This is a sequel to the above subject and is designed to explain how and why financial institutions comply with the dictates of environmental and social concerns in project appraisals.

The piece also highlights the roles of other stakeholders in the environmental and social risk management space. Their collective objective is the conservation of the natural environment and the enhancement in the dignity of labour and the well-being of communities in which economic activities are generated.

An attempt will be made to explain some generic internal processes financial institutions undertake in their bid to comply with the IFC Performance Standards and other guidelines.

The objective is to create awareness among the financial institution’s clients to elicit their cooperation towards the collective responsibility to engage in sustainable development.

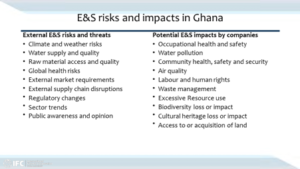

First, let us run through some environmental and social risks and their potential impacts in the following table;

Credit IFC Ghana Office. 2020.

Ghana earned the unenviable reputation of being the dumping ground for Europe’s electronic waste. These were crudely being re-cycled by burning at Agbobloshie and its environs, at the cost of human health and unsightly landscape.

A financial institution found to be supporting such practices would have its reputation dented. The condition provides an opportunity for a financial institution to team up with the Environmental Protection Authority and other investors to establish a modern recycling mechanism. This will protect the health and sanitary conditions of the actors who eke out a living from these practices. Such institutions may stand up for applause from environmentalists for promoting the dignity of the workforce while preventing environmental pollution.

As the above diagram depicts, the respective IFC Performance Standards deal with specific environmental and social risks which financial institutions must ensure that they themselves and their clients have effectively addressed in project finance and other routine operations. The principal objective is to ensure sound environmental and social conditions that promote diverse and holistic sustainable development.

Banks’ due diligence processes

A financial institution’s decision to approve or decline a project for financing is preceded by rigorous due diligence. This routine takes cognizance of environmental and social risk management prescriptions. The process involves an evaluation of the financial institution’s mission and policy on risk appetite in relation to the sector involved in the financing, the customer involved, the location of the project and the expected capital outlay. These will inform the financial institution’s risk categorization of the project, the appropriate product or service offering, pricing and the kind of pre- and post- disbursement covenants that will be applicable in the offer letter for the financing.

The client will thereafter be required to come up with an action plan that seeks to address any identified gaps in the prior Environmental and Social Impact Assessment that was undertaken. Implementation of the respective actions will be monitored during the life cycle of the project and influences further disbursements of tranches of the facility.

Other primary considerations involve the potential impact of the facility on the financial institution’s Single Obligor Limits and/or Capital Adequacy Ratio, and the capacity of the client to meet all regulatory requirements, plus other international standards and guidelines where applicable.

Further due diligence may cover vital considerations like the materiality of the governance risks to the business, that is, whether they are financially or otherwise significant enough and whether they could be avoided or mitigated and by what risk treatment mechanisms.

These will reflect the sufficiency of the management system of the borrowing entity and help the bank’s board to categorize the associated risk as high, medium or low so that appropriate pricing and other risk mitigation approaches may be applied.

Covenants

The approval decision will then be concluded with legal covenants in the offer letter to the client. This will ensure that the bank’s client complies with the applicable requirements covering relevant national legislation pertaining to environmental protection, occupational health, security and safety of the work force and the community, as well as the guidelines relating to the Ghana Sustainable Banking Principles.

A key covenant will require that the client reports on Environmental and Social Action Plans (ESAP) at periodic intervals during the life of the project financing.

The Equator Principles

This is a credit risk management framework for determining, assessing and managing environmental and social risks in project finance transactions. This framework has been adopted by financial institutions and applied where total project capital costs exceed US$10 million.

The Principles are subscribed to by over ninety globally significant financial institutions (the Equator Principles Financial Institutions). Belonging to this group itself confers a degree of global credibility as far as environmental stewardship and responsible social development issues are concerned. It may be said that these principles have become the global benchmark for private financial institutions regarding project finance.

The principles are primarily intended to provide a minimum standard for due diligence to support responsible risk decision-making in project financing. They are based on the IFC Performance Standards and World Bank Guidelines on Environmental Health and Safety, with a view to addressing the adverse impacts on the natural environment and affected communities.

It is instructive to note that although many individual projects in developing countries like Ghana may not come up to the $10 million threshold, the principles enunciated in the standards are still relevant for the assessment of medium scale project financing, irrespective of the project’s geographical location.

This is particularly important as they relate to the extent to which the performance standards permeate project financing even of lower amounts and the applicability and degree of relative due diligence processes.

The Equator Principles have undergone various revisions since its formulation in June 2003. The 2019 review targeted human rights and climate change issues in its scope. (https.// equator principles .com)

The Ghana Sustainable Banking Principles

Like many countries, Ghana’s Sustainability framework has been crafted to align with the IFC’s 8 Performance Standards. These are designed to guide the respective banks in their dealings with their clients regarding sustainability issues in project financing in different sectors. How the banks themselves are to lead by example in the application of sustainability principles in their respective operations is an integral part of these guidelines.

In line with local dynamics, Ghana’s Sustainability Framework has been customized into 7 General Principles and Guidance Notes to correspond to 5 major sectors of the economy.

These are considered to be among the most critically sensitive to the environmental and social (E&S) standards and at thesame time constitute significant proportion of portfolio exposure in the banks.

The sector segments are: Agriculture & Forestry; Construction & Real Estate; Manufacturing; Oil & Gas and Mining; andPower & Energy.

The 7 General Principles, and 5 Sector specific Guidance Notes present sustainable banking as a two-way interrelated imperative, namely:

- Improving the contribution of finance to sustainable and inclusive growth by funding society’s long-term needs;

- Strengthening financial stability by incorporating environmental, social and governance (ESG) factors in lending decision-making. (Bank of Ghana. Guidance Notes for the Sustainable Banking Principles, 2019)

Actors watching the finance space

Financial institutions tend to guard their reputation at great expense, as their brands could be negatively impacted, particularly by local and global organisations which seek to champion sustainability issues.

In August 2000, the Citigroup was “awarded the Most Destructive Bank” by Rainforest Action Network for financing firms perceived to be involved in forest destruction, including negative climate change.

Other organisations watching the financial space for adherence to sustainable financing initiatives include Conservation International, World Resources Institute, World Wildlife Fund, Friends of the Earth, Oxfam, Fauna and Flora International, Human Rights Watch, etc.

Any of these institutions, acting alone or in concert, can significantly impair a financial institution’s reputation and performance. They can mount public pressure against investors whose activities are perceived to be destructive to natural resources and decent communal lives in any geographic location.

Conclusion

It is clear from the foregoing that dramatic climatic changes have affected global warming. This has resulted in extreme weather conditions, like wild bush fires, desertification, flooding, rising sea water levels that threaten some islands, melting ice caps, depleting fish stocks, among major catastrophic conditions. These have been largely attributable to deforestation, inappropriate fishing methods and emission of excessive greenhouse gases into the atmosphere, inter alia.

Such uncontrolled deforestation, depletion of timber,forestry and fisheries resources particularly have negatively affected the livelihoods of large sections of populations in different geographies. These have given rise to the Paris Accord on Climate Change and other global Agreements that seek to preserve the earth and its resources, including the dignity of human life.

Modern financial institutions and indeed the entire global architecture for wealth creation and distribution cannot help but to acknowledge that, conscious efforts toward sustainability are the best bet for a decent future for mankind, not just profits.

Financial institutions must therefore use their muscle in ensuring that profitability and environmental and social considerations do not become exclusive pursuits. Profit is at best, a product of a collection of assumptions but human lives and the quality of living are real.

The writer is a Fellow of the Chartered Institute of Bankers and an adjunct lecturer at the National Banking College, and the Chartered Institute of Bankers, a farmer and the author of “Risk Management in Banking” textbook.

Email; [email protected] Tel. 0244 324181 / /0576436414

This piece is dedicated to my course mates at the IFC ESRM Experts Forum, Cohort 2019/2020