After years of just bubbling under, the ESG megatrend has finally opened the afterburners. At a time when the reminders of past flameouts by the fossil fuel sector have been amplified by the pandemic, the Environmental, Social, and Corporate Governance (ESG) momentum has reached fever-pitch with assets invested in ESG funds eclipsing the pivotal $100B mark.

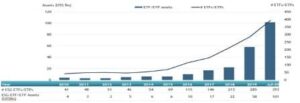

According to ETF navel-gazer ETFGI, assets invented in ESG-themed Exchange-Traded Funds (ETFs) and Exchange-Traded Products (ETPs) reached a record $101B globally by the end of July, 18 years after the products were first introduced into the market.

The remarkable milestone was achieved after the global sector racked up inflows of $38.8B for the first seven months of the year. That was more than 3x the $12.4B that the sector was able to attract during last year’s corresponding period and significantly higher than the $26.7B of net inflows recorded over the entire year.

Around the globe, there were nearly 400 ESG-based ETFs/ETPs at the end of July, with more than 1,000 listings from 92 fund providers in 25 countries.

Europe leads the way

Not surprisingly, Europe-based ETFs have been seeing the lion’s share of the action, accounting for 51.6% of overall assets.

Luxembourg-based Amundi MSCI Emerging ESG Leaders UCITS ETF DR- Acc (SADM GY) was the best-performing fund after garnering $588.82 million. Amundi attempts to replicate the performance of the MSCI EMERGING ESG LEADERS 5% Issuer Capped Net Total Return Index through a direct replication methodology. Its top five holdings are:

-

- Alibaba Group (NYSE: BABA)–0.04%

- Taiwan Semiconductor Manufacturing (NYSE: TSM)–0.04%

- Tencent Holdings (TCEHY)–0.04%

- Meituan Dianping (MPNGF)–0.03%

- Reliance Industries (NSE: RELIANCE)–0.02%

The United States is also well represented in this megatrend, commanding 40.1% of global ESG assets.

U.S.-based iShares ESG MSCI USA ETF has been the second-best performer after attracting new assets worth $587.05 million. The fund seeks to track the investment results of an index composed of U.S. companies that have positive environmental, social, and governance characteristics as identified by the index provider.

Other global ESG ETFs that have been attracting plenty of investor interest include:

- Cathay Taiwan Select ESG Sustainability High Yield ETF–$493.2M

- iShares Global Clean Energy UCITS ETF–$259.03M

- Quadratic Interest Rate Volatility and Inflation ETF–$219.81M

- iShares ESG MSCI EAFE ETF–$217.89M

- iShares ESG USD Corporate Bond ETF–$214.87M

- Xtrackers MSCI Japan ESG UCITS ETF-1C-Acc–$157.86M

- CSIF IE MSCI World ESG Leaders Minimum Volatility Blue UCITS ETF–$143.19M

- iShares MSCI Europe SRI UCITS ETF- Acc–$141.42M

Clean Energy ETFs Outperforming

Back in the U.S., low-carbon and renewable energy ETFs have been shooting the lights out, with some popular names even recording triple-digit gains. For instance, one of the sector’s favorite benchmarks, the First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) is up 81% in the YTD compared to a 52% decline by the Energy Select Sector SPDR Fund (XLE).

Here are some of the top-performing ETFs in the clean energy sector so far this year.

#1. Invesco Solar ETF

AUM: $1.58B

Expense Ratio: 0.7%

YTD Returns: 119.03%

Invesco Solar ETF (TAN) is an exchange-traded fund that’s solely dedicated to companies in the solar sector. The ETF tracks the MAC Global Solar Energy Index, which itself tracks companies involved in a wide range of solar technologies, provision of raw materials, manufacturing, installers, solar plant operations etc.

TAN’s top 5 holdings include:

- SolarEdge Technologies–7.83

- Xinyi Solar Holdings Ltd–6.68%

- First Solar–6.64%

- Enphase Energy Inc.–6.59%

- Sunrun Inc.–6.33%

#2. Invesco WilderHill Clean Energy ETF

AUM: $781.77M

Expense Ratio: 0.7%

YTD Returns: 84.14%

Invesco WilderHill Clean Energy ETF (PBW) is an exchange-traded fund designed to track US-listed stocks in the Clean Energy sector: specifically, companies that stand to benefit from the transition towards the use of cleaner energy, zero-CO2 renewables. PBW is rebalanced quarterly.

Top 5 holdings include:

- Workhorse Group Inc.–4.37%

- NIO Inc.–4.25%

- Ballard Power Systems Inc.–3.29%

- Tesla Inc.–3.19%

- Vivint Solar Inc.–3.15%

#3. First Trust NASDAQ Clean Edge Green Energy Index Fund

AUM: $278.22M

Expense Ratio: 0.6%

YTD Returns: 83.13%

The First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) seeks to replicate the performance of the NASDAQ Clean Edge U.S. Liquid Series Index, a modified market-cap-weighted index designed to track the performance of clean energy companies that are publicly traded in the United States.

QCLN’s top holdings include:

- Tesla Inc.–11.02%

- NIO Inc.–7.29%

- Brookfield Renewable Partners–5.78%

- Albemarle Corp.–5.48%

- SolarEdge Technologies–4.81%