Even though the country’s stock market has also been badly hit by the coronavirus pandemic and plunge it into abysmal form, market watcher SEM Capital Advisors Limited says the falling share prices present a good opportunity for investors who are looking to the future and want to increase their shareholding on the capital market.

The report shows that of the companies listed on the Ghana Stock Exchange (GSE), only two – Ecobank Ghana Ltd and Aluworks Limited – recorded gains in their share prices, 8.7 percent and 10 percent respectively in the second quarter. Sixteen other listed companies all saw a decline of their share prices, with Fan Milk Limited becoming the biggest loser with more than 55 percent loss of its share value and Tullow Oil recording the least loss of 0.08 percent of its share price within the same period. Prices of 14 other stocks, however, remained flat.

The overall performance of the composite index, disappointing it is though, can be largely blamed on the pandemic’s impact, as it created uncertainty in the market, putting investors on high alert. The pandemic also led to manufacturing firms having had to battle with not being able to operate at full capacity in order to comply with social distancing protocols.

Despite the sore performance of the stock exchange, and the virus still remaining a threat, therefore, casting a gloomier outlook for the local bourse, SEM Capital Advisors say it also offers a window of opportunity for investors who want to increase their shareholding now and benefit from the future.

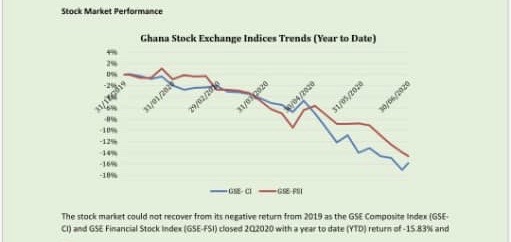

“On the capital market, the GSE Composite and GSE Financial Stock Indices continue to record negative returns. We do not anticipate any significant changes in the market’s performance in the short term as investors adopt a wait-and-see attitude amidst increasing uncertainties of the impact of the COVID-19 on the economy.

We expect stocks in the oil sector and the manufacturing sector to witness further declines due to decline in world crude oil prices and the uncertainties of the Saudi Arabia-Russia oil war. The depreciation of the cedi will negatively impact the cost of sales of manufacturing companies as they import raw materials.

The possible decline in share prices presents buying opportunities for investors who would like to take advantage of the low share prices on the stock market. Investors can increase shareholdings in anticipation of future price appreciation,” it stated.

Other investor opportunities

Besides the declining or lower share prices which have given an escape window for investors in the capital market in these difficult times, the fixed income market also presents them another window of opportunity.

According to the SEM Capital Advisors report, the Ghana Fixed Income Market yields are expected to rise over the short term due to government’s borrowing appetite which presents buying opportunities for investors interested in both short and longer dated securities, especially at the upper end of the yield curve, as investors can purchase longer term securities to maximise returns.

Eurobond prices in the frontier and emerging markets, it states, have significantly dropped and consequently yields have increased. This, it adds, may present an opportunity for investors to increase their returns on their Eurobonds investments.