Converting debt liabilities into investments that protect children is good economics and an ethical imperative

At the height of Africa’s debt crisis in the mid-1980s, Julius Nyerere, the late president of Tanzania, asked his country’s creditors a blunt question: “Should we really let our people starve so that we can pay our debts?” The response can be summarized in two words: if necessary. It took another 20 years to agree to a comprehensive debt reduction program, effectively consigning Africa to a lost decade of development.

Nyerere’s question resonates powerfully today. The economic crisis triggered by COVID-19 has devastated many of the world’s poorest countries. Sub-Saharan Africa is heading for its deepest recession in 50 years. Declining exports, plummeting revenues, and capital flight have left many countries struggling to pay creditors. With poverty rising and budgets for health, education, and safety nets under pressure, will countries be able to put the lives of vulnerable people before their debt obligations?

COVID-19 is not a short-term crisis—and it won’t be resolved by a six-month debt suspension.

Too little, too late

The answer will depend on whether the Group of Twenty’s (G20’s) Debt Service Suspension Initiative (DSSI) marks the beginning of the end of the debt crisis or the start of a protracted set of negotiations that deliver far too little, far too late. Early signs are not propitious.

The G20 initiative offers what it says on the DSSI tin—a suspension of debt service payments. Covering 73 International Development Association (IDA)-eligible countries (and Angola), it provides for a six-month debt service freeze with repayment over three years (after a one-year grace period). The agreement covers all official bilateral creditors. Private creditors have been invited “to participate in the initiative on comparable terms.”

The laudable aim is to release resources for investment in priority areas. While rich countries have exploited the privilege that comes with borrowing in their own currencies to finance vast welfare and recovery programs at rock-bottom interest rates, most poor countries entered the economic crisis triggered by COVID-19 with limited fiscal space—and that space is shrinking. The fiscal response to date in low-income countries has averaged just 1.6 percent of GDP. Sub-Saharan Africa faces a fiscal gap of $44 billion in 2020 alone. Budget pressures are mounting, as are the financing needs for vital services.

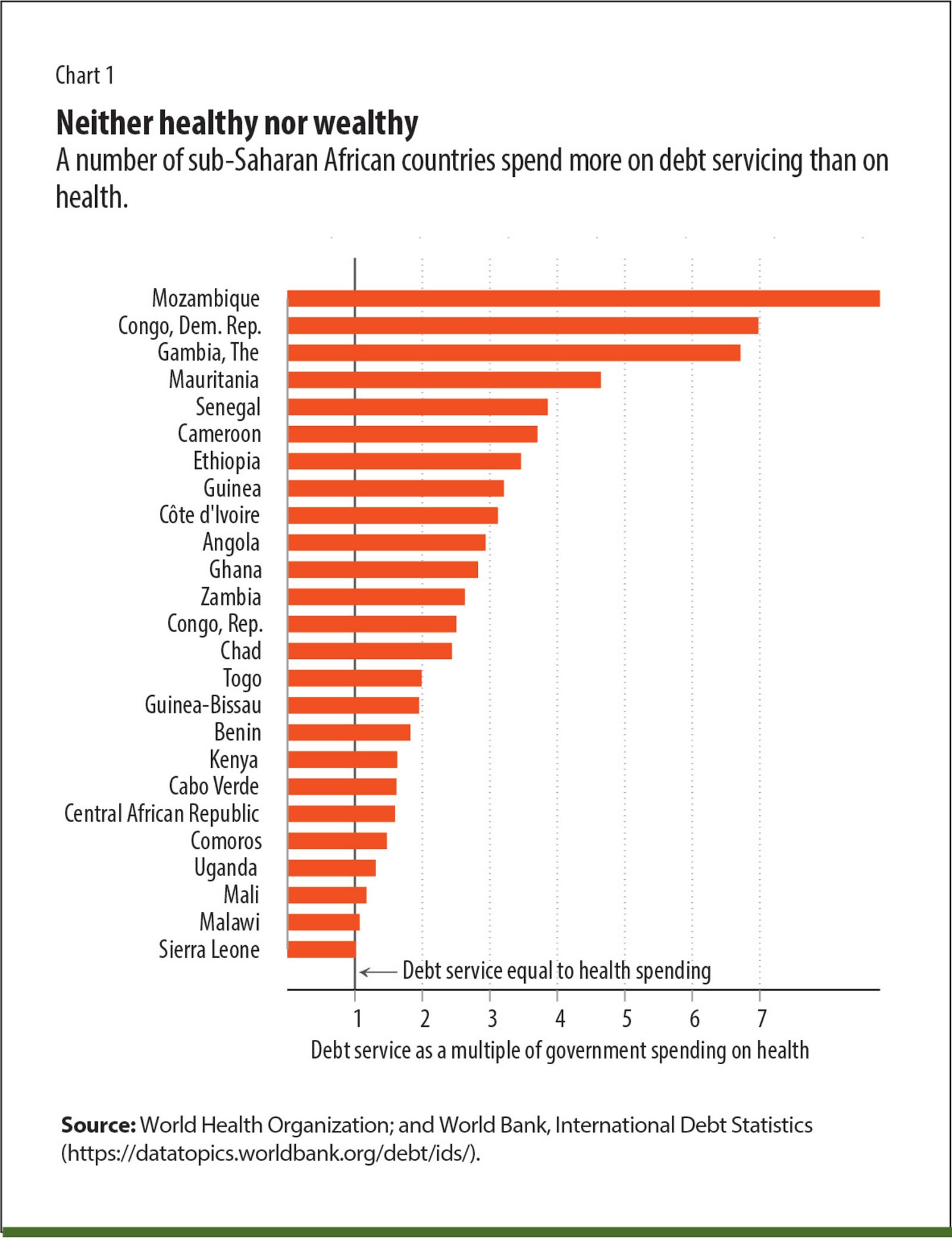

For children in many countries, debt relief is—quite literally—a life and death issue. Research at Johns Hopkins University estimates that the disruption of routine health services because of COVID-19 could result in additional half-a-million child deaths over six months—a devastating reversal of the hard-won progress achieved over the past five years. The suspension of immunization programs, delayed treatment of killer diseases like pneumonia and malaria, and the devastating impact of wasting pose real and immediate threats to children. Yet of the 73 countries covered by the DSSI, 43 are scheduled to spend more on debt repayments in 2020 than on the health of their citizens (Chart 1).

Debt profiles and the role of private creditors

The debt problem in low-income countries was already simmering before the pandemic. Almost half of the countries now eligible for DSSI treatment were at high risk of debt distress, or in debt distress, at the start of 2020. Between 2009 and 2018, the combined external debt stock of IDA-only countries almost doubled. The average ratio of debt to gross national income for sub-Saharan Africa (excluding South Africa) climbed from 24 percent to 32 percent.

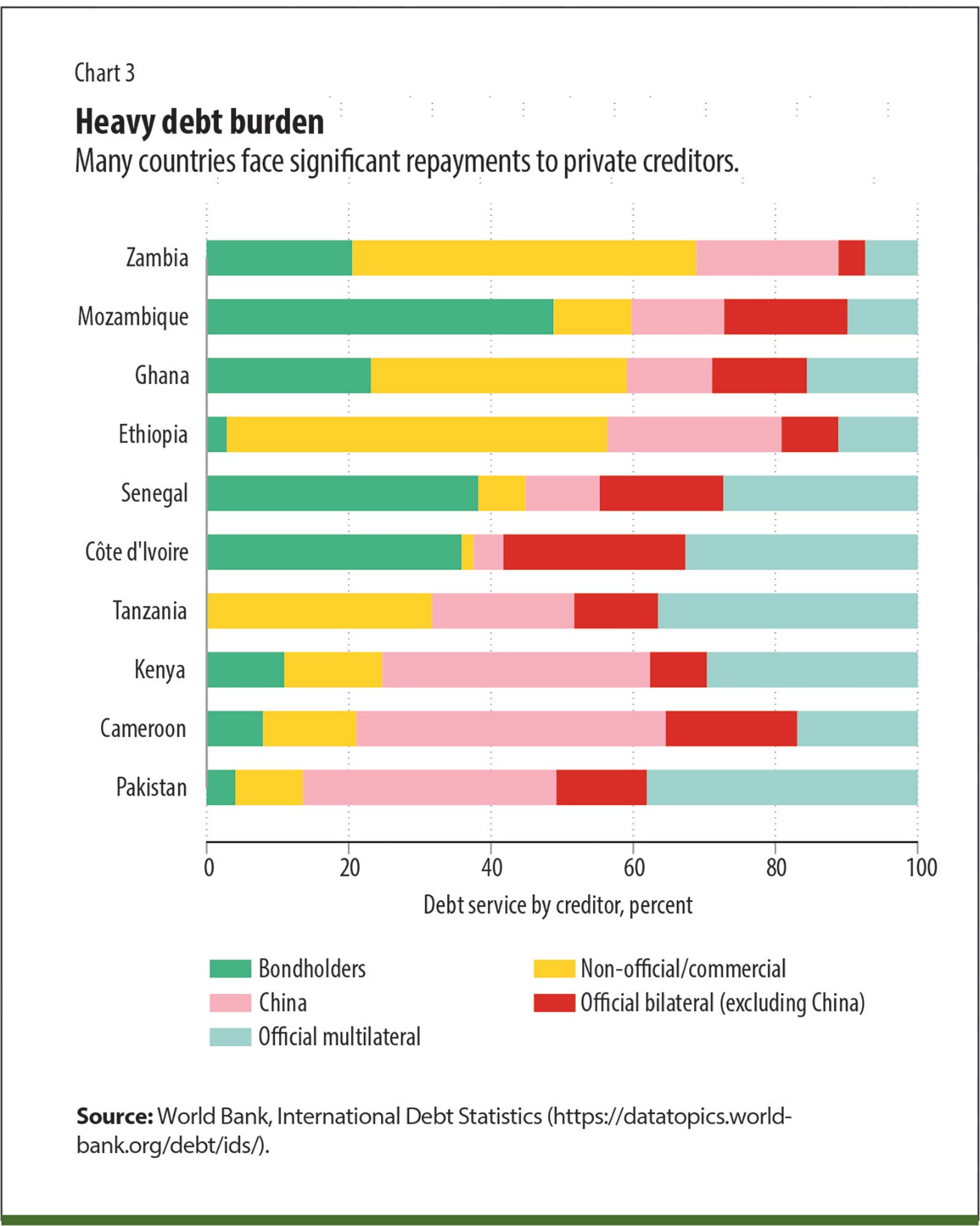

Debt profiles were also shifting. The share of private creditors—sovereign bond holders, banks, and commodity traders—in long-term public debt more than doubled over the same period, to 41 percent. Debt owed to official Chinese creditor agencies also climbed sharply, much of it secured against mineral exports. The IMF regularly sounded the alarm over the accumulation of debt and the growing involvement of commercial creditors providing loans at high interest rates.

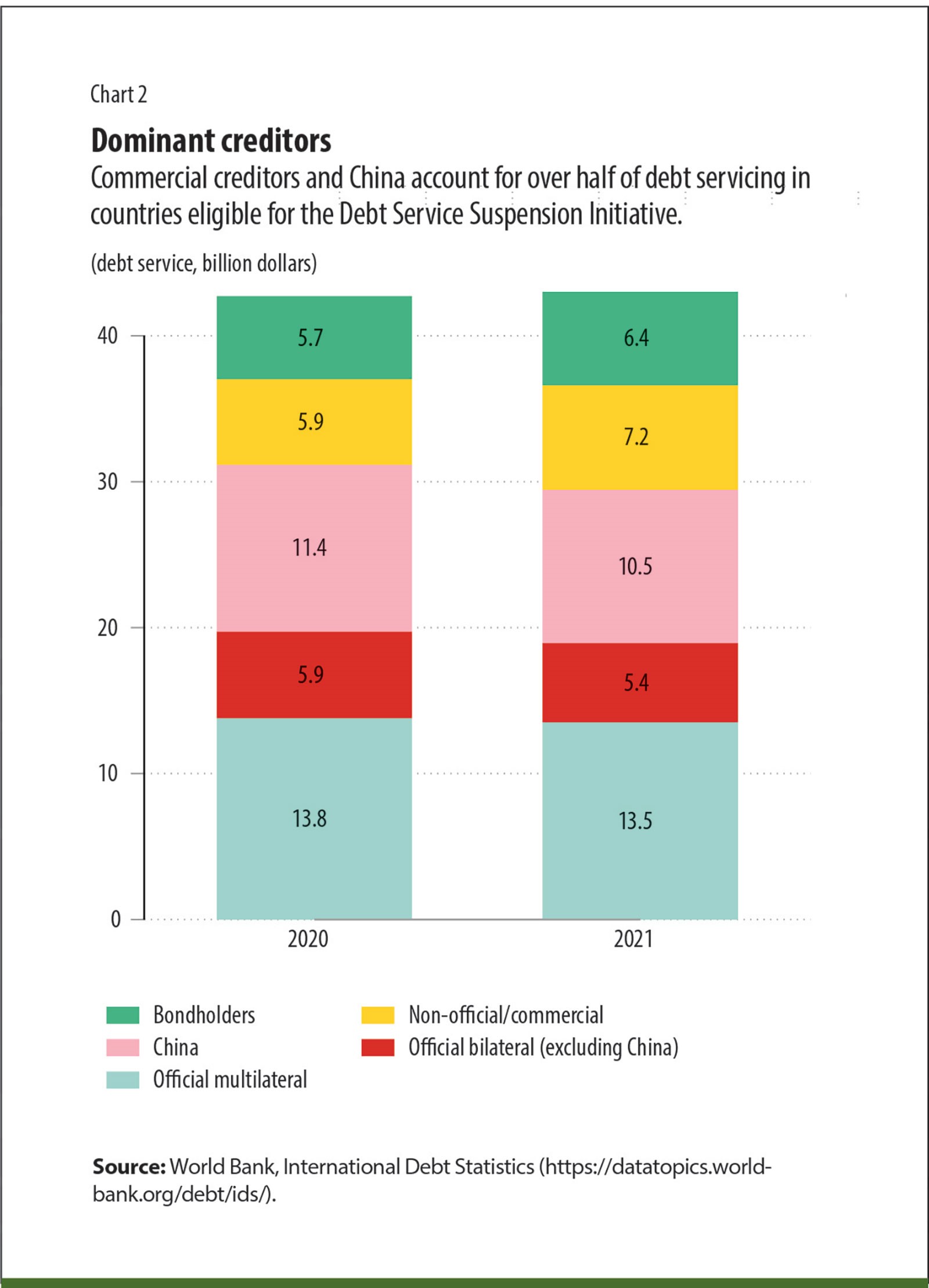

Governments now face a debt service bill dominated by commercial creditors and China (Chart 2). Of the $45 billion in scheduled payments due in 2020, official creditors in the Paris Club account for just $6.2 billion—a little over half the amount owed to Chinese state creditors. Another $14.5 billion is owed to private creditors.

The scheduled repayment profile turns the spotlight on the problems with the DSSI. Private creditors have so far shown no inclination to provide “comparable treatment.” Bondholders may either refuse to suspend payments or charge punitive interest rates during a payment holiday. Even if private creditors do participate, governments with significant commercial debt—like Côte d’Ivoire, Ghana, and Senegal—have to weigh the potential benefits of a temporary suspension against a potential risk downgrade by credit agencies (Chart 3). The terms on which China will participate in the DSSI also remain unclear, with officials indicating they will consider requests on a case-by-case basis.

Multilateral creditors represent another big piece in the jigsaw. The main contribution of the World Bank to financing for the G20 framework countries is through net transfers, including $50 billion in front-loaded IDA support to be disbursed over 15 months. The IMF has approved debt relief to 29 low-income countries through its Catastrophe Containment and Relief Trust and is now seeking support from donor countries to extend debt relief to two years.

The debt repayment arithmetic tells its own story. Without the participation of private creditors and China, the debt service bill will be cut by just 14 percent—and many countries will still be paying far more on debt than they are spending on safety nets and health.

The cost of delaying

If there is one lesson to be drawn from the tortured history of past debt relief initiatives, it is the peril of delay. The response to Latin America’s debt crisis in the 1980s was a decade of repayment suspensions (remember the Baker Plan?) before a resolution was found in debt reduction. It was not until 2006, 20 years after Nyerere’s speech, that the IMF and World Bank Heavily Indebted Poor Countries (HIPC) Initiative resolved Africa’s debt crisis. Delayed action caused immense human suffering and trapped whole regions in slow growth. The costs of delay in the era of COVID-19 will be exponentially higher.

COVID-19 is not a short-term crisis—and it won’t be resolved by a six-month debt suspension. G20 governments should agree now to extend the suspension to the end of 2021. This would enable governments to plan budgets for recovery.

No amount of DSSI redesign will compensate for the noninvolvement of commercial creditors. Debt repayment to sovereign bond holders and other creditors will continue to crowd out vital investments in health, education, and recovery. G20 governments should be using their political authority and regulatory powers to secure full participation. The alternative to a comprehensive standstill is likely to be a raft of disorderly defaults, which would not be in anyone’s interest.

The DSSI is also a test of China’s commitment to the poorest countries. Chinese leaders frequently emphasize their desire to promote self-reliant development in Africa and elsewhere. Now is their opportunity to act on that commitment.

While comprehensive debt suspension is a vital immediate measure, debt restructuring will almost certainly be required for a large group of countries. Currently, there is no framework for restructuring debt owed to private creditors, and G20 governments should be working with the World Bank and the IMF to develop that framework. It will need to include a provision for buying back commercial debt at hefty discounts consistent with market realities—in effect, a “Brady Plan” for commercial debt in low-income countries.

Debt distress can be measured by reference to national income, government revenue, or export earnings, but the real measure of distress is human suffering. In the current pandemic, adults have borne the brunt of the immediate health effects, but vulnerable children will carry for life the scars that come with poverty, malnutrition, the disruption of health systems, and loss of educational opportunities. As Save the Children has shown in a recent report on education , the poverty effects of Covid-19 could force another 10 million children out of school, many of them young girls who face the prospect of being forced into early marriage. Millions more will lose out on the learning that could lift them out of poverty and underpin inclusive growth. Allowing creditor claims to rob children of their right to education and erode the human capital base of entire nations would be an exercise in folly.

There is an alternative.

Converting debt liabilities into investments that protect children is good economics and an ethical imperative. One approach would be the creation of national child investment funds operating under the auspices of national governments, UNICEF, and the World Bank. These funds would direct savings on debt toward priority spending areas, helping build public support. Building on the current DSSI reporting system, the World Bank could record the amount of debt relief delivered by individual creditors. It could—and should—also publicly report on the creditors that refuse to participate. This would equip debt campaigners with valuable material to inform public opinion—and in case anyone has forgotten, the case for HIPC debt relief was fueled by a global campaign.

Rewrite the rules

Of course, debt relief in low income countries alone will not be enough to prevent a devastating surge in poverty. Rich countries have torn up the fiscal rulebook and rewritten monetary policy to protect their citizens. They should be doing the same for developing countries through the IMF and the World Bank. Providing a new trillion-dollar issue of Special Drawing Rights with an allocation in favor of the poorest countries would help restore liquidity, reduce balance of payments pressures, and potentially reduce interest rates. More could also be done to leverage the World Bank’s triple-A rating through credit guarantees and new COVID-response bonds, along with $10 billion in grant financing for a supplemental IDA budget.

After decades of unparalleled progress in human development, we are teetering on the brink of potentially unprecedented reversals.

The leadership of the IMF and the World Bank deserves credit for prompting action. Tentative first steps have been taken. The danger now is that the DSSI will get stuck in the quicksand of G20 politics, with powerful private creditors delaying and diluting the initiative.

The stakes could hardly be higher. After decades of unparalleled progress in human development, we are teetering on the brink of potentially unprecedented reversals. Children will bear the brunt of those reversals. Hunger, rising poverty, the breakdown of health systems, and pressure on education budgets could trap a generation in a downward spiral of deteriorating health and diminishing opportunity.

To paraphrase the question asked by President Nyerere almost four decades ago, should we sacrifice the future of vulnerable children so that governments can repay their creditors?

The answer must be a resounding “no.”

Author: KEVIN WATKINS is the chief executive officer of Save the Children UK.

Credit: Finance & Development