- Introduction

Since the outbreak of COVID-19 in Ghana in March 2020, economic policymaking has been dominated by measures to address the many impacts of the pandemic. In particular, fiscal policy has been deployed on a massive scale to shore up the public health response to COVID-19 and also lessen its effects on the economy. According to the government, taking strong efforts now to tackle the COVID-19 shock will pay off eventually by accelerating the country’s recovery from this unprecedented crisis.

In addition to policies introduced since March, the government recently announced Ghana CARES Obaatan Pa Program, a GHȻ100 billion development initiative designed to mitigate the economic challenges brought about by the pandemic. The program is expected to be rolled out over the next three and a half years, with the first phase of implementation covering the second half of 2020.

Given its estimated large financing requirement, Ghana CARES Obaatan Pa Programme deserves a full and thorough assessment. However, the complete scope of the program, together with the details of the policies and funding strategies, is not yet known. For this reason, this assessment will focus on the fiscal policy response to the pandemic so far. Before doing that, however, we will first discuss the economic growth context for fiscal policy amidst COVID-19.

- Economic Growth Context

After averaging an annual growth rate of 7% in the last three years, the economy had been expected before the outbreak of COVID-19 to maintain a rapid rate of expansion in 2020, with real GDP forecast to grow by 6.8%, according to the 2020 Budget. From this initial rate, real GDP is now predicted to grow by just 0.9% in 2020. This reflects the effects of the pandemic on economic activities due to the public-health emergency restrictions adopted to control its transmission in the country.

The 0.9% forecast is worse than the 1.5% growth rate that was contained in the Finance Minister’s March 30 statement to Parliament. It is even much lower than the 2.5% growth rate predicted by the Bank of Ghana in its March 18 Monetary Policy Committee press statement. This means the pandemic is expected to show worse effects on the economy than earlier projected. The grim fact is that a growth rate of 0.9% would be the lowest in almost four decades. However, the brighter side of the forecast is that the Ghanaian economy is not expected to experience a contraction as is the situation for many other economies, including some peer countries in sub-Saharan Africa.

The projected steep reduction in economic growth will be driven by a 0.8% contraction in services, with output from the domestic trade, hotels & restaurants, real estate, and transport & storage sub-sectors expected to shrink in real terms. Before the pandemic, services had been forecast to grow by 5.8%. Industry is predicted to grow by 0.8%, against a pre-pandemic projection of 8.6%. Of this, the oil and gas sector will be a negative contributor as it is expected to contract by 7.7%. Manufacturing is projected to grow by 0.5%, which is considerably less than the pre-pandemic forecast of 6.8 percent. Agriculture is expected to grow by 3.7%, down from a pre-pandemic projection of 5.1%. This means agriculture is expected to be both the least-affected sector by the pandemic and the main contributor to the projected 0.9% overall real GDP growth rate.

The sharp fall in economic growth is likely to be associated with a reduced rate of job creation and employment. The services sector, which is the biggest and most job-intensive sector of the economy, is also the hardest-hit by the pandemic. This situation is likely to amplify the effect of the crisis on employment. Already, the worst-impacted sub-sectors, such as tourism & hospitality, transport, and education, have begun to shed jobs as businesses reel from shutdowns and shrunken demand. This points to significant economic and social costs of the coronavirus pandemic in Ghana.

Against this backdrop, in deciding how to reconfigure fiscal policy in response to the pandemic, the government was expected to take into consideration the following three challenges: (1) dealing with the erosion of fiscal revenue due to the economic impact of the pandemic; (2) providing the necessary public resources to battle the pandemic and introducing interventions to limit the economic fallout; and (3) ensuring that the fiscal policy choices made were well-targeted, prudent, efficient, and likely to be effective in addressing the problems caused by the pandemic.

- Analysis of 2020 Fiscal Policy Amidst COVID-19

Before we discuss the government’s fiscal policy amidst COVID 19, let us first analyze the country’s fiscal position by the end of 2019 and thus before the pandemic hit Ghana.

3.1 The Fiscal Position by the End of 2019

In 2019, Ghana’s fiscal position was already in a very precarious state. It showed a country that was poised to struggle fiscally if even no disaster occurred. Simply put, by the end of 2019, the government’s financial position was such that the ability of the government to enhance economic growth and development through infrastructural development or even maintain the existing ones was enormously curtailed.

This is because in 2019, the government was able to collect GHȻ53.38 billion in total revenue and grants, representing only 15.3% of GDP and thus 1.8 percentage points below the initial budget forecast of 17.1% of GDP. On the other hand, the government spent as much as GHȻ31.01 billion to service its debt alone (GHȻ19.77 billion in interest payment and GHȻ11.24 billion in principal repayment — amortization). The government also spent GHȻ22.22 billion as employee compensation in 2019. Therefore, the sum of these two expenditure items alone stood at as high as GHȻ53.23 billion, representing 99.7% of the total revenue and grants, which is virtually the entire total revenue and grants. It should be known that these two expenditure items box the government in, in the sense that they are extremely sticky downwards – they are very rigid or inflexible. What is more important is that they limit the ability of the government to spend on developmental projects, which are needed to help grow the economy and improve upon the socio-economic wellbeing of the people

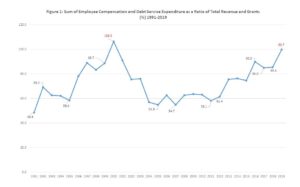

As Figure 1 shows, 2019 adds to 2000 (the year which saw a severe terms-of-trade shock and which preceded the HIPC declaration) as the only years during the Fourth Republic that these two expenditure items alone have been about 100% or more of total revenue and grants. We can see from the figure that this ratio stood at as low as 48.6% in 1991 and 54.7% in 2007, following the implementation of the Economic Recovery Program and HIPC conditionalities respectively. It is important to point out that the large ratios recorded in 2000 and 2019 were driven largely by excessive rates of debt accumulation, which shot up debt service expenditure, even though the high growth rate of employee compensation cannot be overlooked.

Implications and consequences

- In 2019, monies in excess of employee compensation and debt service expenditure needed to meet the other budgetary expenditure items had to be borrowed.

Note: The other expenditure items include:

- Goods and services (which captures most of the Free SHS-related expenditures)

- Capital expenditure

- Earmarked/Statutory transfers, including transfers to GETFund, NHIF, DACF, GNPC, the Petroleum Funds (the Stabilization and Heritage Funds), etc.

- Other expenditures

What is more troubling here is that, for the statutory funds, portions of specific revenues are required to be transferred. Yet, transfers from these revenues prove to be difficult, since those portions are also needed to service debt and pay for employee compensation, the two most urgent expenditure items.

- By the end of 2019, the country had clearly fallen into a debt trap, since borrowing was no more a choice but an imposition by the fiscal state of the country. This cycle can only be reversed if (1) revenue is able to grow at an unusually high rate, (2) growth in employee compensation drastically reduces, (3) there is debt forgiveness as happened in the 2000s, or (4) a combination of some or all of the above occurred. However, none of these was easy to achieve in practice, even before the pandemic hit.

- As a ratio of total revenue and grants, capital expenditure, which is needed to expand the productive base of the economy, decreased to the lowest levels in 2018 and 2019 since 1983. This is demonstrated in Figure 2. We can see from the figure that in 2018 and 2019, capital expenditure as a ratio of total revenue and grants stood at as low as 9.7% and 11.5% respectively. The reason for the low ratios in 2018 and 2019 is that the size of debt service expenditure and employee compensation is so huge and rigid that, not much room can be created to accommodate capital spending. This is exactly what happened in the 1990s, which sharply decreased the ratio from 68.0% in 1992 to 17.3% by the end of 2002.

3.2 2020 Fiscal Policy

We can see clearly from the above analysis that by the end of 2019, the fiscal position of the country was poor and fragile. Therefore, any negative shock was poised to hit the country hard fiscally.

However, because the pandemic was devastating even rich and advanced economies when it began to hit Ghana, we at IFS commend the government for taking swift actions to secure financial resources to help the country’s fight against the pandemic and bring some relief to the vulnerable in the society. Thus, borrowing to help fight the pandemic was unavoidable, given the limited nature of government revenue, which, as already discussed, was only sufficient to cover employee compensation and debt service expenditure, even before the pandemic hit.

Given the nature of the threat the pandemic posed – and still poses – and the poor fiscal state of the country, it was expected that additional expenditures that are not essential in the fight against the pandemic and to alleviate its economic effects on the vulnerable would be rejected by the government, despite 2020 being an election year. It was also expected that existing revenue sources would be carefully guarded. Yet, since the pandemic hit the country, the government has taken certain fiscal policy actions that are quite head-scratching, and which were reflected in the 2020 Reviewed Budget. These include:

- The announcement of a 15% salary increase for civil servants in March 2020 after the pandemic had already hit the country and when a lockdown was imminent, given the kinds of personalities and organizations that were calling for a lockdown. This was against the backdrop of the fact that in many countries that had been hit by the virus, salaries had begun to be reduced.

- As said above, while it was commendable on the part of the government to help the vulnerable cope with the pandemic, including ensuring that their access to water in the face of the pandemic was not restricted by affordability issues, the government went ahead to provide free water for all from April to June 2020, including for those who were not vulnerable and were capable of paying for their water consumption. The free water for all has since been extended for another three months.

- Again, while paying for the electricity bills of the lifeline and other vulnerable consumers in the face of the pandemic was the right thing to do, the government decided to pay half the electricity bills from April to June for all other consumers, including the well-to-do who could have afforded to pay themselves.

- While the pandemic has significantly affected revenue mobilization because of the projected decline in economic growth, and in the face of the pandemic-related expenditures, which have compounded the expenditure problems explained earlier, the Minister of Finance has announced that the communications service tax will be reduced effective September 2020.

The questions that arise are:

- What is actually driving these head-scratching fiscal decisions and choices in the face of COVID 19, whose end is still not yet known?

- Is the government not aware that the country’s fiscal position was already in a precarious state before the pandemic hit?

- Is the government again not aware that it was too much borrowing that landed the country in the state in which it found itself in the 1970s and 1990s, which caused the country to call on the IMF and the World Bank for an economic bailout in the 1980s and debt forgiveness in the 2000s?

The 2020 revised budget clearly demonstrates that the country’s fiscal position has dramatically worsened. Total revenue and grants for 2020 is now projected to be only GHȻ53.7 billion. However, total debt service expenditure is now projected at GHȻ38.5 billion while employee compensation is projected at GHȻ27.1 billion. Therefore, the sum of these two expenditure items alone is projected at GHȻ65.5 billion, thus exceeding total revenue and grants by as much as GHȻ11.8 billion or 22.1% of the total revenue and grants. Therefore, in 2020, the government has to borrow to the tune of GHȻ11.8 billion or 22.1% of total revenue and grants before it can fully service its debt and pay for employee compensation alone. This is unprecedented in the Fourth Republic, and perhaps in the country’s fiscal history. It should be noted again that all the other expenditures as listed above remain (which also have to be funded through borrowing). Figure 3 depicts the sum of employee compensation and debt service expenditure as a ratio of total revenue and grants from 1991 to 2020, using the projected data in the revised budget for the calculation of the 2020 ratio.

While it is true that the pandemic is what has mostly caused the bad fiscal position at the end of 2019 to dramatically deteriorate in 2020, the head-scratching choices of the government listed above have added some fuel to the fire.

- How Can the Country Get Out of this Fiscal Predicament?

Given the country’s poor and delicate fiscal position, which has dramatically worsened due to COVID-19 and some of the policy choices of the government, we recommend that the government should:

- Refrain from engaging in fiscal populism despite the looming 2020 elections, in order not to compound the country’s fiscal problems. Indeed, a critical analysis of the economic history of Ghana reveals that fiscal populism has been one of the main causes of the country’s recurring fiscal and economic distress since independence.

- Immediately seek debt reliefs, including debt forgiveness, from its major creditors so as to minimize the enormous size of the country’s debt service expenditure, which is consuming the biggest chunk of the country’s revenues (projected to be 71.6% of total revenue and grants in 2020).

- Take steps to reduce the rate of growth in employee compensation in order to minimize its relative size over time. For specific recommendations on this, we recommend that the government should consult the Institute for Fiscal Studies (IFS) Occasional Paper No. 22, entitled “Ghana’s Large Public Sector Compensation Bill: Agitations, Policies, Implications, Causes and Recommendations”.

- Take steps to generate more revenue, particularly from the extractive sector of the economy in the short to medium term. The IFS is happy to announce that it is conducting a study on government revenue generation from the country’s extractive sector. We give the assurance that we will be prepared to share our findings and recommendations with the government upon the completion of the study.