutorial powers also contributed greatly to the growth recorded.

The report further revealed that total registered private pension schemes under regulation were 241 at the close of 2019, and that they were being administered by 30 Corporate Trustees and 1,046 Individual Trustees. Pension Fund Custodians in operation stood at 15, and Pension Fund Managers – investment advisors – in operation numbered 49.

In terms of contributors, the total number of contributors for the mandatory second tier was estimated at 1.75 million; with total establishments – number of employers – numbering 69,911 at the close of the year under review.

“When the pension reform started, regulatory efforts focused on ensuring compliance with the second tier mandatory scheme for workers in the formal sector would be at par with the 1st Tier Basic National Social Security Scheme. By the end of 2019, the authority had achieved that objective, evidenced by the comparable number of contributors – workers, and establishments – employers, which had enrolled.

These are mainly attributed to closure of the Temporary Pension Fund Account, the set-up of public and more private sector schemes, and enhanced enforcement of compliance following the acquisition of prosecutorial powers by NPRA,” Mr. Krufi noted.