(managing outsourcing risks)

Last week, I started another series of some tips in managing internal fraud. This was triggered by Bank of Ghana’s publication of the 2019 Banking Fraud Report. Most of the data report was not too new but what hurts is the fact that history continues to repeat itself, and perhaps the lessons learnt are not shared. Maybe we rather have short memories. However, if bank’s internal control activities were always on point, the report should rather show less losses. Last week, I looked at how internal fraud can be reduced through effective recruitment and induction of new employees. This week, I will tackle the headache of the cost-cutting strategy of outsourcing some bank functions and how it sometimes back-fires through increased losses. Extracts are from a similar article I published in 2017.

Managing outsourcing risk.

Financial services institutions throughout the world are increasingly using third parties to carry out activities that the institutions themselves would normally have undertaken. Industry research and surveys by regulators show financial firms outsourcing significant parts of their regulated and unregulated activities. These outsourcing arrangements are also becoming increasingly complex.

I have watched an interesting trend of events within the last decade and wish to share some thoughts with you about the increased numbers of outsourced staff in cashiering, guard duties, sales and front desk activities.

Come with your binoculars and you will notice that in some institutions, all is not well. Even on the outer surface, you may find some front liners working as if they are doing customers a favour. Let me attempt some of the hidden factors causing some of them to be unprofessional in their attitude and service. Banks are now being compelled to adopt outsourcing as a policy for some activities for various reasons. These involve guard duties, sales, customer service, cashiering. All these persons are working hand in hand with the permanent staff to achieve the goals of the institutions.

Do customers need to know that some of the staff have been outsourced? Obviously not! They are not interested. Banks are offering services to their customers. Who offers what service, is not the concern of customers. They only need to receive the service as promised or as expected, and off, they go.

Before I continue, let me list some typical utterances of regular and outsourced staff from the grape vine. I have exaggerated some of them just for emphasis.

THE UTTERANCES FROM THE GRAPEVINE

| OUTSOURCED STAFF | PERMANENT STAFF |

| “Who do they think they are? Are they better than us”?

|

“Small boys and girls are young. They don’t know it is only a stepping stone to their future. Why are they always complaining”? |

| “Look at how hard we have been working. We only get” peanuts, compared to them. | “I have been an outsourced staff before, however I know that once I shine my corner, the sky is the limit.” |

| “How come we are doing the same job and yet we are unable to get proper medical attention when we are sick?” | “Some of them are not committed at all. They just go out to open accounts to every Tom, Dick and Harry. As for the KYC, they don’t use it. They are only interested in the commissions.” |

| “See how I am always eating my “garri and beans”, while they are always buying expensive lunch and “take-aways”? My time will come”. | “They are the face of the bank and yet they come in with hardly any knowledge. I wonder why my bank is risking its reputation with these people. Their companies do not give them adequate training before transferring them to the banks.” |

| “How come we are all sitting in the same office and yet our dressing is different? What will they lose if we are given the same uniform to wear”? | “Because they are not appointed by the bank, there is not much commitment in the work they are doing. They know they can always maneuver to be transferred to another bank, so they cannot be bothered”. |

| “Customers think we are inferior.” | “Some of these guys are more hardworking than the permanent staff. I wish they can be employed permanently by the bank.” |

| “No training for us apart from orientation program. What do they expect from us? Sometimes I feel so under-equipped. How can I refer everything to my boss or the other staff at the back office? Perhaps they should have been here to face the customers”. | “Some of them are just pushing the customers away with their attitude. We know our customers and we should be the ones facing them. Cheap things eventually become expensive.” |

| “The pay is so small and yet the temptations we face on the job are huge. It takes God’s favour to stop us from committing fraud to supplement our meagre pay. God help me”. | “The outsourcing policy has really helped the bank save a lot on staff costs, especially salaries and medical bills”. |

| “We are not on the email or intranet. How can we know the current trend of affairs and respond to customer enquiries”? | “It would have been nice to include outsourced staff on our email and intranet. It will make my task as a supervisor far easier. The training materials should be accessed by them to upgrade their skills”. |

| “Our companies do not monitor our career development. They only want their commission, that’s all. I will just stay here only by default and not by choice.” | “They need to attend more training programs. It will make my work easier.” |

| “I don’t have job security. How can I be committed to a job that I have no feelings for? “ | “Some of them are not committed and the questionable ones end up perpetrating fraud. I believe making them permanent will cause more loyalty to the bank.” |

| “They think by putting me permanently in the Remittance Section, I am not part of the bank. Nobody bothers to know how I am faring. I will continue to “chop my bonus” from the “sakawa boys”. I need to make my money fast, finish my building project and leave before I am caught.” | “ A thief is a thief, whether outsourced or permanent. The status of the person doesn’t matter”. |

The Outsourcing Policy

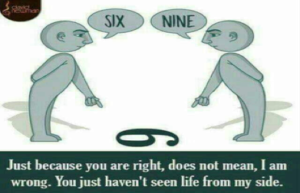

The above common utterances from the grapevine from both outsourced and regular staff, is an indication that we need to manage communication and training in such a way that all stakeholders in the bank appreciate the objectives of an institution’s outsourcing policy and work better towards achieving a win-win situation. Today, outsourcing is increasingly used as a means of both reducing costs and achieving strategic aims. However, outsourcing has been identified in various industry and regulatory reports as raising issues related to risk transfer and management. Among the specific concerns raised by outsourcing activities is the potential for over-reliance on outsourced activities that are critical to the ongoing viability of an institution, as well as its obligations to customers.

Let us take a typical case of some banks in Ghana. Somewhere around the late nineties, when most transactions in the economy were cash-based. Banks faced several cash management challenges. For convenience and security purposes, banks created Bulk Counting bays at their back offices for counting bulk cash received from customers. Most of these cashiers were elderly, middle aged women who had either retired or been “right-sized” and placed on contract. These ladies were seen to be very meticulous and honest, having already “seen it all in their career” and would not like to mar their reputation with petty thefts. They were very friendly with customers and the relationship with their old customers continued unabated, even though they were seated with them at the back offices. These “old ladies’ have all been replaced by young cashiers from outsourced agencies. Despite the good intentions for outsourcing, there are some bad nuts with the wrong attitude either indulging in bad customer service due to lack of training, or exploiting laxity in controls leading to frauds and errors ending in huge losses to the banks.

Despite the need to cut down on costs involved in payment of huge salaries and medical bills, it is the management of outsourcing process which is the crux of the matter. The need to blend the functions and the human relations among the outsourced and regular staff to enhance teamwork and achieve success, is critical.

Next week, we shall share a few tips on how the implementation of this strategic policy should not go down to affect the bottom line.

TO BE CONTINUED

ABOUT THE AUTHOR

Alberta Quarcoopome is a Fellow of the Institute of Bankers, and CEO of ALKAN Business Consult Ltd. She is the Author of two books: “The 21st Century Bank Teller: A Strategic Partner” and “My Front Desk Experience: A Young Banker’s Story”. She uses her experience and practical case studies, training young bankers in operational risk management, sales, customer service, banking operations and fraud.

CONTACT

Website www.alkanbiz.com

Email:alberta@alkanbiz.com or [email protected]